Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

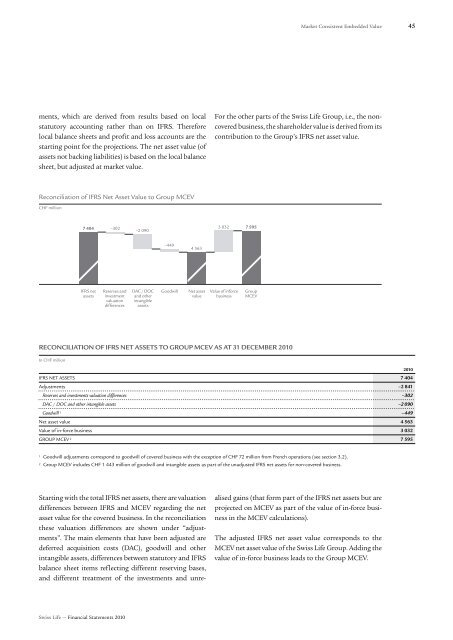

<strong>Market</strong> <strong>Consistent</strong> <strong>Embedded</strong> <strong>Value</strong>45ments, which are derived from results based on localstatutory accounting rather than on IFRS. Thereforelocal balance sheets and profit and loss accounts are thestarting point for the projections. The net asset value (ofassets not backing liabilities) is based on the local balancesheet, but adjusted at market value.For the other parts of the <strong>Swiss</strong> <strong>Life</strong> Group, i.e., the noncoveredbusiness, the shareholder value is derived from itscontribution to the Group’s IFRS net asset value.Reconciliation of IFRS Net Asset <strong>Value</strong> to Group <strong>MCEV</strong>CHF million7 404–302–2 0903 0327 595–4494 563IFRS netassetsReserves andinvestmentvaluationdifferencesDAC / DOCand otherintangibleassetsGoodwillNet assetvalue<strong>Value</strong> of inforcebusinessGroup<strong>MCEV</strong>RECONCILIATION OF IFRS NET ASSETS TO GROUP <strong>MCEV</strong> AS AT 31 DECEMBER 2010In CHF million2010IFRS NET ASSETS 7 404Adjustments –2 841Reserves and investments valuation differences –302DAC / DOC and other intangible assets –2 090Goodwill 1 – 449Net asset value 4 563<strong>Value</strong> of in-force business 3 032GROUP <strong>MCEV</strong> 2 7 5951 Goodwill adjustments correspond to goodwill of covered business with the exception of CHF 72 million from French operations (see section 3.2).2 Group <strong>MCEV</strong> includes CHF 1 443 million of goodwill and intangible assets as part of the unadjusted IFRS net assets for non-covered business.Starting with the total IFRS net assets, there are valuationdifferences between IFRS and <strong>MCEV</strong> regarding the netasset value for the covered business. In the reconciliationthese valuation differences are shown under “adjustments”.The main elements that have been adjusted aredeferred acquisition costs (DAC), goodwill and otherintangible assets, differences between statutory and IFRSbalance sheet items reflecting different reserving bases,and different treatment of the investments and unrealisedgains (that form part of the IFRS net assets but areprojected on <strong>MCEV</strong> as part of the value of in-force businessin the <strong>MCEV</strong> calculations).The adjusted IFRS net asset value corresponds to the<strong>MCEV</strong> net asset value of the <strong>Swiss</strong> <strong>Life</strong> Group. Adding thevalue of in-force business leads to the Group <strong>MCEV</strong>.<strong>Swiss</strong> <strong>Life</strong> — Financial Statements 2010