pdf (2MB) - McBride

pdf (2MB) - McBride

pdf (2MB) - McBride

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

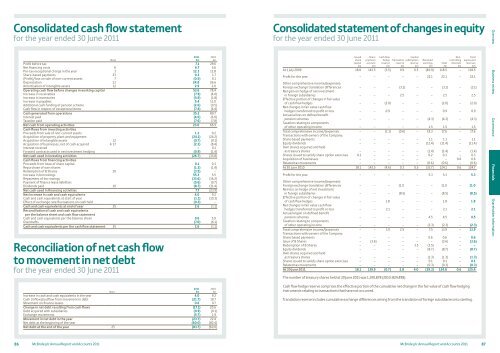

Consolidated cash flow statementfor the year ended 30 June 2011NoteProfit before tax 7.1 29.6Net financing costs 6 6.7 5.6Pre-tax exceptional charge in the year 3 12.3 12.8Share-based payments 23 0.3 1.7(Profit)/loss on sale of non-current assets 7 (0.5) 0.1Depreciation 13 24.8 26.6Amortisation of intangible assets 12 2.9 2.0Operating cash flow before changes in working capital 53.6 78.4Increase in receivables (7.9) (4.0)Increase in inventories (5.9) (1.8)Increase in payables 5.4 13.0Additional cash funding of pension scheme (2.6) (0.5)Cash flow in respect of exceptional items (7.4) (4.4)Cash generated from operations 35.2 80.7Interest paid (4.6) (6.0)Taxation paid (7.6) (7.8)Net cash from operating activities 23.0 66.9Cash flows from investing activitiesProceeds from sale of non-current assets 1.2 0.2Acquisition of property, plant and equipment (24.1) (24.2)Acquisition of intangible assets 12 (0.7) (0.1)Acquisition of businesses, net of cash acquired 4, 17 (2.2) (8.4)Interest received – 0.1Forward contracts used in net investment hedging (0.9) (1.4)Net cash used in investing activities (26.7) (33.8)Cash flows from financing activitiesProceeds from issue of share capital 0.1 0.3Repurchase of own shares (1.3) (1.4)Redemption of B Shares 10 (3.5) –Increase in borrowings 55.3 5.5Repayment of borrowings (33.6) (16.2)Payment of finance lease liabilities (0.6) (0.7)Dividends paid 10 (8.7) (11.4)Net cash used in financing activities 7.7 (23.9)Net increase in cash and cash equivalents 4.0 9.2Cash and cash equivalents at start of year (1.1) (10.3)Effect of exchange rate fluctuations on cash held (0.3) –Cash and cash equivalents at end of year 25 2.6 (1.1)Reconciliation of cash and cash equivalentsper the balance sheet and cash flow statementCash and cash equivalents per the balance sheet 9.6 5.0Overdrafts (7.0) (6.1)Cash and cash equivalents per the cash flow statement 25 2.6 (1.1)Reconciliation of net cash flowto movement in net debtfor the year ended 30 June 20112011£m2010£mConsolidated statement of changes in equityfor the year ended 30 June 2011IssuedshareSharepremiumCash flowhedgeCapitalTranslation redemption RetainedNoncontrollingTotalequity andcapital£maccount£mreserve£mreserve£mreserve£mearnings£mTotal£minterests£mreserves£mAt 1 July 2009 18.0 143.5 (3.5) 0.9 0.5 (40.9) 118.5 – 118.5Profit for the year – – – – – 22.1 22.1 – 22.1Other comprehensive income/(expense):Foreign exchange translation differences – – – (3.1) – – (3.1) – (3.1)Net gain on hedge of net investmentin foreign subsidiaries – – – 2.5 – – 2.5 – 2.5Effective portion of changes in fair valueof cash flow hedges – – (2.0) – – – (2.0) – (2.0)Net changes in fair value cash flowhedges transferred to profit or loss – – 0.9 – – – 0.9 – 0.9Actuarial loss on defined benefitpension schemes – – – – – (4.3) (4.3) – (4.3)Taxation relating to componentsof other operating income – – – – – 1.5 1.5 – 1.5Total comprehensive income/(expense): – – (1.1) (0.6) – 19.3 17.6 – 17.6Transactions with owners of the Company:Share based payments – – – – – 1.1 1.1 – 1.1Equity dividends – – – – – (11.4) (11.4) – (11.4)Own shares acquired and heldas treasury shares – – – – – (1.4) (1.4) – (1.4)Shares issued to satisfy share option exercises 0.1 – – – – 0.2 0.3 – 0.3Acquisition of businesses – – – – – – – 0.6 0.6Related tax movements – – – – – (0.6) (0.6) – (0.6)At 30 June 2010 18.1 143.5 (4.6) 0.3 0.5 (33.7) 124.1 0.6 124.7Profit for the year – – – – – 5.3 5.3 – 5.3Other comprehensive income/(expense):Foreign exchange translation differences – – – 11.0 – – 11.0 – 11.0Net loss on hedge of net investmentin foreign subsidiaries – – – (8.5) – – (8.5) – (8.5)Effective portion of changes in fair valueof cash flow hedges – – 1.8 – – – 1.8 – 1.8Net changes in fair value cash flowhedges transferred to profit or loss – – 2.1 – – – 2.1 – 2.1Actuarial gain on defined benefitpension schemes – – – – – 4.5 4.5 – 4.5Taxation relating to componentsof other operating income – – – – – (2.3) (2.3) – (2.3)Total comprehensive income/(expense): – – 3.9 2.5 – 7.5 13.9 – 13.9Transactions with owners of the Company:Share based payments – – – – – 0.6 0.6 – 0.6Issue of B Shares – (3.6) – – – – (3.6) – (3.6)Redemption of B Shares – – – – 3.5 (3.5) – – –Equity dividends – – – – – (8.7) (8.7) – (8.7)Own shares acquired and heldas treasury shares – – – – – (1.3) (1.3) – (1.3)Shares issued to satisfy share option exercises – – – – – 0.1 0.1 – 0.1Related tax movements – – – – – (0.3) (0.3) – (0.3)At 30 June 2011 18.1 139.9 (0.7) 2.8 4.0 (39.3) 124.8 0.6 125.4The number of treasury shares held at 30 June 2011 was 1,190,878 (2010: 824,498).Overview Business review Governance Financials Shareholder informationNoteIncrease in cash and cash equivalents in the year 4.0 9.2Cash (inflow)/outflow from movement in debt (21.7) 10.7Movement on finance leases 0.6 0.7Change in net debt resulting from cash flows (17.1) 20.6Debt acquired with subsidiaries (0.9) (0.1)Exchange movements (5.7) 1.9Movement in net debt in the year (23.7) 22.4Net debt at the beginning of the year (60.0) (82.4)Net debt at the end of the year 25 (83.7) (60.0)2011£m2010£mCash flow hedge reserve comprises the effective portion of the cumulative net change in the fair value of cash flow hedginginstruments relating to transactions that have not occurred.Translation reserve includes cumulative exchange differences arising from the translation of foreign subsidiaries into sterling.86 <strong>McBride</strong> plc Annual Report and Accounts 2011 <strong>McBride</strong> plc Annual Report and Accounts 2011 87