Retail Entitlement Offer - Documents Mailed to ... - AWB Limited

Retail Entitlement Offer - Documents Mailed to ... - AWB Limited

Retail Entitlement Offer - Documents Mailed to ... - AWB Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

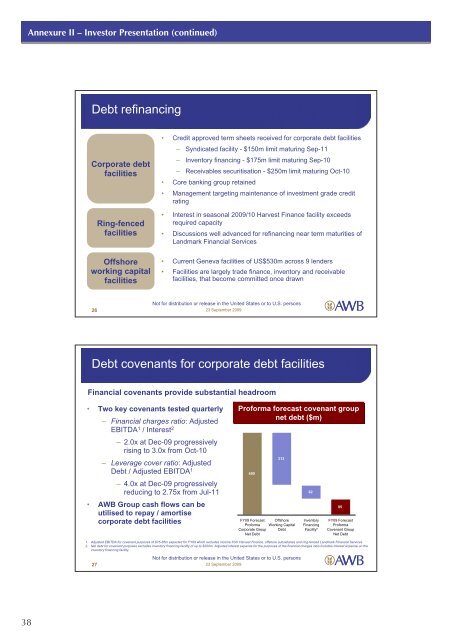

Annexure II – Inves<strong>to</strong>r Presentation (continued)Debt refinancingCorporate debtfacilitiesRing-fencedfacilitiesOffshoreworking capitalfacilities• Credit approved term sheets received for corporate debt facilities– Syndicated facility - $150m limit maturing Sep-11– Inven<strong>to</strong>ry financing - $175m limit maturing Sep-10– Receivables securitisation - $250m limit maturing Oct-10• Core banking group retained• Management targeting maintenance of investment grade creditrating• Interest in seasonal 2009/10 Harvest Finance facility exceedsrequired capacity• Discussions well advanced for refinancing near term maturities ofLandmark Financial Services• Current Geneva facilities of US$530m across 9 lenders• Facilities are largely trade finance, inven<strong>to</strong>ry and receivablefacilities, that become committed once drawnNot for distribution or release in the United States or <strong>to</strong> U.S. persons26 23 September 2009Debt covenants for corporate debt facilitiesFinancial covenants provide substantial headroom• Two key covenants tested quarterly– Financial charges ratio: AdjustedEBITDA 1 / Interest 2– 2.0x at Dec-09 progressivelyrising <strong>to</strong> 3.0x from Oct-10– Leverage cover ratio: AdjustedDebt / Adjusted EBITDA 1– 4.0x at Dec-09 progressivelyreducing <strong>to</strong> 2.75x from Jul-11• <strong>AWB</strong> Group cash flows can beutilised <strong>to</strong> repay / amortisecorporate debt facilitiesProforma forecast covenant groupnet debt ($m)490313FY09 Forecast OffshoreProforma Working CapitalCorporate Group DebtNet Debt82Inven<strong>to</strong>ryFinancingFacility²95FY09 ForecastProformaCovenant GroupNet Debt1. Adjusted EBITDA for covenant purposes of $75-85m expected for FY09 which excludes income from Harvest Finance, offshore subsidiaries and ring-fenced Landmark Financial Services.2. Net debt for covenant purposes excludes inven<strong>to</strong>ry financing facility of up <strong>to</strong> $200m. Adjusted interest expense for the purposes of the financial charges ratio includes interest expense on theinven<strong>to</strong>ry financing facility.Not for distribution or release in the United States or <strong>to</strong> U.S. persons27 23 September 200938