Manual for the Scrutiny of Central Excise Returns 2008

Manual for the Scrutiny of Central Excise Returns 2008

Manual for the Scrutiny of Central Excise Returns 2008

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

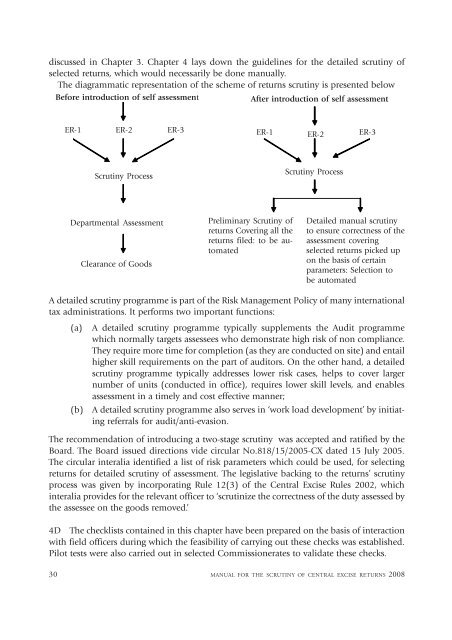

discussed in Chapter 3. Chapter 4 lays down <strong>the</strong> guidelines <strong>for</strong> <strong>the</strong> detailed scrutiny <strong>of</strong>selected returns, which would necessarily be done manually.The diagrammatic representation <strong>of</strong> <strong>the</strong> scheme <strong>of</strong> returns scrutiny is presented belowBe<strong>for</strong>e introduction <strong>of</strong> self assessmentAfter introduction <strong>of</strong> self assessmentER-1 ER-2 ER-3 ER-1 ER-2 ER-3<strong>Scrutiny</strong> Process<strong>Scrutiny</strong> ProcessDepartmental AssessmentClearance <strong>of</strong> GoodsPreliminary <strong>Scrutiny</strong> <strong>of</strong>returns Covering all <strong>the</strong>returns filed: to be automatedDetailed manual scrutinyto ensure correctness <strong>of</strong> <strong>the</strong>assessment coveringselected returns picked upon <strong>the</strong> basis <strong>of</strong> certainparameters: Selection tobe automatedA detailed scrutiny programme is part <strong>of</strong> <strong>the</strong> Risk Management Policy <strong>of</strong> many internationaltax administrations. It per<strong>for</strong>ms two important functions:(a)(b)A detailed scrutiny programme typically supplements <strong>the</strong> Audit programmewhich normally targets assessees who demonstrate high risk <strong>of</strong> non compliance.They require more time <strong>for</strong> completion (as <strong>the</strong>y are conducted on site) and entailhigher skill requirements on <strong>the</strong> part <strong>of</strong> auditors. On <strong>the</strong> o<strong>the</strong>r hand, a detailedscrutiny programme typically addresses lower risk cases, helps to cover largernumber <strong>of</strong> units (conducted in <strong>of</strong>fice), requires lower skill levels, and enablesassessment in a timely and cost effective manner;A detailed scrutiny programme also serves in ‘work load development’ by initiatingreferrals <strong>for</strong> audit/anti-evasion.The recommendation <strong>of</strong> introducing a two-stage scrutiny was accepted and ratified by <strong>the</strong>Board. The Board issued directions vide circular No.818/15/2005-CX dated 15 July 2005.The circular interalia identified a list <strong>of</strong> risk parameters which could be used, <strong>for</strong> selectingreturns <strong>for</strong> detailed scrutiny <strong>of</strong> assessment. The legislative backing to <strong>the</strong> returns’ scrutinyprocess was given by incorporating Rule 12(3) <strong>of</strong> <strong>the</strong> <strong>Central</strong> <strong>Excise</strong> Rules 2002, whichinteralia provides <strong>for</strong> <strong>the</strong> relevant <strong>of</strong>ficer to ‘scrutinize <strong>the</strong> correctness <strong>of</strong> <strong>the</strong> duty assessed by<strong>the</strong> assessee on <strong>the</strong> goods removed.’4D The checklists contained in this chapter have been prepared on <strong>the</strong> basis <strong>of</strong> interactionwith field <strong>of</strong>ficers during which <strong>the</strong> feasibility <strong>of</strong> carrying out <strong>the</strong>se checks was established.Pilot tests were also carried out in selected Commissionerates to validate <strong>the</strong>se checks.30 MANUAL FOR THE SCRUTINY OF CENTRAL EXCISE RETURNS <strong>2008</strong>