Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

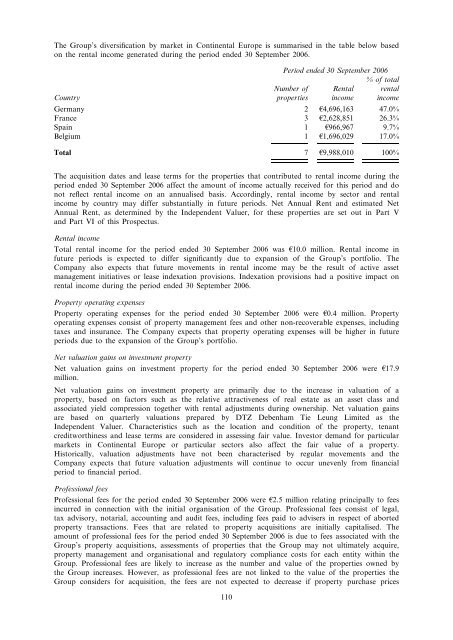

The Group’s diversification by market in Continental Europe is summarised in the table below based<br />

on the rental income generated during the period ended 30 September 2006.<br />

Country<br />

Period ended 30 September 2006<br />

Number of<br />

properties<br />

Rental<br />

income<br />

% of total<br />

rental<br />

income<br />

Germany 2 A4,696,163 47.0%<br />

France 3 A2,628,851 26.3%<br />

Spain 1 A966,967 9.7%<br />

Belgium 1 A1,696,029 17.0%<br />

Total 7 A9,988,010 100%<br />

The acquisition dates and lease terms for the properties that contributed to rental income during the<br />

period ended 30 September 2006 affect the amount of income actually received for this period and do<br />

not reflect rental income on an annualised basis. Accordingly, rental income by sector and rental<br />

income by country may differ substantially in future periods. Net Annual Rent and estimated Net<br />

Annual Rent, as determined by the Independent Valuer, for these properties are set out in Part V<br />

and Part VI of this Prospectus.<br />

Rental income<br />

Total rental income for the period ended 30 September 2006 was A10.0 million. Rental income in<br />

future periods is expected to differ significantly due to expansion of the Group’s portfolio. The<br />

Company also expects that future movements in rental income may be the result of active asset<br />

management initiatives or lease indexation provisions. Indexation provisions had a positive impact on<br />

rental income during the period ended 30 September 2006.<br />

Property operating expenses<br />

Property operating expenses for the period ended 30 September 2006 were A0.4 million. Property<br />

operating expenses consist of property management fees and other non-recoverable expenses, including<br />

taxes and insurance. The Company expects that property operating expenses will be higher in future<br />

periods due to the expansion of the Group’s portfolio.<br />

Net valuation gains on investment property<br />

Net valuation gains on investment property for the period ended 30 September 2006 were A17.9<br />

million.<br />

Net valuation gains on investment property are primarily due to the increase in valuation of a<br />

property, based on factors such as the relative attractiveness of real estate as an asset class and<br />

associated yield compression together with rental adjustments during ownership. Net valuation gains<br />

are based on quarterly valuations prepared by DTZ Debenham Tie Leung Limited as the<br />

Independent Valuer. Characteristics such as the location and condition of the property, tenant<br />

creditworthiness and lease terms are considered in assessing fair value. Investor demand for particular<br />

markets in Continental Europe or particular sectors also affect the fair value of a property.<br />

Historically, valuation adjustments have not been characterised by regular movements and the<br />

Company expects that future valuation adjustments will continue to occur unevenly from financial<br />

period to financial period.<br />

Professional fees<br />

Professional fees for the period ended 30 September 2006 were A2.5 million relating principally to fees<br />

incurred in connection with the initial organisation of the Group. Professional fees consist of legal,<br />

tax advisory, notarial, accounting and audit fees, including fees paid to advisers in respect of aborted<br />

property transactions. Fees that are related to property acquisitions are initially capitalised. The<br />

amount of professional fees for the period ended 30 September 2006 is due to fees associated with the<br />

Group’s property acquisitions, assessments of properties that the Group may not ultimately acquire,<br />

property management and organisational and regulatory compliance costs for each entity within the<br />

Group. Professional fees are likely to increase as the number and value of the properties owned by<br />

the Group increases. However, as professional fees are not linked to the value of the properties the<br />

Group considers for acquisition, the fees are not expected to decrease if property purchase prices<br />

110