Vanguard International Stock Index Funds Annual Report

Vanguard International Stock Index Funds Annual Report

Vanguard International Stock Index Funds Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58<br />

Pacific <strong>Stock</strong> <strong>Index</strong> Fund<br />

B. The <strong>Vanguard</strong> Group furnishes at cost investment advisory, corporate management, administrative,<br />

marketing, and distribution services. The costs of such services are allocated to the fund under methods<br />

approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets<br />

in capital contributions to <strong>Vanguard</strong>. At October 31, 2009, the fund had contributed capital of $1,210,000<br />

to <strong>Vanguard</strong> (included in Other Assets), representing 0.02% of the fund’s net assets and 0.48% of<br />

<strong>Vanguard</strong>’s capitalization. The fund’s trustees and officers are also directors and officers of <strong>Vanguard</strong>.<br />

C. The fund’s custodian bank has agreed to reduce its fees when the fund maintains cash on deposit<br />

in the non-interest-bearing custody account. For the year ended October 31, 2009, custodian fee offset<br />

arrangements reduced the fund’s expenses by $86,000 (an annual rate of 0.00% of average net assets).<br />

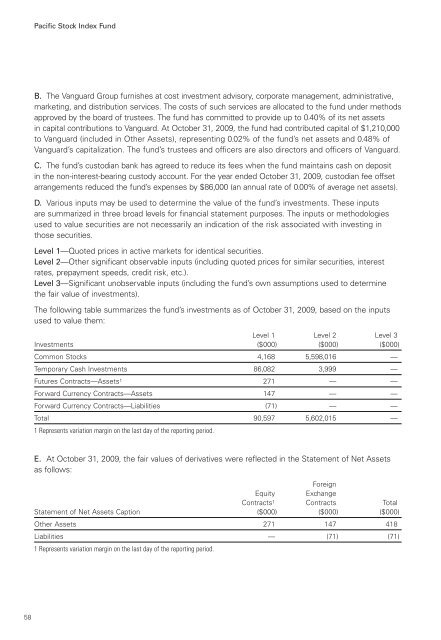

D. Various inputs may be used to determine the value of the fund’s investments. These inputs<br />

are summarized in three broad levels for financial statement purposes. The inputs or methodologies<br />

used to value securities are not necessarily an indication of the risk associated with investing in<br />

those securities.<br />

Level 1—Quoted prices in active markets for identical securities.<br />

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest<br />

rates, prepayment speeds, credit risk, etc.).<br />

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine<br />

the fair value of investments).<br />

The following table summarizes the fund’s investments as of October 31, 2009, based on the inputs<br />

used to value them:<br />

Level 1 Level 2 Level 3<br />

Investments ($000) ($000) ($000)<br />

Common <strong>Stock</strong>s 4,168 5,598,016 —<br />

Temporary Cash Investments 86,082 3,999 —<br />

Futures Contracts—Assets1 271 — —<br />

Forward Currency Contracts—Assets 147 — —<br />

Forward Currency Contracts—Liabilities (71) — —<br />

Total<br />

1 Represents variation margin on the last day of the reporting period.<br />

90,597 5,602,015 —<br />

E. At October 31, 2009, the fair values of derivatives were reflected in the Statement of Net Assets<br />

as follows:<br />

Equity<br />

Foreign<br />

Exchange<br />

Contracts1 Contracts Total<br />

Statement of Net Assets Caption ($000) ($000) ($000)<br />

Other Assets 271 147 418<br />

Liabilities<br />

1 Represents variation margin on the last day of the reporting period.<br />

— (71) (71)