Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

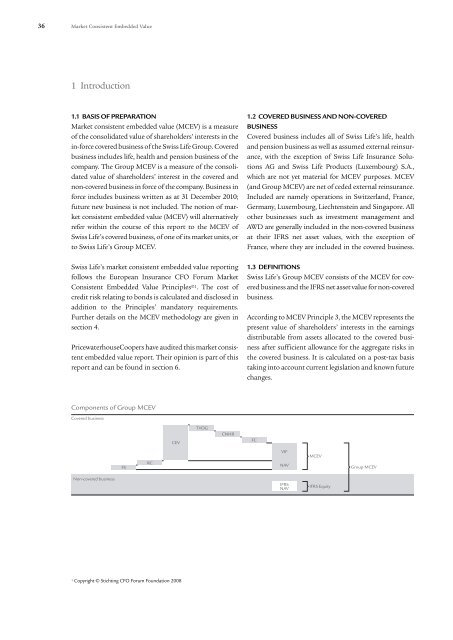

36 <strong>Market</strong> <strong>Consistent</strong> <strong>Embedded</strong> <strong>Value</strong>1 Introduction1.1 BASIS OF PREPARATION<strong>Market</strong> consistent embedded value (<strong>MCEV</strong>) is a measureof the consolidated value of shareholders’ interests in thein-force covered business of the <strong>Swiss</strong> <strong>Life</strong> Group. Coveredbusiness includes life, health and pension business of thecompany. The Group <strong>MCEV</strong> is a measure of the consolidatedvalue of shareholders’ interest in the covered andnon-covered business in force of the company. Business inforce includes business written as at 31 December 2010;future new business is not included. The notion of marketconsistent embedded value (<strong>MCEV</strong>) will alternativelyrefer within the course of this report to the <strong>MCEV</strong> of<strong>Swiss</strong> <strong>Life</strong>’s covered business, of one of its market units, orto <strong>Swiss</strong> <strong>Life</strong>’s Group <strong>MCEV</strong>.1.2 COVERED BUSINESS AND NON-COVEREDBUSINESSCovered business includes all of <strong>Swiss</strong> <strong>Life</strong>’s life, healthand pension business as well as assumed external reinsurance,with the exception of <strong>Swiss</strong> <strong>Life</strong> Insurance SolutionsAG and <strong>Swiss</strong> <strong>Life</strong> Products (Luxembourg) S.A.,which are not yet material for <strong>MCEV</strong> purposes. <strong>MCEV</strong>(and Group <strong>MCEV</strong>) are net of ceded external reinsurance.Included are namely operations in Switzerland, France,Germany, Luxembourg, Liechtenstein and Singapore. Allother businesses such as investment management andAWD are generally included in the non-covered businessat their IFRS net asset values, with the exception ofFrance, where they are included in the covered business.<strong>Swiss</strong> <strong>Life</strong>’s market consistent embedded value reportingfollows the European Insurance CFO Forum <strong>Market</strong><strong>Consistent</strong> <strong>Embedded</strong> <strong>Value</strong> Principles ©1 . The cost ofcredit risk relating to bonds is calculated and disclosed inaddition to the Principles’ mandatory requirements.Further details on the <strong>MCEV</strong> methodology are given insection 4.PricewaterhouseCoopers have audited this market consistentembedded value report. Their opinion is part of thisreport and can be found in section 6.1.3 DEFINITIONS<strong>Swiss</strong> <strong>Life</strong>’s Group <strong>MCEV</strong> consists of the <strong>MCEV</strong> for coveredbusiness and the IFRS net asset value for non-coveredbusiness.According to <strong>MCEV</strong> Principle 3, the <strong>MCEV</strong> represents thepresent value of shareholders’ interests in the earningsdistributable from assets allocated to the covered businessafter sufficient allowance for the aggregate risks inthe covered business. It is calculated on a post-tax basistaking into account current legislation and known futurechanges.Components of Group <strong>MCEV</strong>Covered businessCEVTVOGCNHRFCVIF<strong>MCEV</strong>FSRCNAVGroup <strong>MCEV</strong>Non-covered businessIFRSNAVIFRS Equity1 Copyright © Stichting CFO Forum Foundation 2008