pdf (2MB) - McBride

pdf (2MB) - McBride

pdf (2MB) - McBride

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

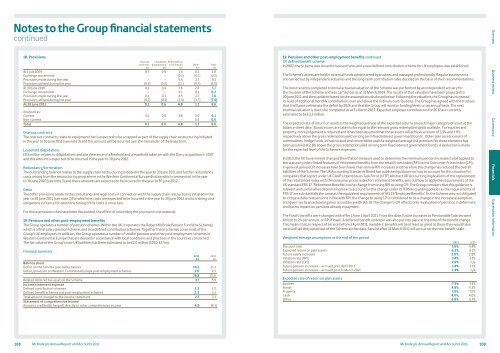

Notes to the Group financial statementscontinued18. ProvisionsOnerouscontracts£mLeaseholddilapidations£mRedundancy/termination£mAt 1 July 2009 0.7 0.6 1.4 0.1 2.8Exchange movements – – (0.1) (0.1) (0.2)Provisions made during the year – – 5.4 2.7 8.1Provisions utilised during the year (0.5) (0.2) (3.1) (0.7) (4.5)At 30 June 2010 0.2 0.4 3.6 2.0 6.2Exchange movements – – 0.1 0.1 0.2Provisions made during the year 0.1 0.3 4.5 2.7 7.6Provisions utilised during the year (0.2) (0.1) (3.4) (3.7) (7.4)At 30 June 2011 0.1 0.6 4.8 1.1 6.6Analysed as:Current 0.1 0.6 4.8 0.6 6.1Non-current – – – 0.5 0.5Total 0.1 0.6 4.8 1.1 6.6Onerous contractsThe onerous contracts relate to equipment that is expected to be scrapped as part of the supply chain restructuring initiatedin the year to 30 June 2011 (see note 3) and this amount will be incurred over the remainder of the lease term.Leasehold dilapidations£0.6 million relates to dilapidations and site clearance of a freehold and a leasehold taken on with the Darcy acquisition in 2007and this amount is expected to be incurred in the year to 30 June 2012.Redundancy/terminationThe outstanding balance relates to the supply chain restructuring initiated in the year to 30 June 2011 and further redundancycosts arising from the restructuring programme in the Western Continental Europe division which commenced in the yearto 30 June 2010 (see note 3) and these amounts are expected to be incurred in the year to 30 June 2012.OtherThe other provisions relate to the consultancy and legal costs in connection with the supply chain restructuring initiated in theyear to 30 June 2011 (see note 3) for which the costs are expected to be incurred in the year to 30 June 2012 and to training costobligations in France for which the timing of the costs is uncertain.For those provisions that have been discounted, the effect of unwinding the provision is not material.19. Pensions and other post-employment benefitsThe Group operates a number of pension schemes. Within the UK, it operates the Robert <strong>McBride</strong> Pension Fund (the Scheme),which is a final salary pension scheme, and also defined contribution schemes. Together these schemes cover most of theGroup’s UK employees. In addition, the Group operates a number of smaller pension and other post-employment schemes inWestern Continental Europe that are devised in accordance with local conditions and practices in the countries concerned.The fair value of the Group’s non-UK liabilities has been estimated to be £2.0 million (2010: £2.5m).Financial summaryBalance sheetDeficit on the Scheme (see tables below) 14.2 21.1Deficit/provision on Western Continental Europe post-employment schemes 2.0 2.516.2 23.6Related deferred tax asset on the Scheme 3.7 5.9Income statement expenseDefined contribution schemes 1.2 1.2Defined benefit schemes and post-employment schemes 1.5 2.1Total amount charged to the income statement 2.7 3.3Statement of comprehensive incomeAmounts credited/(charged) directly to other comprehensive income 4.5 (4.3)Other£m2011£mTotal£m2010£m19. Pensions and other post-employment benefits continuedUK defined benefit schemeIn 2002, the Scheme was closed to new entrants and a new defined contribution scheme for UK employees was established.The Scheme’s assets are held in external funds administered by trustees and managed professionally. Regular assessmentsare carried out by independent actuaries and the long-term contribution rates decided on the basis of their recommendations.The most recently completed triennial actuarial valuation of the Scheme was performed by an independent actuary forthe trustees of the Scheme and was carried out as at 31 March 2009. The results of that valuation have been projected to30 June 2011 and then updated based on the assumptions disclosed below. Following the valuation, the Group has increasedits level of additional monthly contributions over and above the ordinary contributions. The Group has agreed with the trusteesthat it will aim to eliminate the deficit by 2026 and that the Group will monitor funding levels on an annual basis. The nexttriennial valuation is due to be completed as at 31 March 2012. Expected employer contributions for 2012 are currentlyestimated to be £3.3 million.The expected rate of return on assets is the weighted average of the expected returns on each major category of asset at thebalance sheet date. Bond returns are taken to be equal to the relevant gross redemption yields available. For equities andproperty, more judgement is required and it has been assumed that those assets will achieve a return of 3.5% and 3.0%respectively above the gross redemption yield on long term fixed interest government bonds. Other plan assets consist ofcommodities, hedge funds, infrastructure and convertibles and the weighted average risk premium for these elements hasbeen assumed at 2.8% above the gross redemption yield on long term fixed interest government bonds. A deduction is madefor the expected level of the Scheme’s expenses.In 2010, the UK Government changed the inflation measure used to determine the minimum pension increases to be applied tothe statutory index-linked features of retirement benefits from the retail Prices Index (RPI) to the Consumer Prices Index (CPI).In general, annual CPI increases have been lower than annual RPI increases and therefore the change has reduced the overallliabilities of the Scheme. The UK Accounting Standards Board has published guidance on how to account for this situation forcompanies that report under UK GAAP. Urgent Issues Task Force (UITF) Abstract 48 ‘Accounting implications of the replacementof the retail prices index with the consumer prices index for retirement benefits, sets out how to apply the requirements of theUK standard FRS 17, ‘Retirement Benefits’, to the change from using RPI to using CPI. The Group considers that this guidance isrelevant and useful when determining how to account for this change under its IFRS accounting policies as the requirements ofFRS 17 are substantially the same as the equivalent requirements of IAS 19 ‘Employee Benefits’. As the Scheme was not obligatedto increase deferred pensions in line with RPI, the change to using CPI is considered to be a change in the increase assumption,and gives rise to an actuarial gain in accordance with IAS 19. The change to CPI affects only revaluation of pensions in defermentand has no impact on pensions already in payment.The Fund’s benefits were changed with effect from 1 April 2011. From this date, future increases to Pensionable Salaries werelimited to 2% per annum, or RPI if lower. A deferred benefit underpin was also put into place at the time of the benefit change.This means that, in respect of service before 1 April 2011, members’ benefits will be at least as great as those they would havereceived had they opted out of the Scheme at that date. Service after 31 March 2011 will accrue on the new benefit scale.Weighted average assumptions at the end of the period2011 2010Discount rate 5.6% 5.4%Expected return on plan assets 6.3% 6.1%Future salary increases 2.0% 2.8%Inflation rate (RPI) 3.4% 3.1%Inflation rate (CPI) 2.6% n/aFuture pension increases – accrued pre 1 April 2011 3.4% 3.1%Future pension increases – accrued post 31 March 2011 2.4% n/aExpected rate of return on plan assetsEquities 7.5% 7.5%Bonds 4.8% 5.3%Property 7.0% 7.0%Cash 4.0% 4.0%Other 6.8% 6.7%Overview Business review Governance Financials Shareholder information108 <strong>McBride</strong> plc Annual Report and Accounts 2011 <strong>McBride</strong> plc Annual Report and Accounts 2011 109