pdf (2MB) - McBride

pdf (2MB) - McBride

pdf (2MB) - McBride

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

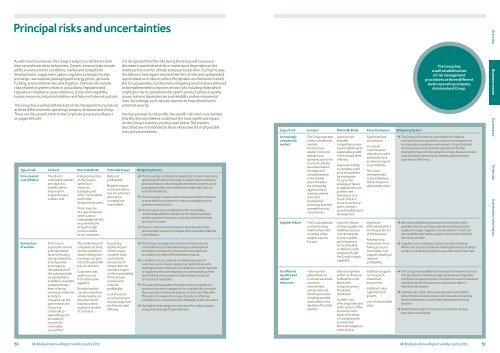

Principal risks and uncertaintiesAs with most businesses, the Group is subject to risk factors bothinternal and external to its business. Generic external risks includepolitical and economic conditions, market and competitivedevelopments, supply interruption, regulatory changes, foreignexchange, raw material, packaging and energy prices, pensionsfunding, environmental risks and litigation. Internal risks includerisks related to systems reliance, acquisitions, legislative andregulatory compliance, asset resilience, production capability,human resources, industrial relations and failure of internal controls.The Group has a well established set of risk management proceduresat three different levels: operating company, divisional and Group.These are discussed further in the Corporate Governance Reporton pages 60 to 65.Type of risk Context Risk to <strong>McBride</strong> Potential impact Mitigating factorsUnrecoveredcost inflationSerious lossof volumeThe oil andcommodity marketsare subject tovolatility whichmay result ina rapid increasein base costs.The Group isexposed to variousexternal marketfactors includingstrong competitoractivity as wellas increasingrationalisation ofthe customer baseon a global basis.In addition, brandedcompanies havebeen offeringintense promotionalactivity toconsumers at thesame time as theGroup hascontinued toseek selling priceincreases torecover thecommodityprice effect.A large proportionof the Group’sspend is onmaterials,packaging andother consumablesused in theproduction process.Prices may riseat a rate and speedwhich cannotimmediately be fullyrecovered by theGroup throughprice increasesto our customers.The combination ofcompetitor activityand the inability toobtain selling priceincreases can giverise to the potentialloss of contracts.Customers mayseek to sourcefrom alternativesuppliers.Branded activitycan also mean thatretailer loyalty canbecome limitedleading to moreregular re-tendersof contracts.Reducedprofitability.Negative impacton volume due toloss of customerswhen priceincreases areunavoidable.Loss of anysignificant partof the Group’scustomer basecould lead toserious loss ofvolume with theresultant impacton the sustainabilityof the Group’srevenue andreducedprofitability.Loss of volumeas consumers areenticed away fromthe Private Labeloffering.It is recognised that the risks facing the Group will increase ordecrease in potential severity or importance dependent on themarket and economic climate at any particular time. During the year,the divisions have again revisited their lists of risks and updated andreprioritised such risks to reflect the dynamic environment in whichthe Group operates. Furthermore, mitigating actions have continuedto be implemented to improve certain risks including those whichmight give rise to operational disruption, product safety or qualityissues, systems dependencies and reliability and environmentalrisks. Accordingly, such risks are deemed to have diminished inpotential severity.Having reviewed its risk profile, the specific risks and uncertaintiesthat the directors believe could have the most significant impacton the Group’s business are discussed below. The mattersdescribed are not intended to be an exhaustive list of all possiblerisks and uncertainties.> The Group has continued to develop its focus on improvingoperating efficiencies through increased asset utilisationand automation, reduced waste and minimising the use ofpackaging and the use of alternative materials, sourcesand reformulations.> The Group has in place numerous sustainability initiativesto work with its customers to reduce packaging and tooptimise material costs.> The Group invests considerable effort in buildingrelationships with the retailers at the highest possiblelevel to explain the business criticality behind the needfor price increases.> There is continued investment to identify alternativeprocurement sources to mitigate where possible materialcost inflation.> The Group’s strategy is to continue to have a strongcommitment to private label category developmentincluding investment in new product developmentto enable us to offer differentiated products.> In addition, focus continues on delivering superiorcustomer service levels, deepening relationships withexisting and new customers and seeking out new channelsof supply as well as developing our understanding of theretail market and customers’ expectations across allterritories of operation.> This year, we have taken the opportunity to expand ourbusiness into wider categories, for example Skincare withthe acquisition of the new business in the Czech Republic.This aims to broaden the range of products offeringsavailable to our customers and, ultimately, to the consumer.> Our high level strategy is to drive specific category plansin key areas through Project Refresh.Type of risk Context Risk to <strong>McBride</strong> Potential impact Mitigating factorsIncreasinglycompetitivemarketSupplier failureInsufficientliquidity andcapitalresourcesThe Group operatesin very competitivemarkets.Furthermore,weaker consumerdemand andspending due to theeconomic climatehas exacerbatedthe degree ofcompetitivenessin the marketplace. Retailersare competingaggressively tomaintain marketshare andpromotionalactivity by brandedcompetitors is atrecord levels.The Group dependson close tradingrelationships witha number of keysuppliers acrossEurope.In the currentglobal financialcrisis and uncertaineconomicenvironment,certain externalrisks may increaseincluding possibleconstraints in theliquidity of the debtmarkets.Lower pricedbrandedcompetition posesa potential threat tosustainable growthof the private labeloffering.A general inabilityto compete couldarise should therebe inadequatefocus on thestrategy or failureto address the costprofile in thebusiness or as aresult of lack offocus on technicalplans, categorygrowth and productdevelopment.Loss of or failureof a key supplier, theinability to sourcecritical materialsor poor supplierperformance interms of qualityor delivery couldseriously disruptthe Group’s supplycapability.Failure to operatewithin our financialframework couldlead to theGroup becomingfinanciallydistressed.A credit crisisaffecting banks andother sectors of theeconomy couldimpact the abilityof counterpartiesto meet theirfinancial obligationsto the Group.Significant lossof contracts.Increasedcustomisationof products couldpotentially havean adverse impacton profitability.This couldultimately leadto the inability todeliver long termshareholder value.Significantdetrimental effecton the operationsof the business.Potential costimplications fromhaving to sourcefrom higher costsuppliers leading toreducedprofitability.Inability to supportour long terminvestmentprogramme.Inability to raisecapital to fundgrowth.Loss of shareholdervalue.The Group hasa well established setof risk managementprocedures at three differentlevels: operating company,divisional and Group.> The Group is focused on a multitude of initiativesto ensure that we are able to continue to compete in anincreasingly competitive environment. Project Refreshhas been announced with the objective of furtherstrengthening and refocusing the Group’s business modeland ultimately improving our market positioning andoperational efficiency.> We have established procedures for identifying thepossible risks for each key material including possiblesupply shortages. Suppliers are checked for credit andpre-qualified alternative suppliers have been identifiedwherever possible.> Suppliers’ own contingency plans are also reviewed.Where this is not possible we retain higher levels of safetystocks or we identify options to use alternative materials.> The Group has established a financial framework to ensurethat it is able to maintain an appropriate level of liquidityand financial capacity and to constrain the level of assessedcapital at risk for the purposes of positions taken infinancial instruments.> Commercial credit risk is measured and controlled todetermine the Group’s total credit risk and our bankingfacilities have been successfully renegotiated duringthe year.> Monthly divisional and Treasury Committee reviewshave been established.Overview Business review Governance Financials Shareholder information56 <strong>McBride</strong> plc Annual Report and Accounts 2011 <strong>McBride</strong> plc Annual Report and Accounts 2011 57