Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

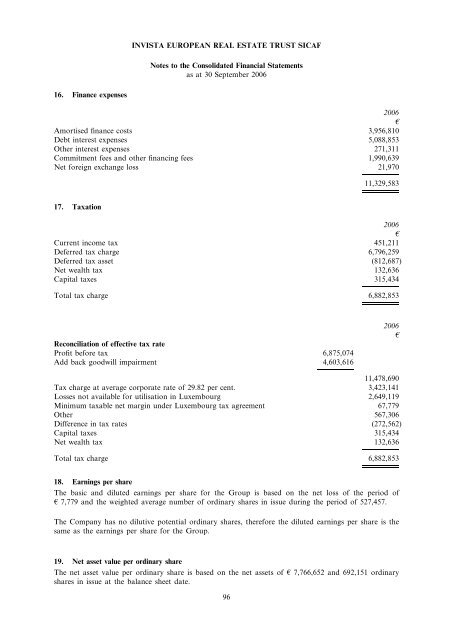

16. Finance expenses<br />

2006<br />

B<br />

Amortised finance costs 3,956,810<br />

Debt interest expenses 5,088,853<br />

Other interest expenses 271,311<br />

Commitment fees and other financing fees 1,990,639<br />

Net foreign exchange loss 21,970<br />

17. Taxation<br />

INVISTA EUROPEAN REAL ESTATE TRUST SICAF<br />

Notes to the Consolidated Financial Statements<br />

as at 30 September 2006<br />

11,329,583<br />

2006<br />

B<br />

Current income tax 451,211<br />

Deferred tax charge 6,796,259<br />

Deferred tax asset (812,687)<br />

Net wealth tax 132,636<br />

Capital taxes 315,434<br />

Total tax charge 6,882,853<br />

Reconciliation of effective tax rate<br />

Profit before tax 6,875,074<br />

Add back goodwill impairment 4,603,616<br />

11,478,690<br />

Tax charge at average corporate rate of 29.82 per cent. 3,423,141<br />

Losses not available for utilisation in Luxembourg 2,649,119<br />

Minimum taxable net margin under Luxembourg tax agreement 67,779<br />

Other 567,306<br />

Difference in tax rates (272,562)<br />

Capital taxes 315,434<br />

Net wealth tax 132,636<br />

Total tax charge 6,882,853<br />

18. Earnings per share<br />

The basic and diluted earnings per share for the Group is based on the net loss of the period of<br />

A 7,779 and the weighted average number of ordinary shares in issue during the period of 527,457.<br />

The Company has no dilutive potential ordinary shares, therefore the diluted earnings per share is the<br />

same as the earnings per share for the Group.<br />

19. Net asset value per ordinary share<br />

The net asset value per ordinary share is based on the net assets of A 7,766,652 and 692,151 ordinary<br />

shares in issue at the balance sheet date.<br />

96<br />

2006<br />

B