Vanguard International Stock Index Funds Annual Report

Vanguard International Stock Index Funds Annual Report

Vanguard International Stock Index Funds Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

90<br />

Emerging Markets <strong>Stock</strong> <strong>Index</strong> Fund<br />

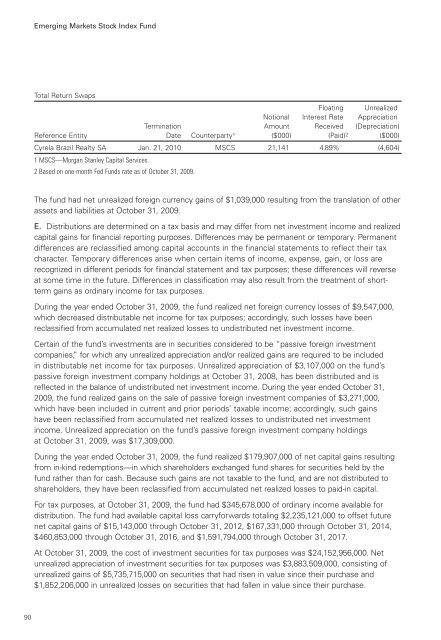

Total Return Swaps<br />

Floating Unrealized<br />

Notional Interest Rate Appreciation<br />

Termination Amount Received (Depreciation)<br />

Reference Entity Date Counterparty1 ($000) (Paid) 2 ($000)<br />

Cyrela Brazil Realty SA Jan. 21, 2010 MSCS 21,141 4.89% (4,604)<br />

1 MSCS—Morgan Stanley Capital Services.<br />

2 Based on one-month Fed <strong>Funds</strong> rate as of October 31, 2009.<br />

The fund had net unrealized foreign currency gains of $1,039,000 resulting from the translation of other<br />

assets and liabilities at October 31, 2009.<br />

E. Distributions are determined on a tax basis and may differ from net investment income and realized<br />

capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent<br />

differences are reclassified among capital accounts in the financial statements to reflect their tax<br />

character. Temporary differences arise when certain items of income, expense, gain, or loss are<br />

recognized in different periods for financial statement and tax purposes; these differences will reverse<br />

at some time in the future. Differences in classification may also result from the treatment of shortterm<br />

gains as ordinary income for tax purposes.<br />

During the year ended October 31, 2009, the fund realized net foreign currency losses of $9,547,000,<br />

which decreased distributable net income for tax purposes; accordingly, such losses have been<br />

reclassified from accumulated net realized losses to undistributed net investment income.<br />

Certain of the fund’s investments are in securities considered to be “passive foreign investment<br />

companies,” for which any unrealized appreciation and/or realized gains are required to be included<br />

in distributable net income for tax purposes. Unrealized appreciation of $3,107,000 on the fund’s<br />

passive foreign investment company holdings at October 31, 2008, has been distributed and is<br />

reflected in the balance of undistributed net investment income. During the year ended October 31,<br />

2009, the fund realized gains on the sale of passive foreign investment companies of $3,271,000,<br />

which have been included in current and prior periods’ taxable income; accordingly, such gains<br />

have been reclassified from accumulated net realized losses to undistributed net investment<br />

income. Unrealized appreciation on the fund’s passive foreign investment company holdings<br />

at October 31, 2009, was $17,309,000.<br />

During the year ended October 31, 2009, the fund realized $179,907,000 of net capital gains resulting<br />

from in-kind redemptions—in which shareholders exchanged fund shares for securities held by the<br />

fund rather than for cash. Because such gains are not taxable to the fund, and are not distributed to<br />

shareholders, they have been reclassified from accumulated net realized losses to paid-in capital.<br />

For tax purposes, at October 31, 2009, the fund had $345,678,000 of ordinary income available for<br />

distribution. The fund had available capital loss carryforwards totaling $2,235,121,000 to offset future<br />

net capital gains of $15,143,000 through October 31, 2012, $167,331,000 through October 31, 2014,<br />

$460,853,000 through October 31, 2016, and $1,591,794,000 through October 31, 2017.<br />

At October 31, 2009, the cost of investment securities for tax purposes was $24,152,956,000. Net<br />

unrealized appreciation of investment securities for tax purposes was $3,883,509,000, consisting of<br />

unrealized gains of $5,735,715,000 on securities that had risen in value since their purchase and<br />

$1,852,206,000 in unrealized losses on securities that had fallen in value since their purchase.