Signaling currency crises in South Africa - South African Reserve Bank

Signaling currency crises in South Africa - South African Reserve Bank

Signaling currency crises in South Africa - South African Reserve Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

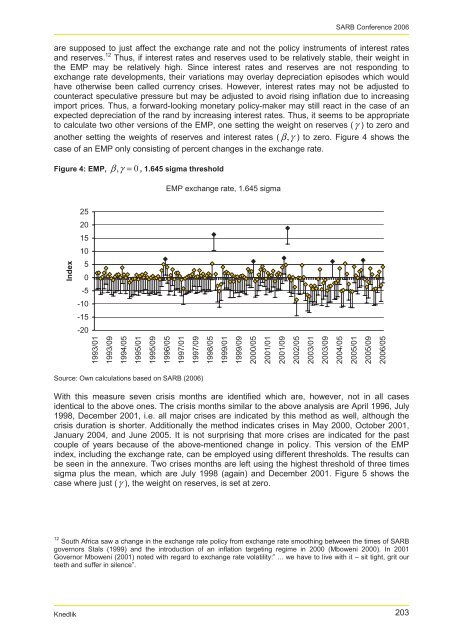

SARB Conference 2006are supposed to just affect the exchange rate and not the policy <strong>in</strong>struments of <strong>in</strong>terest ratesand reserves. 12 Thus, if <strong>in</strong>terest rates and reserves used to be relatively stable, their weight <strong>in</strong>the EMP may be relatively high. S<strong>in</strong>ce <strong>in</strong>terest rates and reserves are not respond<strong>in</strong>g toexchange rate developments, their variations may overlay depreciation episodes which wouldhave otherwise been called <strong>currency</strong> <strong>crises</strong>. However, <strong>in</strong>terest rates may not be adjusted tocounteract speculative pressure but may be adjusted to avoid ris<strong>in</strong>g <strong>in</strong>flation due to <strong>in</strong>creas<strong>in</strong>gimport prices. Thus, a forward-look<strong>in</strong>g monetary policy-maker may still react <strong>in</strong> the case of anexpected depreciation of the rand by <strong>in</strong>creas<strong>in</strong>g <strong>in</strong>terest rates. Thus, it seems to be appropriateto calculate two other versions of the EMP, one sett<strong>in</strong>g the weight on reserves (γ ) to zero andanother sett<strong>in</strong>g the weights of reserves and <strong>in</strong>terest rates ( βγ) , to zero. Figure 4 shows thecase of an EMP only consist<strong>in</strong>g of percent changes <strong>in</strong> the exchange rate.Figure 4: EMP, βγ= , 0, 1.645 sigma thresholdEMP exchange rate, 1.645 sigma25201510Index50-5-10-15-201993/011993/091994/051995/011995/091996/051997/011997/091998/051999/011999/092000/052001/012001/092002/052003/012003/092004/052005/012005/092006/05Source: Own calculations based on SARB (2006)With this measure seven crisis months are identified which are, however, not <strong>in</strong> all casesidentical to the above ones. The crisis months similar to the above analysis are April 1996, July1998, December 2001, i.e. all major <strong>crises</strong> are <strong>in</strong>dicated by this method as well, although thecrisis duration is shorter. Additionally the method <strong>in</strong>dicates <strong>crises</strong> <strong>in</strong> May 2000, October 2001,January 2004, and June 2005. It is not surpris<strong>in</strong>g that more <strong>crises</strong> are <strong>in</strong>dicated for the pastcouple of years because of the above-mentioned change <strong>in</strong> policy. This version of the EMP<strong>in</strong>dex, <strong>in</strong>clud<strong>in</strong>g the exchange rate, can be employed us<strong>in</strong>g different thresholds. The results canbe seen <strong>in</strong> the annexure. Two <strong>crises</strong> months are left us<strong>in</strong>g the highest threshold of three timessigma plus the mean, which are July 1998 (aga<strong>in</strong>) and December 2001. Figure 5 shows thecase where just (γ ), the weight on reserves, is set at zero.12 <strong>South</strong> <strong>Africa</strong> saw a change <strong>in</strong> the exchange rate policy from exchange rate smooth<strong>in</strong>g between the times of SARBgovernors Stals (1999) and the <strong>in</strong>troduction of an <strong>in</strong>flation target<strong>in</strong>g regime <strong>in</strong> 2000 (Mboweni 2000). In 2001Governor Mboweni (2001) noted with regard to exchange rate volatility:” ... we have to live with it – sit tight, grit ourteeth and suffer <strong>in</strong> silence”.Knedlik 203