pdf (2MB) - McBride

pdf (2MB) - McBride

pdf (2MB) - McBride

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

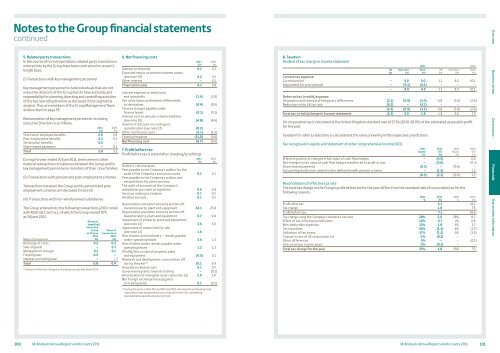

Notes to the Group financial statementscontinued5. Related party transactionsIn the course of normal operations, related party transactionsentered into by the Group have been contracted on an arm’slength basis.(i) Transactions with key management personnelKey management personnel include individuals that are notexecutive directors of the Group but do have authority andresponsibility for planning, directing and controlling activitiesof the key operating divisions as disclosed in the segmentalanalysis. They are members of the Group Management Teamas described on page 59.Remuneration of key management personnel, includingexecutive Directors is as follows:2011£m2010£mShort-term employee benefits 2.0 2.6Post-employment benefits 0.2 0.3Termination benefits 0.6 –Share-based payments – 0.3Total 2.8 3.2During the year ended 30 June 2011, there were no othermaterial transactions or balances between the Group and itskey management personnel or members of their close families.(ii) Transactions with pension and post-employment schemesTransactions between the Group and its pension and postemploymentschemes are disclosed in note 19.(iii) Transactions with non-wholly owned subsidiariesThe Group entered into the following transactions (2010: none)with <strong>McBride</strong> Czech a.s. of which the Group owned 70%at 30 June 2011:Balances(owed by)/due to theNature of transactionsGroupat 30 June2011£mValue oftransactions2011£mRecharge of costs 0.2 0.2Sale of goods – 0.1Management charges 0.1 0.1Funding loan 0.5 –Interest on funding loan – – (1)Total 0.8 0.4(1)Amount of interest charged on funding loan was less than £0.1m.6. Net financing costs2011£m2010£mInterest on deposits 0.1 0.1Expected return on pension scheme assets(see note 19) 4.2 3.6Other interest – 0.1Financial income 4.3 3.8Interest expense on bank loansand overdrafts (3.4) (3.0)Fair value losses and interest differentialson derivatives (0.4) (0.5)Finance charges payable underfinance leases (0.1) (0.1)Interest cost on pension scheme liabilities(see note 19) (4.8) (4.6)Unwind of discount on contingentconsideration (see note 17) (0.2) –Other net finance costs (2.1) (1.2)Financial expense (11.0) (9.4)Net financing cost (6.7) (5.6)7. Profit before taxProfit before tax is stated after charging/(crediting):2011£m2010£mAuditors’ remunerationFees payable to the Company’s auditor for theaudit of the Company’s annual accounts 0.1 0.1Fees payable to the Company’s auditor andnetwork firms for other services:The audit of accounts of the Company’ssubsidiaries pursuant to legislation 0.4 0.4Services relating to taxation 0.1 0.2All other services 0.1 0.1Depreciation and other amounts written offowned property, plant and equipment 24.1 25.8Depreciation and other amounts written offleased property, plant and equipment 0.7 0.8Impairment of property, plant and equipment(see note 13) 3.4 5.0Impairment of assets held for sale(see note 13) 1.6 –Hire of plant and machinery – rentals payableunder operating leases 3.6 3.3Hire of other assets rentals payable underoperating leases 1.3 1.2(Profit)/loss on sale of property, plantand equipment (0.5) 0.1Research and development costs written offduring the year (2) 10.1 6.9Acquisition related costs 0.1 0.7Government grants towards training – (0.1)Amortisation of intangible assets (see note 12) 2.9 2.0Net foreign exchange losses/(gains)on trading items 0.1 (0.1)(2)During the years ended 30 June 2010 and 2011, all research and developmentexpenditure was expensed as incurred as the criteria for capitalisingdevelopment expenditure were not met.8. TaxationAnalysis of tax charge in income statementUK£mOverseas£m2011 2010TotalUK Overseas Total£m£m£m£mCurrent tax expense:Current period – 5.0 5.0 1.1 9.0 10.1Adjustment for prior periods – (0.1) (0.1) – – –– 4.9 4.9 1.1 9.0 10.1Deferred tax (credit)/expense:Origination and reversal of temporary differences (2.1) (0.9) (3.0) 0.8 (3.4) (2.6)Reduction in the UK tax rate (0.1) – (0.1) – – –(2.2) (0.9) (3.1) 0.8 (3.4) (2.6)Total tax (credit)/charge in income statement (2.2) 4.0 1.8 1.9 5.6 7.5UK corporation tax is calculated at the United Kingdom standard rate of 27.5% (2010: 28.0%) of the estimated assessable profitfor the year.Taxation for other jurisdictions is calculated at the rates prevailing in the respective jurisdictions.Tax recognised in equity and statement of other comprehensive income (OCI)Effective portion of changes in fair value of cash flow hedges – (0.5) – 0.6Net changes in fair value of cash flow hedges transferred to profit or loss – (0.6) – (0.3)Share-based payments (0.3) – (0.6) –Actuarial (gains)/losses related to the defined benefit pension scheme – (1.2) – 1.2(0.3) (2.3) (0.6) 1.5Reconciliation of effective tax rateThe total tax charge on the Group’s profit before tax for the year differs from the standard rate of corporation tax for thefollowing reasons:Profit after tax 5.3 22.1Tax charge 1.8 7.5Profit before tax 7.1 29.6Tax charge using the Company’s domestic tax rate 28% 2.0 28% 8.3Effect of tax in foreign jurisdictions 10% 0.7 2% 0.8Non-deductible expenses 25% 1.8 6% 1.7Tax incentives -18% (1.3) -6% (1.7)Utilisation of tax losses -17% (1.2) -5% (1.5)Change in rate of UK corporation tax -2% (0.1) – –Other differences 0% – – (0.1)Over provision in prior years -2% (0.1) – –Total tax charge for the year 25% 1.8 25% 7.52011Equity£m2011%2011OCI£m2011£m2010Equity£m2010%2010OCI£m2010£mOverview Business review Governance Financials Shareholder information100 <strong>McBride</strong> plc Annual Report and Accounts 2011 <strong>McBride</strong> plc Annual Report and Accounts 2011 101