83 BrandZ <strong>Top</strong> <strong>100</strong> 2011: SECTORS/COMMENTARYBrandZ <strong>Top</strong> <strong>100</strong> 2011: SECTORS/COMMENTARY 84Apple continued quietly developing acloud and loudly discovered an emptyspace in the <strong>com</strong>puting category that itfilled with a new device – the iPad. In thelast quarter of 2010, Apple sold moreiPads than Mac <strong>com</strong>puters. The iPad,which quickly met <strong>com</strong>petition from othertablet makers like Samsung, helpedApple pass Dell and HP in total portable<strong>com</strong>puter sales. An Apple cloud wouldfurther strengthen the brand as a trinity ofplatform, content and device.At the same time, the smartphone category expandedwith the introduction of iPhone 4 and many versions ofGoogle’s Android platform. Android became the bestsellingsmartphone platform over Apple and Symbian byNokia. BlackBerry worked to sustain appeal among twohigh-messaging groups: business people and teens.The B2B brands also continued moving to the cloud.While the opportunities are great, so are the challenges.Privacy and confidentiality remain vulnerable, asWikiLeaks demonstrated. And the ability to managedatabases that respond to unpredictable change fallsmore in the province of Twitter and Facebook thanbrands like Oracle, SAP and Siemens, which arerenowned for structured databases. As applications andfiles move to clouds it potentially be<strong>com</strong>es less criticalto have Intel inside.In a strengthening economy, leading brands such asIBM, with its focused “Smarter Planet” strategy, benefitedfrom increased business and government spending ontechnology and consultation. The value of the IBM brandincreased 17 percent. Brands from fast-growing marketsalso became more of a global presence, includingTencent/QQ, China’s social network site, which appearedin the BrandZ <strong>Top</strong> <strong>100</strong> ranking for the first time, and theChinese search engine Baidu. Its 141 percent increasein brand value made it the fastest riser after Facebook.The brand value of India’s IT leader, Infosys, appreciatedsignificantly.TECHNOLOGYHIGHLIGHTSTelevision and the Internet becameincreasingly linked, and brands, notablySamsung, introduced 3D TV.Facebook and Twitter, cloud venues for thelatest content, became the water coolers forconversation about last night’s TV shows.Technology brands deepened their bondwith customers as activities like sharingphotos and music insinuated the brandsdeeply into personal lives.TECHNOLOGYIN 2011Stephen Yap, Group Director, TNSFacebook transcends social networking“Perhaps the most important trend we’ve seenover the last few months is the rise of Facebook.Transcending its roots as just a social network,a place where people send messages to andfrom their contact list, to be<strong>com</strong>e very much anaggregator of all kinds of <strong>com</strong>munication andentertainment activities that people do on their<strong>com</strong>puters and mobile devices. Whether it’splaying games, sharing photos, videos or chatting,Facebook is increasingly be<strong>com</strong>ing the dominantplatform for all kinds of technology activities forconsumers across the world.”SPOTLIGHTThe emergence of cloud <strong>com</strong>puting portendsheated <strong>com</strong>petition over who will own theconsumer – device or platform. When thebattle was about winning the PC market,consumers were less concerned about theparticular brand of PC or laptop as long it ranMicrosoft Office. With the cloud, consumersmay care less about the brand of their mobiledevice as long as it can access Facebook.Apple could be an exception because of thestrong emotional and functional appeal ofthe brand.

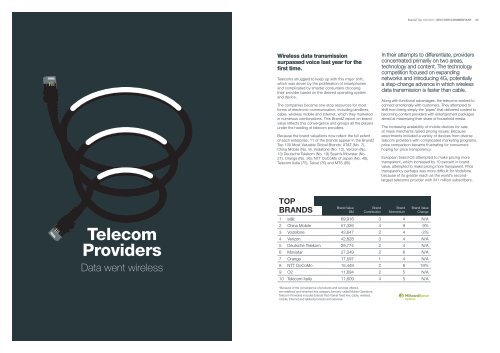

BrandZ <strong>Top</strong> <strong>100</strong> 2011: SECTORS/COMMENTARY 86Wireless data transmissionsurpassed voice last year for thefirst time.Tele<strong>com</strong>s struggled to keep up with this major shift,which was driven by the proliferation of smartphonesand <strong>com</strong>plicated by smarter consumers choosingtheir provider based on the desired operating systemand device.The <strong>com</strong>panies became one-stop resources for mostforms of electronic <strong>com</strong>munication, including landlines,cable, wireless mobile and Internet, which they marketedin numerous <strong>com</strong>binations. This BrandZ report on brandvalue reflects this convergence and groups all the playersunder the heading of tele<strong>com</strong> providers.Because the brand valuations now reflect the full extentof each enterprise, 11 of the brands appear in the BrandZ<strong>Top</strong> <strong>100</strong> Most Valuable Global Brands: AT&T (No. 7),China Mobile (No. 9), Vodafone (No. 12), Verizon (No.13) Deutsche Telekom (No. 19) Spain’s Movistar (No.21), Orange (No. 36), NTT DoCoMo of Japan (No. 48),Tele<strong>com</strong> Italia (75), Telcel (76) and MTS (80).In their attempts to differentiate, providersconcentrated primarily on two areas,technology and content. The technology<strong>com</strong>petition focused on expandingnetworks and introducing 4G, potentiallya step-change advance in which wirelessdata transmission is faster than cable.Along with functional advantages, the tele<strong>com</strong>s worked toconnect emotionally with customers. They attempted toshift from being simply the “pipes” that delivered content tobe<strong>com</strong>ing content providers with entertainment packagesaimed at maximizing their share of household media.The increasing availability of mobile devices for saleat mass merchants raised pricing issues. Becauseassortments included a variety of devices from diversetele<strong>com</strong> providers with <strong>com</strong>plicated marketing programs,price <strong>com</strong>parison became frustrating for consumershoping for price transparency.European brand O2 attempted to make pricing moretransparent, which increased by 10 percent in brandvalue, attempted to make pricing more transparent. Pricetransparency perhaps was more difficult for Vodafonebecause of its greater reach as the world’s secondlargesttele<strong>com</strong>s provider with 341 million subscribers.Tele<strong>com</strong>ProvidersData went wirelessTOPBRANDSBrand Value$MBrandContributionBrandMomentumBrand ValueChange1 at&t 69,916 3 4 N/A2 China Mobile 57,326 4 9 9%3 Vodafone 43,647 2 4 -2%4 Verizon 42,828 3 4 N/A5 Deutsche Telekom 29,774 2 4 N/A6 Movistar 27,249 2 6 N/A7 Orange 17,597 1 4 N/A8 NTT DoCoMo 15,449 2 8 19%9 O2 11,694 2 5 N/A10 Tele<strong>com</strong> Italia 11,609 4 5 N/A*Because of the convergence of products and services offered,we redefined and renamed this category, formerly called Mobile Operators.Tele<strong>com</strong> Providers includes brands that market fixed line, cable, wireless,mobile, Internet and related products and services.