Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

Market Consistent Embedded Value (MCEV) - Swiss Life - Online ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

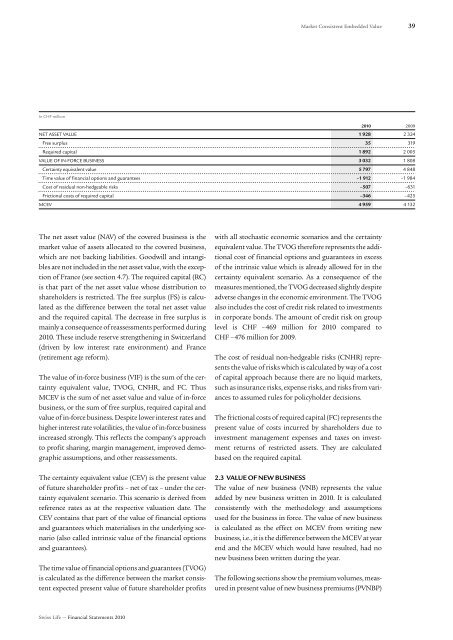

<strong>Market</strong> <strong>Consistent</strong> <strong>Embedded</strong> <strong>Value</strong>39In CHF million2010 2009NET ASSET VALUE 1 928 2 324Free surplus 35 319Required capital 1 892 2 005VALUE OF IN-FORCE BUSINESS 3 032 1 808Certainty equivalent value 5 797 4 848Time value of financial options and guarantees –1 912 –1 984Cost of residual non-hedgeable risks –507 –631Frictional costs of required capital –346 –425<strong>MCEV</strong> 4 959 4 132The net asset value (NAV) of the covered business is themarket value of assets allocated to the covered business,which are not backing liabilities. Goodwill and intangiblesare not included in the net asset value, with the exceptionof France (see section 4.7). The required capital (RC)is that part of the net asset value whose distribution toshareholders is restricted. The free surplus (FS) is calculatedas the difference between the total net asset valueand the required capital. The decrease in free surplus ismainly a consequence of reassessments performed during2010. These include reserve strengthening in Switzerland(driven by low interest rate environment) and France(retirement age reform).The value of in-force business (VIF) is the sum of the certaintyequivalent value, TVOG, CNHR, and FC. Thus<strong>MCEV</strong> is the sum of net asset value and value of in-forcebusiness, or the sum of free surplus, required capital andvalue of in-force business. Despite lower interest rates andhigher interest rate volatilities, the value of in-force businessincreased strongly. This reflects the company’s approachto profit sharing, margin management, improved demographicassumptions, and other reassessments.The certainty equivalent value (CEV) is the present valueof future shareholder profits – net of tax – under the certaintyequivalent scenario. This scenario is derived fromreference rates as at the respective valuation date. TheCEV contains that part of the value of financial optionsand guarantees which materialises in the underlying scenario(also called intrinsic value of the financial optionsand guarantees).The time value of financial options and guarantees (TVOG)is calculated as the difference between the market consistentexpected present value of future shareholder profitswith all stochastic economic scenarios and the certaintyequivalent value. The TVOG therefore represents the additionalcost of financial options and guarantees in excessof the intrinsic value which is already allowed for in thecertainty equivalent scenario. As a consequence of themeasures mentioned, the TVOG decreased slightly despiteadverse changes in the economic environment. The TVOGalso includes the cost of credit risk related to investmentsin corporate bonds. The amount of credit risk on grouplevel is CHF –469 million for 2010 compared toCHF –476 million for 2009.The cost of residual non-hedgeable risks (CNHR) representsthe value of risks which is calculated by way of a costof capital approach because there are no liquid markets,such as insurance risks, expense risks, and risks from variancesto assumed rules for policyholder decisions.The frictional costs of required capital (FC) represents thepresent value of costs incurred by shareholders due toinvestment management expenses and taxes on investmentreturns of restricted assets. They are calculatedbased on the required capital.2.3 VALUE OF NEW BUSINESSThe value of new business (VNB) represents the valueadded by new business written in 2010. It is calculatedconsistently with the methodology and assumptionsused for the business in force. The value of new businessis calculated as the effect on <strong>MCEV</strong> from writing newbusiness, i.e., it is the difference between the <strong>MCEV</strong> at yearend and the <strong>MCEV</strong> which would have resulted, had nonew business been written during the year.The following sections show the premium volumes, measuredin present value of new business premiums (PVNBP)<strong>Swiss</strong> <strong>Life</strong> — Financial Statements 2010