Other Short-Term Operating LiabilitiesOther Short-Term Operating Liabilities (EUR) 31. 12. <strong>2009</strong> 31. 12. 2008Short-term operating liabilities to the government 490,972 487,417Short-term operating liabilities to the employees 2,352,604 2,629,708Other short-term operating liabilities 749,365 702,367Total 3,592,941 3,819,492As at 31 December <strong>2009</strong>, no operatingliabilities are due to the management and thesupervisory board or the employees, otherthan the amounts due for December <strong>2009</strong>wages and salaries.Other short-term operating liabilities mainlyrepresent court damages due to JAT <strong>Airways</strong>Beograd.6.1.15. Short-Term Accrued Costs and Deferred RevenueEUR 31.12.<strong>2009</strong> 31.12.2008Short-term accrued costs and deferred revenue 530,551 1,724,408A total € 530,551 of accrued costs and deferredrevenues comprise short-term accrued costs orexpenses (interests for credits) in the amountof € 61,114, and deferred revenues (charterflights and tickets sold for future flights) in theamount of € 469,435.6.1.16. Off-Balance Sheet Assets/LiabilitiesOff-Balance Sheet Assets/Liabilities (EUR) 31.12.<strong>2009</strong> 31.12.2008Mortgages 112,654,140 108,733,078Guarantees 4,528,798 3,211,466Other 28,474 28,474Total 117,211,412 111,973,018The increase in the mortgage volume isattributable to the insurance of received newlong-term loans and an additional insurance ofshort-term loans.The mortgage volume with a maturity longerthan five years amounts to € 91,244,166. Forall other items the period of obligations is notlonger than five years.The off-balance sheet records representmortgages (pledges) entered for the benefitof the local banks against long-term credits forthe purchase of aircraft and short-term creditsfor operating and fixed assets.As at 31 December 2010, a total of € 81,489,570of loans is secured with mortgages.Guarantees represent payment guaranteesgranted to the suppliers for the purchase ofgoods and services at home and abroad (€3,137,476.71), and guarantees received as asecurity against receivables (€ 1,391,321.58).The Company is involved in court proceedingseither as a plaintiff or a defendant. These courtactions mainly relate to breach of obligationsor labour disputes. As a result of a requestfor judicial protection, <strong>Adria</strong> <strong>Airways</strong> is alsosubject to procedures of the supervisory andgovernment institutions.No additional provisions were made for thesedisputes as we do not expect the outcome ofthese to have a significant financial impact.104

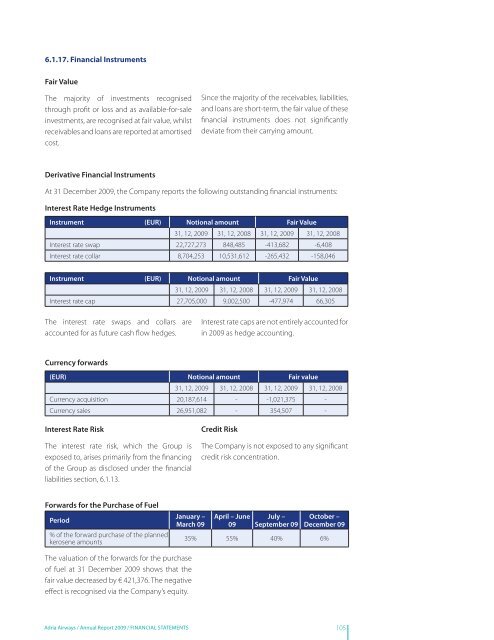

6.1.17. Financial InstrumentsFair ValueThe majority of investments recognisedthrough profit or loss and as available-for-saleinvestments, are recognised at fair value, whilstreceivables and loans are <strong>report</strong>ed at amortisedcost.Since the majority of the receivables, liabilities,and loans are short-term, the fair value of thesefinancial instruments does not significantlydeviate from their carrying amount.Derivative Financial InstrumentsAt 31 December <strong>2009</strong>, the Company <strong>report</strong>s the following outstanding financial instruments:Interest Rate Hedge InstrumentsInstrument (EUR) Notional amount Fair Value31, 12, <strong>2009</strong> 31, 12, 2008 31, 12, <strong>2009</strong> 31, 12, 2008Interest rate swap 22,727,273 848,485 -413,682 -6,408Interest rate collar 8,704,253 10,531,612 -265,432 -158,046Instrument (EUR) Notional amount Fair Value31, 12, <strong>2009</strong> 31, 12, 2008 31, 12, <strong>2009</strong> 31, 12, 2008Interest rate cap 27,705,000 9,002,500 -477,974 66,305The interest rate swaps and collars areaccounted for as future cash flow hedges.Interest rate caps are not entirely accounted forin <strong>2009</strong> as hedge accounting.Currency forwards(EUR) Notional amount Fair value31, 12, <strong>2009</strong> 31, 12, 2008 31, 12, <strong>2009</strong> 31, 12, 2008Currency acquisition 20,187,614 - -1,021,375 -Currency sales 26,951,082 - 354,507 -Interest Rate RiskThe interest rate risk, which the Group isexposed to, arises primarily from the financingof the Group as disclosed under the financialliabilities section, 6.1.13.Credit RiskThe Company is not exposed to any significantcredit risk concentration.Forwards for the Purchase of FuelPeriod% of the forward purchase of the plannedkerosene amountsJanuary –March 09April – June09July –September 09October –December 0935% 55% 40% 6%The valuation of the forwards for the purchaseof fuel at 31 December <strong>2009</strong> shows that thefair value decreased by € 421,376. The negativeeffect is recognised via the Company’s equity.<strong>Adria</strong> <strong>Airways</strong> / <strong>Annual</strong> Report <strong>2009</strong> / Financial Statements 105

- Page 4 and 5:

RepAnnual ReportPart 12

- Page 6 and 7:

Introduction1. Ke y Ac h i e v e -m

- Page 8 and 9:

Development Indicators for Adria Ai

- Page 10 and 11:

1. 3. Letter from the Management Bo

- Page 13 and 14:

2.1. About the Company2. Ge n e ra

- Page 15:

Airbus A-320Length37.57 mHeight11.7

- Page 18 and 19:

2.4. Company Historynovember2009Mov

- Page 20 and 21:

Members of the Supervisory Board, s

- Page 22 and 23:

Business Report20

- Page 24 and 25:

flights from the home airport;• p

- Page 26 and 27:

has 305 card holders. In 2009, 36 n

- Page 28 and 29:

The cargo transport of the AEA air

- Page 30 and 31:

Index of Increase in Passengers,Fli

- Page 32 and 33:

Plans and Goals for 2010In 2010, th

- Page 35 and 36:

The secretof flying liesnot in thee

- Page 37 and 38:

the prices with the goal to put the

- Page 39 and 40:

Strategic goals of development in t

- Page 41 and 42:

theoretical trainings for the aircr

- Page 43 and 44:

Adria Airways pays a lot of attenti

- Page 45 and 46:

In 2009, we continued to maintain a

- Page 47 and 48:

Risk Assessment - evaluation of the

- Page 49 and 50:

cations running via IP networks is

- Page 51 and 52:

majority of our partner travel agen

- Page 53 and 54:

The economic recession and financia

- Page 55 and 56: of 2009 but were on average still a

- Page 57 and 58: In the structure of liabilities the

- Page 59 and 60: passenger coupon and maintain the v

- Page 61 and 62: ility Repor2005 2006 2007 2008 2009

- Page 63 and 64: Adria Airways is a company that ise

- Page 65: The corporate communication departm

- Page 68 and 69: The Adria Airways d.d. Company got

- Page 71 and 72: Company Management:Tadej Tufek,M.Sc

- Page 73: MOSCOW, RussiaAdria AirwaysDerbenev

- Page 77 and 78: Ta b l e o f Co n t e n t s1. Gener

- Page 79 and 80: 2. St a t e m e n t o fResponsibili

- Page 81 and 82: 4.1. Balance Sheet 14. Fi n a n c i

- Page 83 and 84: No. Item 2009 2008A/ Cash flows fro

- Page 85 and 86: Statement ofChanges in Equityfor 20

- Page 87 and 88: Adria Airways d.d. converts the pur

- Page 89 and 90: Investment propertyAn investment pr

- Page 91 and 92: amount and are part of the operatin

- Page 93 and 94: and equipment as an excess of their

- Page 95 and 96: 6.1.2. Property, Plant and Equipmen

- Page 97 and 98: Movements in Property, Plant and Eq

- Page 99 and 100: 6.1.4. Long-Term Financial Investme

- Page 101 and 102: 6.1.8. Short-Term Operating Receiva

- Page 103 and 104: • € 2,691,263 from other revenu

- Page 105: Classification of Long-Term Financi

- Page 109 and 110: Compared to the previous year, the

- Page 111 and 112: The majority of the financial expen

- Page 113 and 114: Transactions with Major Shareholder

- Page 117: Publisher: Adria Airways, Slovenski