Manual for the Scrutiny of Central Excise Returns 2008

Manual for the Scrutiny of Central Excise Returns 2008

Manual for the Scrutiny of Central Excise Returns 2008

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

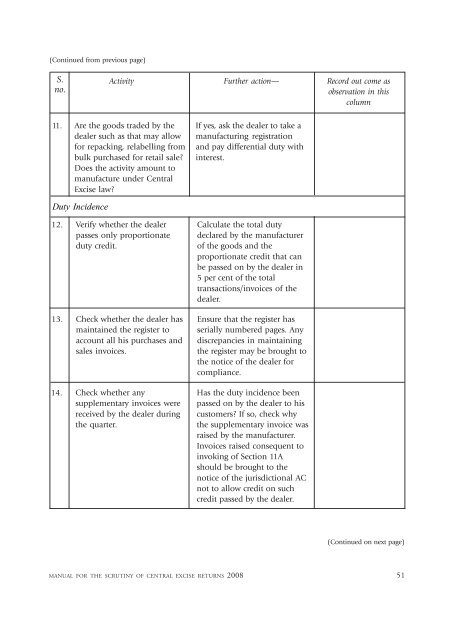

(Continued from previous page)S.no.Activity Fur<strong>the</strong>r action— Record out come asobservation in thiscolumn11.Are <strong>the</strong> goods traded by <strong>the</strong>dealer such as that may allow<strong>for</strong> repacking, relabelling frombulk purchased <strong>for</strong> retail sale?Does <strong>the</strong> activity amount tomanufacture under <strong>Central</strong><strong>Excise</strong> law?If yes, ask <strong>the</strong> dealer to take amanufacturing registrationand pay differential duty withinterest.Duty Incidence12.13.14.Verify whe<strong>the</strong>r <strong>the</strong> dealerpasses only proportionateduty credit.Check whe<strong>the</strong>r <strong>the</strong> dealer hasmaintained <strong>the</strong> register toaccount all his purchases andsales invoices.Check whe<strong>the</strong>r anysupplementary invoices werereceived by <strong>the</strong> dealer during<strong>the</strong> quarter.Calculate <strong>the</strong> total dutydeclared by <strong>the</strong> manufacturer<strong>of</strong> <strong>the</strong> goods and <strong>the</strong>proportionate credit that canbe passed on by <strong>the</strong> dealer in5 per cent <strong>of</strong> <strong>the</strong> totaltransactions/invoices <strong>of</strong> <strong>the</strong>dealer.Ensure that <strong>the</strong> register hasserially numbered pages. Anydiscrepancies in maintaining<strong>the</strong> register may be brought to<strong>the</strong> notice <strong>of</strong> <strong>the</strong> dealer <strong>for</strong>compliance.Has <strong>the</strong> duty incidence beenpassed on by <strong>the</strong> dealer to hiscustomers? If so, check why<strong>the</strong> supplementary invoice wasraised by <strong>the</strong> manufacturer.Invoices raised consequent toinvoking <strong>of</strong> Section 11Ashould be brought to <strong>the</strong>notice <strong>of</strong> <strong>the</strong> jurisdictional ACnot to allow credit on suchcredit passed by <strong>the</strong> dealer.(Continued on next page)MANUAL FOR THE SCRUTINY OF CENTRAL EXCISE RETURNS <strong>2008</strong> 51