Manual for the Scrutiny of Central Excise Returns 2008

Manual for the Scrutiny of Central Excise Returns 2008

Manual for the Scrutiny of Central Excise Returns 2008

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

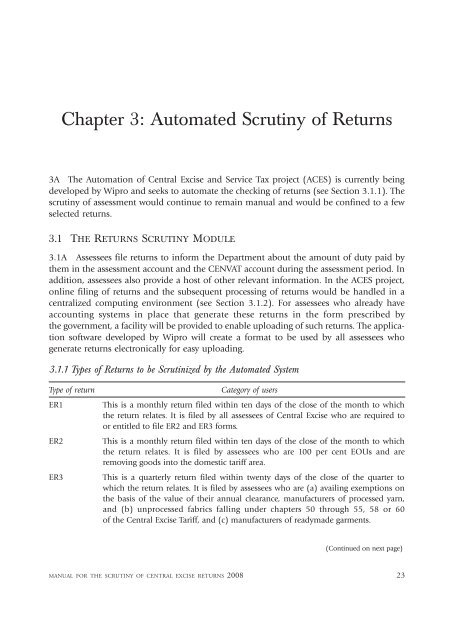

Chapter 3: Automated <strong>Scrutiny</strong> <strong>of</strong> <strong>Returns</strong>3A The Automation <strong>of</strong> <strong>Central</strong> <strong>Excise</strong> and Service Tax project (ACES) is currently beingdeveloped by Wipro and seeks to automate <strong>the</strong> checking <strong>of</strong> returns (see Section 3.1.1). Thescrutiny <strong>of</strong> assessment would continue to remain manual and would be confined to a fewselected returns.3.1 THE RETURNS SCRUTINY MODULE3.1A Assessees file returns to in<strong>for</strong>m <strong>the</strong> Department about <strong>the</strong> amount <strong>of</strong> duty paid by<strong>the</strong>m in <strong>the</strong> assessment account and <strong>the</strong> CENVAT account during <strong>the</strong> assessment period. Inaddition, assessees also provide a host <strong>of</strong> o<strong>the</strong>r relevant in<strong>for</strong>mation. In <strong>the</strong> ACES project,online filing <strong>of</strong> returns and <strong>the</strong> subsequent processing <strong>of</strong> returns would be handled in acentralized computing environment (see Section 3.1.2). For assessees who already haveaccounting systems in place that generate <strong>the</strong>se returns in <strong>the</strong> <strong>for</strong>m prescribed by<strong>the</strong> government, a facility will be provided to enable uploading <strong>of</strong> such returns. The applications<strong>of</strong>tware developed by Wipro will create a <strong>for</strong>mat to be used by all assessees whogenerate returns electronically <strong>for</strong> easy uploading.3.1.1 Types <strong>of</strong> <strong>Returns</strong> to be Scrutinized by <strong>the</strong> Automated SystemType <strong>of</strong> returnER1ER2ER3Category <strong>of</strong> usersThis is a monthly return filed within ten days <strong>of</strong> <strong>the</strong> close <strong>of</strong> <strong>the</strong> month to which<strong>the</strong> return relates. It is filed by all assessees <strong>of</strong> <strong>Central</strong> <strong>Excise</strong> who are required toor entitled to file ER2 and ER3 <strong>for</strong>ms.This is a monthly return filed within ten days <strong>of</strong> <strong>the</strong> close <strong>of</strong> <strong>the</strong> month to which<strong>the</strong> return relates. It is filed by assessees who are 100 per cent EOUs and areremoving goods into <strong>the</strong> domestic tariff area.This is a quarterly return filed within twenty days <strong>of</strong> <strong>the</strong> close <strong>of</strong> <strong>the</strong> quarter towhich <strong>the</strong> return relates. It is filed by assessees who are (a) availing exemptions on<strong>the</strong> basis <strong>of</strong> <strong>the</strong> value <strong>of</strong> <strong>the</strong>ir annual clearance, manufacturers <strong>of</strong> processed yarn,and (b) unprocessed fabrics falling under chapters 50 through 55, 58 or 60<strong>of</strong> <strong>the</strong> <strong>Central</strong> <strong>Excise</strong> Tariff, and (c) manufacturers <strong>of</strong> readymade garments.(Continued on next page)MANUAL FOR THE SCRUTINY OF CENTRAL EXCISE RETURNS <strong>2008</strong> 23