Signaling currency crises in South Africa - South African Reserve Bank

Signaling currency crises in South Africa - South African Reserve Bank

Signaling currency crises in South Africa - South African Reserve Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

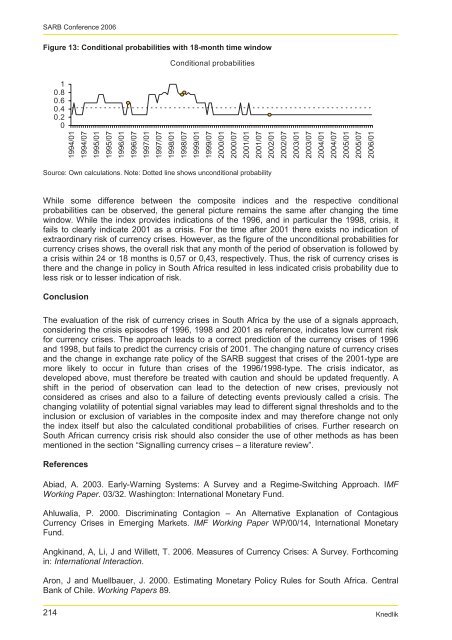

SARB Conference 2006Figure 13: Conditional probabilities with 18-month time w<strong>in</strong>dowConditional probabilities10.80.60.40.201994/011994/071995/011995/071996/011996/071997/011997/071998/011998/071999/011999/072000/012000/072001/012001/072002/012002/072003/012003/072004/012004/072005/012005/072006/01Source: Own calculations. Note: Dotted l<strong>in</strong>e shows unconditional probabilityWhile some difference between the composite <strong>in</strong>dices and the respective conditionalprobabilities can be observed, the general picture rema<strong>in</strong>s the same after chang<strong>in</strong>g the timew<strong>in</strong>dow. While the <strong>in</strong>dex provides <strong>in</strong>dications of the 1996, and <strong>in</strong> particular the 1998, crisis, itfails to clearly <strong>in</strong>dicate 2001 as a crisis. For the time after 2001 there exists no <strong>in</strong>dication ofextraord<strong>in</strong>ary risk of <strong>currency</strong> <strong>crises</strong>. However, as the figure of the unconditional probabilities for<strong>currency</strong> <strong>crises</strong> shows, the overall risk that any month of the period of observation is followed bya crisis with<strong>in</strong> 24 or 18 months is 0,57 or 0,43, respectively. Thus, the risk of <strong>currency</strong> <strong>crises</strong> isthere and the change <strong>in</strong> policy <strong>in</strong> <strong>South</strong> <strong>Africa</strong> resulted <strong>in</strong> less <strong>in</strong>dicated crisis probability due toless risk or to lesser <strong>in</strong>dication of risk.ConclusionThe evaluation of the risk of <strong>currency</strong> <strong>crises</strong> <strong>in</strong> <strong>South</strong> <strong>Africa</strong> by the use of a signals approach,consider<strong>in</strong>g the crisis episodes of 1996, 1998 and 2001 as reference, <strong>in</strong>dicates low current riskfor <strong>currency</strong> <strong>crises</strong>. The approach leads to a correct prediction of the <strong>currency</strong> <strong>crises</strong> of 1996and 1998, but fails to predict the <strong>currency</strong> crisis of 2001. The chang<strong>in</strong>g nature of <strong>currency</strong> <strong>crises</strong>and the change <strong>in</strong> exchange rate policy of the SARB suggest that <strong>crises</strong> of the 2001-type aremore likely to occur <strong>in</strong> future than <strong>crises</strong> of the 1996/1998-type. The crisis <strong>in</strong>dicator, asdeveloped above, must therefore be treated with caution and should be updated frequently. Ashift <strong>in</strong> the period of observation can lead to the detection of new <strong>crises</strong>, previously notconsidered as <strong>crises</strong> and also to a failure of detect<strong>in</strong>g events previously called a crisis. Thechang<strong>in</strong>g volatility of potential signal variables may lead to different signal thresholds and to the<strong>in</strong>clusion or exclusion of variables <strong>in</strong> the composite <strong>in</strong>dex and may therefore change not onlythe <strong>in</strong>dex itself but also the calculated conditional probabilities of <strong>crises</strong>. Further research on<strong>South</strong> <strong>Africa</strong>n <strong>currency</strong> crisis risk should also consider the use of other methods as has beenmentioned <strong>in</strong> the section “Signall<strong>in</strong>g <strong>currency</strong> <strong>crises</strong> – a literature review”.ReferencesAbiad, A. 2003. Early-Warn<strong>in</strong>g Systems: A Survey and a Regime-Switch<strong>in</strong>g Approach. IMFWork<strong>in</strong>g Paper. 03/32. Wash<strong>in</strong>gton: International Monetary Fund.Ahluwalia, P. 2000. Discrim<strong>in</strong>at<strong>in</strong>g Contagion – An Alternative Explanation of ContagiousCurrency Crises <strong>in</strong> Emerg<strong>in</strong>g Markets. IMF Work<strong>in</strong>g Paper WP/00/14, International MonetaryFund.Angk<strong>in</strong>and, A, Li, J and Willett, T. 2006. Measures of Currency Crises: A Survey. Forthcom<strong>in</strong>g<strong>in</strong>: International Interaction.Aron, J and Muellbauer, J. 2000. Estimat<strong>in</strong>g Monetary Policy Rules for <strong>South</strong> <strong>Africa</strong>. Central<strong>Bank</strong> of Chile. Work<strong>in</strong>g Papers 89.214Knedlik