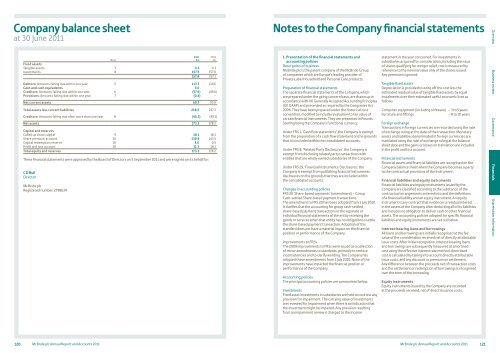

Company balance sheetat 30 June 2011NoteFixed assetsTangible assets 3 0.3 0.3Investments 4 157.5 157.0157.8 157.3Debtors: Amounts falling due within one year 5 113.7 119.6Cash and cash equivalents 5.0 –Creditors: Amounts falling due within one year 6 (57.6) (49.6)Provisions: Amounts falling due within one year 7 (0.4) –Net current assets 60.7 70.0Total assets less current liabilities 218.5 227.3Creditors: Amounts falling due after more than one year 8 (45.2) (49.1)Net assets 173.3 178.2Capital and reservesCalled up share capital 9 18.1 18.1Share premium account 10 139.9 143.5Capital redemption reserve 10 4.0 0.5Profit and loss account 10 11.3 16.1Total equity and reserves 173.3 178.2These financial statements were approved by the Board of Directors on 5 September 2011 and were signed on its behalf by:C D BullDirector<strong>McBride</strong> plcRegistered number: 27986342011£m2010£mNotes to the Company financial statements1. Presentation of the financial statements andaccounting policiesDescription of business<strong>McBride</strong> plc is the parent company of the <strong>McBride</strong> Groupof companies which are Europe’s leading provider ofPrivate Label Household and Personal Care products.Preparation of financial statementsThe separate financial statements of the Company, whichare prepared under the going concern basis, are drawn up inaccordance with UK Generally Accepted Accounting Principles(UK GAAP) and presented as required by the Companies Act2006. They have been prepared under the historical costconvention, modified to include revaluation to fair value ofcertain financial instruments. They are presented in PoundsSterling being the Company’s functional currency.Under FRS 1, ‘Cash flow statements’, the Company is exemptfrom the preparation of a cash flow statement on the groundsthat it is included within the consolidated accounts.Under FRS 8, ‘Related Party Disclosures’, the Company isexempt from disclosing related party transactions withentities that are wholly owned subsidiaries of the Company.Under FRS 29, ‘Financial Instruments: Disclosures’, theCompany is exempt from publishing financial instrumentsdisclosures on the grounds that they are included withinthe consolidated accounts.Changes in accounting policiesFRS 20 ‘Share-based payments’ (amendment) – GroupCash-settled Share-based payment transactionsThe amendment to FRS 20 has been adopted from 1 July 2010.It clarifies that the accounting for group cash-settledshare-based payment transactions in the separate orindividual financial statements of the entity receiving thegoods or services when that entity has no obligation to settlethe share-based payment transaction. Adoption of thisstandard does not have a material impact on the financialposition or performance of the Company.Improvements to FRSsThe 2009 improvements to FRSs were issued as a collectionof minor amendments to standards, primarily to removeinconsistencies and to clarify wording. The Company hasadopted these amendments from 1 July 2010. None of theimprovements have impacted the financial position orperformance of the Company.Accounting policiesThe principal accounting policies are summarised below.InvestmentsFixed asset investments in subsidiaries are held at cost less anyprovision for impairment. The carrying value of investmentsare reviewed for impairment when there is an indication thatthe investment might be impaired. Any provision resultingfrom an impairment review is charged to the incomestatement in the year concerned. For investments insubsidiaries acquired for consideration, including the issueof shares qualifying for merger relief, cost is measured byreference to the nominal value only of the shares issued.Any premium is ignored.Tangible fixed assetsDepreciation is provided to write off the cost less theestimated residual value of tangible fixed assets by equalinstalments over their estimated useful economic lives asfollows:Computer equipment (including software) – 3 to 5 yearsFurniture and fittings– 8 to 10 yearsForeign exchangeTransactions in foreign currencies are recorded using the rateof exchange ruling at the date of the transaction. Monetaryassets and liabilities denominated in foreign currencies aretranslated using the rate of exchange ruling at the balancesheet date and the gains or losses on translation are includedin the profit and loss account.Financial instrumentsFinancial assets and financial liabilities are recognised on theCompany balance sheet when the Company becomes a partyto the contractual provisions of the instrument.Financial liabilities and equity instrumentsFinancial liabilities and equity instruments issued by theCompany are classified according to the substance of thecontractual arrangements entered into and the definitionsof a financial liability and an equity instrument. An equityinstrument is any contract that evidences a residual interestin the assets of the Company after deducting all of its liabilitiesand includes no obligation to deliver cash or other financialassets. The accounting policies adopted for specific financialliabilities and equity instruments are set out below.Interest-bearing loans and borrowingsAll loans and borrowings are initially recognised at the fairvalue of the consideration received net of directly attributableissue costs. After initial recognition, interest-bearing loansand borrowings are subsequently measured at amortisedcost using the effective interest rate method. Amortisedcost is calculated by taking into account directly attributableissue costs, and any discount or premium on settlement.Any difference between the proceeds net of transaction costsand the settlement or redemption of borrowings is recognisedover the term of the borrowing.Equity instrumentsEquity instruments issued by the Company are recordedat the proceeds received, net of direct issuance costs.Overview Business review Governance Financials Shareholder information120 <strong>McBride</strong> plc Annual Report and Accounts 2011 <strong>McBride</strong> plc Annual Report and Accounts 2011 121

Notes to the Company financial statementscontinued1. Presentation of the financial statements andaccounting policies continuedDerivative financial instrumentsThe Company does not enter into speculative derivativecontracts. The Company’s activities expose it to the financialrisks of changes in foreign exchange rates and interest rates.Derivative financial instruments such as foreign currencyforward contracts and interest rate swaps are used to hedgethese risks. Such derivative financial instruments are statedat fair value. The fair value of forward exchange contractsis calculated by reference to current forward exchangecontracts with similar maturity profiles. The fair value ofinterest rate swap contracts is determined by referenceto market values for similar instruments and is the amountthat the Company would receive or pay to terminate theswap at the balance sheet date. Changes in fair value areimmediately recognised in the income statement. TheCompany has not designated any derivatives for the purposesof hedge accounting.Payments to shareholdersOn 24 March 2011, the shareholders of the Company passeda resolution to make payments to shareholders via the issueand subsequent redemption of B Shares. Subject toshareholder approval at each AGM, it is the Company’sintention that, for the foreseeable future, all payments toshareholders will be made in this way. B Shares are recognisedas liabilities when they are issued and are held at amortisedcost from the date of issue until redeemed. Prior to thisshareholder resolution, payments to shareholders were madeby payment of dividends which were recognised in the Group’sfinancial statements in the period in which they were paid.Treasury sharesOwn equity instruments which are reacquired (Treasuryshares) are deducted from equity. No gain or loss is recognisedin the income statement on the purchase, sale, issue orcancellation of the Company’s own equity instruments.Proceeds from the sale of treasury shares are recognised inthe profit and loss reserve.LeasesOperating leases are charged to the profit and loss accounton a straight-line basis over the life of the operating lease.The value of any lease incentive received to take on anoperating lease is recognised as deferred income andis released over the period to the next rent review.Share-based paymentsWhere a parent company grants share-based payments toemployees of a subsidiary and such share-based compensationis accounted for as equity- or cash-settled in the consolidatedfinancial statements of the parent, the subsidiary is requiredto record an expense for such compensation in accordancewith FRS 20, ‘Share-Based Payments’, with a correspondingincrease recognised in equity of £0.6 million and decreasein recognised liabilities of £0.1 million. Consequently,the Company has recognised an addition to fixed assetinvestments of the aggregate amount of these contributionsof £0.5 million (2010: £1.7m) with a net credit to equity/liabilityfor the same amount.TaxationCurrent tax is provided at the amounts expected to be paidapplying tax rates that have been enacted or substantivelyenacted by the balance sheet date.The Company accounts for taxation which is deferredor accelerated by reason of timing differences which haveoriginated but not reversed by the balance sheet date.Deferred tax assets are only recognised to the extent thatthey are considered recoverable against future taxable profits.Deferred tax is measured at the tax rates that are enactedor substantively enacted at the reporting date.Contingent liabilitiesWhen the Company enters into financial guarantee contractsto guarantee the indebtedness of other companies withinthe Group, the Company considers these to be insurancearrangements and accounts for them as such. In this respect,the Company treats the guarantee contract as a contingentliability until such time as it becomes probable that theCompany will be required to make a payment under theguarantee.2. Profit for the yearAs permitted by section 408 of the Companies Act 2006, theCompany has elected not to present its own profit and lossaccount for the year. The Company reported a profit for thefinancial year ended 30 June 2011 of £8.5 million (2010: loss of£2.1m). Fees payable to the Company’s auditors for the audit ofthe Company’s annual accounts were £0.1 million (2010: £0.1m).Fees payable to the Company’s auditors for services relatingto tax were £nil (2010: £nil). The Company had no employeesfor the year ended 30 June 2011 (2010: nil).3. Tangible fixed assetsDuring the year ended 30 June 2011, there were £nil ofadditions to the Company’s tangible fixed assets (2010: £0.1m).At 30 June 2011, the Company had tangible fixed assetsrelating to furniture and fittings of £0.3 million (2010: £0.3m)and computer equipment of £nil (2010: £nil).4. Investments£mShares in subsidiary undertakings at costAt 1 July 2010 157.0Share-based payment granted to employeesof subsidiaries 0.5At 30 June 2011 157.54. Investments continuedSet out below are the principal subsidiary undertakingsof the Company whose results are included in the consolidatedfinancial statements as at 30 June 2011. The country ofincorporation is also the principal country of operation.The main business activity of the major operating subsidiariesinvolves the manufacture and distribution of Household andPersonal Care products. A full list of subsidiaries is filed withthe Registrar of Companies.CountryCompanyOwnership of incorporationTrading subsidiaries(ordinary shares)Robert <strong>McBride</strong> Limited (1) 100.0% England<strong>McBride</strong> S.A. 100.0% Belgium<strong>McBride</strong> Zhongshan Limited 100.0% China<strong>McBride</strong> Czech a.s. (2)70.0% Czech Republic<strong>McBride</strong> S.r.o.100.0% Czech Republic<strong>McBride</strong> S.A.S. 100.0% FranceProblanc S.A.S. 100.0% FranceVitherm S.A.S. 100.0% FranceChemolux GmbH 100.0% Germany<strong>McBride</strong> Hungary Kft 100.0% Hungary<strong>McBride</strong> S.p.A. 100.0% ItalyChemolux S.a.r.l. 100.0% LuxembourgFortune Laboratories Sdn Bhd (2) 85.0% Malaysia<strong>McBride</strong> B.V. 100.0% NetherlandsIntersilesia <strong>McBride</strong> Polska Sp.Z.o.o. 100.0% PolandOOO <strong>McBride</strong> Russia 100.0% Russia<strong>McBride</strong> S.A.U. 100.0% SpainNewlane CosmeticsCompany Limited 92.5% VietnamInvestment companies<strong>McBride</strong> Holdings Limited (1) 100.0% England<strong>McBride</strong> CE Holdings Limited 100.0% England<strong>McBride</strong> Australia PTY Limited 100.0% Australia<strong>McBride</strong> Hong KongHoldings Limited 100.0% Hong KongCNL Holdings Sdn Bhd (3) 92.5% MalaysiaFortlab Holdings Sdn Bhd (2) 85.0% MalaysiaFortune Organics (F.E.)Sdn Bhd (4) 46.8% Malaysia(1)These companies are directly owned subsidiary undertakings of <strong>McBride</strong> plc(the Company) with <strong>McBride</strong> Holdings Limited 100.0% owned andRobert <strong>McBride</strong> Limited 57.7% owned by the Company.(2)As disclosed in note 4 to the consolidated financial statements thesecompanies are accounted for using the anticipated acquisition method andno non-controlling interests have been recognised.(3)This company is 50% owned by <strong>McBride</strong> Hong Kong Holdings Limited and 50% heldby Fortlab Holdings Sdn Bhd therefore the effective indirect ownership by theCompany of this investment company and Newlane Cosmetics Company Limited,its wholly owned subsidiary, is 92.5%. However as disclosed in note 4 to theconsolidated financial statements these companies are accounted for usingthe anticipated acquisition method and no non-controlling interest has beenrecognised.(4)This company is 55% owned by Fortlab Holdings Sdn Bhd and therefore theeffective indirect ownership of this investment company and its wholly ownedsubsidiary by the Company is 46.8%. As disclosed in note 4 to the consolidatedfinancial statements, its parent company has been accounted for using theanticipated acquisition method. As a result no non-controlling interest in respectof the parent company has been recognised and the non-controlling interestin this investment company in the consolidated financial statements is 45%.5. Debtors: amounts falling due within one year2011£m2010£mAmounts owed by Group undertakings 108.9 112.7Foreign currency contracts 0.2 –Forward contract assets – 1.5Deferred tax assets (note 11) 0.9 1.0Other debtors 3.4 4.2Prepayments and accrued income 0.3 0.2Total debtors 113.7 119.66. Creditors: amounts falling due within one year2011£m2010£mBank overdrafts (unsecured) – 0.4Amount relating to cash-settled share-basedpayments granted to employees of subsidiaries 0.5 0.6Forward contract liabilities 0.2 –Interest rate swaps 2.0 3.2Unredeemed B Shares 0.1 –Other creditors 0.5 0.3Amounts owed to Group undertakings 53.5 43.5Accruals and deferred income 0.8 1.6Total creditors 57.6 49.6On 24 March 2011, shareholders approved proposals for theimplementation of a ‘B Share’ scheme as a mechanism formaking payments to shareholders. This involves the issueof non-cumulative redeemable preference shares (knownas ‘B Shares’) in place of income distributions. Shareholdersare able to redeem any number of their B Shares for cash.Any B Shares retained attract a dividend of 75 per cent ofLIBOR on the 0.1p nominal value of each share, paid ona twice-yearly basis.Movements in the B Shares during the year were as follows:2011Nominalvalue£m Number2010Nominalvalue£mNumberIssued and fully paidAt 1 July – – – –Issued to equityshareholders 3,607,902,100 3.6 – –Redeemed (3,471,530,095) (3.5) – –At 30 June 136,372,005 0.1 – –7. Provisions: amounts falling due within one year2011£mAt 1 July 2010 –Provided in year 1.3Utilised in year (0.9)At 30 June 2011 0.4Overview Business review Governance Financials Shareholder information122 <strong>McBride</strong> plc Annual Report and Accounts 2011 <strong>McBride</strong> plc Annual Report and Accounts 2011 123