Signaling currency crises in South Africa - South African Reserve Bank

Signaling currency crises in South Africa - South African Reserve Bank

Signaling currency crises in South Africa - South African Reserve Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

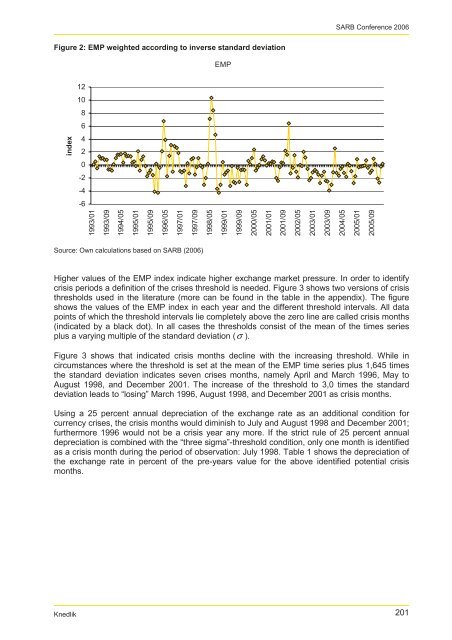

SARB Conference 2006Figure 2: EMP weighted accord<strong>in</strong>g to <strong>in</strong>verse standard deviationEMP121086<strong>in</strong>dex420-2-4-61993/011993/091994/051995/011995/091996/051997/011997/091998/051999/011999/092000/052001/012001/092002/052003/012003/092004/052005/012005/09Source: Own calculations based on SARB (2006)Higher values of the EMP <strong>in</strong>dex <strong>in</strong>dicate higher exchange market pressure. In order to identifycrisis periods a def<strong>in</strong>ition of the <strong>crises</strong> threshold is needed. Figure 3 shows two versions of crisisthresholds used <strong>in</strong> the literature (more can be found <strong>in</strong> the table <strong>in</strong> the appendix). The figureshows the values of the EMP <strong>in</strong>dex <strong>in</strong> each year and the different threshold <strong>in</strong>tervals. All datapo<strong>in</strong>ts of which the threshold <strong>in</strong>tervals lie completely above the zero l<strong>in</strong>e are called crisis months(<strong>in</strong>dicated by a black dot). In all cases the thresholds consist of the mean of the times seriesplus a vary<strong>in</strong>g multiple of the standard deviation (σ ).Figure 3 shows that <strong>in</strong>dicated crisis months decl<strong>in</strong>e with the <strong>in</strong>creas<strong>in</strong>g threshold. While <strong>in</strong>circumstances where the threshold is set at the mean of the EMP time series plus 1,645 timesthe standard deviation <strong>in</strong>dicates seven <strong>crises</strong> months, namely April and March 1996, May toAugust 1998, and December 2001. The <strong>in</strong>crease of the threshold to 3,0 times the standarddeviation leads to “los<strong>in</strong>g” March 1996, August 1998, and December 2001 as crisis months.Us<strong>in</strong>g a 25 percent annual depreciation of the exchange rate as an additional condition for<strong>currency</strong> <strong>crises</strong>, the crisis months would dim<strong>in</strong>ish to July and August 1998 and December 2001;furthermore 1996 would not be a crisis year any more. If the strict rule of 25 percent annualdepreciation is comb<strong>in</strong>ed with the “three sigma”-threshold condition, only one month is identifiedas a crisis month dur<strong>in</strong>g the period of observation: July 1998. Table 1 shows the depreciation ofthe exchange rate <strong>in</strong> percent of the pre-years value for the above identified potential crisismonths.Knedlik 201