pdf (2MB) - McBride

pdf (2MB) - McBride

pdf (2MB) - McBride

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

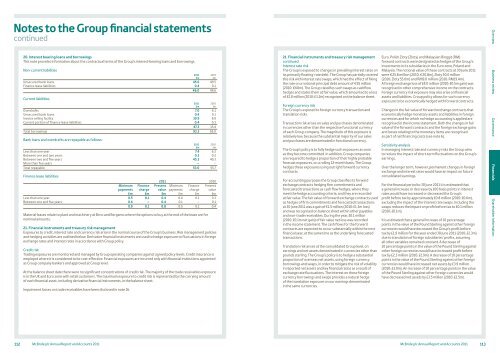

Notes to the Group financial statementscontinued20. Interest bearing loans and borrowingsThis note provides information about the contractual terms of the Group’s interest-bearing loans and borrowings.Non-current liabilitiesUnsecured bank loans 45.6 49.5Finance lease liabilities 0.4 0.146.0 49.6Current liabilitiesOverdrafts 7.0 6.1Unsecured bank loans 0.4 0.1Invoice selling facility 39.5 8.9Current portion of finance lease liabilities 0.4 0.347.3 15.4Total borrowings 93.3 65.0Bank loans and overdrafts are repayable as follows:Less than one year 7.4 6.2Between one and two years 0.3 0.2Between two and five years 45.3 49.3More than five years – –Total repayable 53.0 55.7Finance lease liabilitiesMinimumpayments£mFinancecharge£mPresentvalue£m2011£m2011£m2011£m2010£m2010£m2010£m2011 2010Minimum Finance Presentpayments charge value£m £m £mLess than one year 0.5 0.1 0.4 0.4 0.1 0.3Between one and five years 0.4 – 0.4 0.1 – 0.10.9 0.1 0.8 0.5 0.1 0.4Material leases relate to plant and machinery at Brno and Bergamo where the options to buy at the end of the lease are fornominal amounts.21. Financial instruments and treasury risk managementExposures to credit, interest rate and currency risk arise in the normal course of the Group’s business. Risk management policiesand hedging activities are outlined below. Derivative financial instruments are used to hedge exposure to fluctuations in foreignexchange rates and interest rates in accordance with Group policy.Credit riskTrading exposures are monitored and managed by Group operating companies against agreed policy levels. Credit insurance isemployed where it is considered to be cost-effective. Financial exposures are incurred only with financial institutions appointedas Group company bankers and approved at Group level.At the balance sheet date there were no significant concentrations of credit risk. The majority of the trade receivables exposureis in the UK and Euro zone with retail customers. The maximum exposure to credit risk is represented by the carrying amountof each financial asset, including derivative financial instruments, in the balance sheet.Impairment losses on trade receivables have been disclosed in note 16.21. Financial instruments and treasury risk managementcontinuedInterest rate riskThe Group is exposed to changes in prevailing interest rates onits primarily floating-rate debt. The Group has partially coveredthis risk with interest rate swaps, which had the effect of fixingthe rate on a notional principal debt amount of €55 million(2010: €60m). The Group classifies such swaps as cashflowhedges and states them at fair value, which amounted to a lossof £2.0 million (2010: £3.2m) recognised on the balance sheet.Foreign currency riskThe Group is exposed to foreign currency transaction andtranslation risks.Transaction risk arises on sales and purchases denominatedin currencies other than the respective functional currencyof each Group company. The magnitude of this exposure isrelatively low, because the substantial majority of our salesand purchases are denominated in functional currency.The Group’s policy is to fully hedge such exposures as soonas they become committed. In addition, Group companiesare required to hedge a proportion of their highly probableforecast exposures, on a rolling 12-month basis. The Grouphedges these exposures using outright forward currencycontracts.For accounting purposes the Group classifies its forwardexchange contracts hedging firm commitments andforecasted transactions as cash flow hedges, where theymeet the hedge accounting criteria, and they are recordedat fair value. The fair value of forward exchange contracts usedas hedges of firm commitments and forecasted transactionsat 30 June 2011 was a gain of £1.5 million (2010: £1.3m loss)and was recognised on balance sheet within other payablesand non-trade receivables. During the year, £0.1 million(2010: £0.1m net gain) of fair value net loss was recordedin the income statement. The cash flows for the forwardcontracts are expected to occur substantially within the nextfinancial year, at the same time as the underlying forecastedtransactions.Translation risk arises at the consolidated Group level, onearnings and net assets denominated in currencies other thanpounds sterling. The Group’s policy is to hedge a substantialproportion of overseas net assets, using foreign currencyborrowings and swaps, in order to mitigate the risk of volatilityin reported net assets and key financial ratios as a result ofexchange rate fluctuations. The interest on these foreigncurrency borrowings and swaps provides a natural hedgeof the translation exposure on our earnings denominatedin the same currencies.Euro, Polish Zloty (Zloty) and Malaysian Ringgit (RM)forward contracts were designated as hedges of the Group’sinvestments in its subsidiaries in the Euro zone, Poland andMalaysia. The notional value of these contracts at 30 June 2011were €25.8 million (2010: €20.8m), Zloty 50.0 million(2010: Zloty 55.0m) and RM9.0 million (2010: RM19.4m).A foreign exchange loss of £4.0 million (2010: £0.5m gain) wasrecognised in other comprehensive income on the contracts.Foreign currency risk exposure may also arise on financialassets and liabilities. Group policy allows for such currencyexposure to be economically hedged with forward contracts.Changes in the fair value of forward exchange contracts thateconomically hedge monetary assets and liabilities in foreigncurrencies and for which no hedge accounting is applied arerecognised in the income statement. Both the changes in fairvalue of the forward contracts and the foreign exchange gainsand losses relating to the monetary items are recognisedas part of net financing costs (see note 6).Sensitivity analysisIn managing interest rate and currency risks the Group aimsto reduce the impact of short-term fluctuations on the Group’searnings.Over the longer term, however, permanent changes in foreignexchange and interest rates would have an impact on futureconsolidated earnings.For the financial period to 30 June 2011 it is estimated thata general increase or decrease by 100 basis points in interestrates would have increased or decreased the Group’sprofit before tax by approximately £0.8 million (2010: £0.6m),excluding the impact of the interest rate swaps. Including theswaps reduces the impact on profit before tax to £0.1 million(2010: £0.1m).It is estimated that a general increase of 10 percentagepoints in the value of the Pound Sterling against other foreigncurrencies would have decreased the Group’s profit beforetax by £1.9 million for the year ended 30 June 2011 (2010: £2.3m)due to translation of foreign subsidiaries’ profits, assumingall other variables remained constant. A decrease of10 percentage points in the value of the Pound Sterling againstother foreign currencies would have increased profit beforetax by £2.3 million (2010: £2.9m). A decrease of 10 percentagepoints in the value of the Pound Sterling against other foreigncurrencies would have increased net assets by £3.9 million(2010: £3.0m). An increase of 10 percentage points in the valueof the Pound Sterling against other foreign currencies wouldhave decreased net assets by £3.5 million (2010: £2.5m).Overview Business review Governance Financials Shareholder information112 <strong>McBride</strong> plc Annual Report and Accounts 2011 <strong>McBride</strong> plc Annual Report and Accounts 2011 113