Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

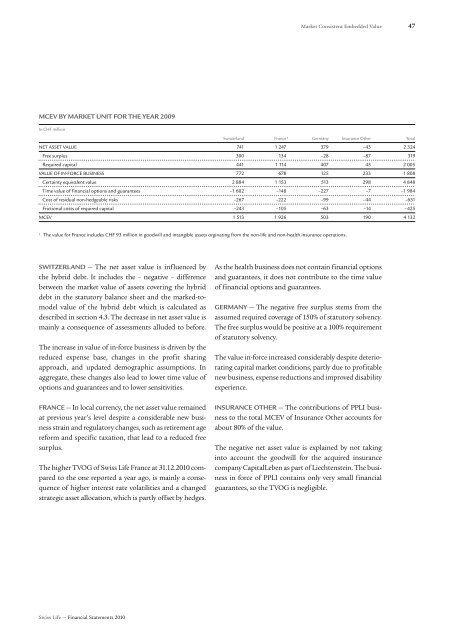

<strong>Market</strong> <strong>Consistent</strong> <strong>Embedded</strong> <strong>Value</strong>47<strong>MCEV</strong> BY MARKET UNIT FOR THE YEAR 2009In CHF millionSwitzerland France 1 Germany Insurance Other TotalNET ASSET VALUE 741 1 247 379 –43 2 324Free surplus 300 134 –28 –87 319Required capital 441 1 114 407 45 2 005VALUE OF IN-FORCE BUSINESS 772 678 125 233 1 808Certainty equivalent value 2 884 1 153 513 298 4 848Time value of financial options and guarantees –1 602 –148 –227 –7 –1 984Cost of residual non-hedgeable risks –267 –222 –99 –44 –631Frictional costs of required capital –243 –105 –63 –14 –425<strong>MCEV</strong> 1 513 1 926 503 190 4 1321 The value for France includes CHF 93 million in goodwill and intangible assets orginating from the non-life and non-health insurance operations.SWITZERLAND — The net asset value is influenced bythe hybrid debt. It includes the – negative – differencebetween the market value of assets covering the hybriddebt in the statutory balance sheet and the marked-tomodelvalue of the hybrid debt which is calculated asdescribed in section 4.3. The decrease in net asset value ismainly a consequence of assessments alluded to before.The increase in value of in-force business is driven by thereduced expense base, changes in the profit sharingapproach, and updated demographic assumptions. Inaggregate, these changes also lead to lower time value ofoptions and guarantees and to lower sensitivities.FRANCE — In local currency, the net asset value remainedat previous year’s level despite a considerable new businessstrain and regulatory changes, such as retirement agereform and specific taxation, that lead to a reduced freesurplus.The higher TVOG of <strong>Swiss</strong> <strong>Life</strong> France at 31.12.2010 comparedto the one reported a year ago, is mainly a consequenceof higher interest rate volatilities and a changedstrategic asset allocation, which is partly offset by hedges.As the health business does not contain financial optionsand guarantees, it does not contribute to the time valueof financial options and guarantees.GERMANY — The negative free surplus stems from theassumed required coverage of 150% of statutory solvency.The free surplus would be positive at a 100% requirementof statutory solvency.The value in-force increased considerably despite deterioratingcapital market conditions, partly due to profitablenew business, expense reductions and improved disabilityexperience.INSURANCE OTHER — The contributions of PPLI businessto the total <strong>MCEV</strong> of Insurance Other accounts forabout 80% of the value.The negative net asset value is explained by not takinginto account the goodwill for the acquired insurancecompany CapitalLeben as part of Liechtenstein. The businessin force of PPLI contains only very small financialguarantees, so the TVOG is negligible.<strong>Swiss</strong> <strong>Life</strong> — Financial Statements 2010