Retail Entitlement Offer - Documents Mailed to ... - AWB Limited

Retail Entitlement Offer - Documents Mailed to ... - AWB Limited

Retail Entitlement Offer - Documents Mailed to ... - AWB Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

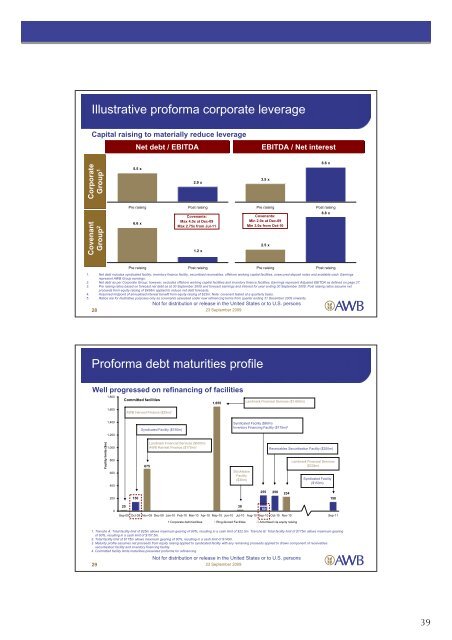

Illustrative proforma corporate leverageCapital raising <strong>to</strong> materially reduce leverageNet debt / EBITDAEBITDA / Net interestCorporateGroup 15.5 x2.9 x3.5 x6.6 xCovenantGroup 2Pre raising6.6 xPost raisingCovenants:Max 4.0x at Dec-09Max 2.75x from Jul-111.2 xPre raisingCovenants:Min 2.0x at Dec-09Min 3.0x from Oct-102.5 xPost raising8.8 xPre raisingPost raisingPre raisingPost raising1. Net debt includes syndicated facility, inven<strong>to</strong>ry finance facility, securitised receivables, offshore working capital facilities, unsecured deposit notes and available cash. Earningsrepresent <strong>AWB</strong> Group earnings.2. Net debt as per Corporate Group; however, excludes offshore working capital facilities and inven<strong>to</strong>ry finance facilities. Earnings represent Adjusted EBITDA as defined on page 27.3. Pre raising ratios based on forecast net debt as at 30 September 2009 and forecast earnings and interest for year ending 30 September 2009. Post raising ratios assume netproceeds from equity raising of $436m applied <strong>to</strong> reduce net debt forecasts.4. Assumed midpoint of annualised interest benefit from equity raising of $23m. Note: covenant tested at a quarterly basis.5. Ratios are for illustrative purposes only as covenants assessed under new refinancing terms from quarter ending 31 December 2009 onwards.Not for distribution or release in the United States or <strong>to</strong> U.S. persons28 23 September 2009Proforma debt maturities profileWell progressed on refinancing of facilities1,800Committed facilitiesLandmark Financial Services ($1,655m)1,6551,600<strong>AWB</strong> Harvest Finance ($25m)¹1,4001,200Syndicated Facility ($150m)Syndicated Facility ($80m)Inven<strong>to</strong>ry Financing Facility ($175m)²Facility limits ($m)1,000800600400675Landmark Financial Services ($500m)<strong>AWB</strong> Harvest Finance ($175m)¹S<strong>to</strong>ckleaseFacility($30m)Receivables Securitisation Facility ($250m)Landmark Financial Services($234m)Syndicated Facility($150m)200150255 2502341500253080Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Sep-11Corporate debt facilities Ring-fenced Facilities Amortised via equity raising1. Tranche A: Total facility limit of $25m allows maximum gearing of 90%, resulting in a cash limit of $22.5m. Tranche B: Total facility limit of $175m allows maximum gearingof 90%, resulting in a cash limit of $157.5m.2. Total facility limit of $175m allows maximum gearing of 80%, resulting in a cash limit of $140m.3. Maturity profile assumes net proceeds from equity raising applied <strong>to</strong> syndicated facility with any remaining proceeds applied <strong>to</strong> drawn component of receivablessecuritisation facility and inven<strong>to</strong>ry financing facility.4. Committed facility limits maturities presented proforma for refinancing.Not for distribution or release in the United States or <strong>to</strong> U.S. persons29 23 September 200939