Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

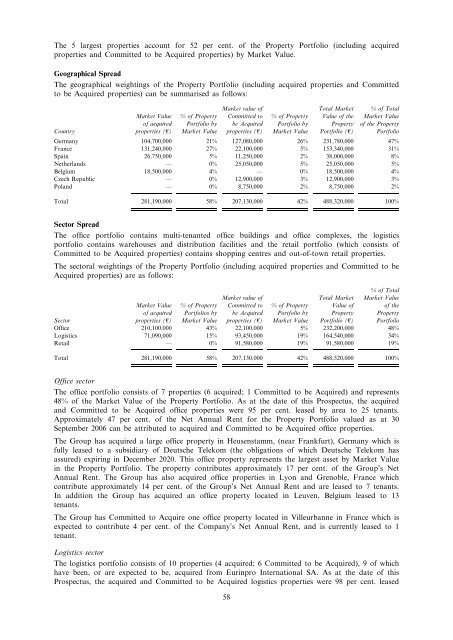

The 5 largest properties account for 52 per cent. of the Property Portfolio (including acquired<br />

properties and Committed to be Acquired properties) by Market Value.<br />

Geographical Spread<br />

The geographical weightings of the Property Portfolio (including acquired properties and Committed<br />

to be Acquired properties) can be summarised as follows:<br />

Country<br />

Market Value<br />

of acquired<br />

properties (A)<br />

% of Property<br />

Portfolio by<br />

Market Value<br />

Market value of<br />

Committed to<br />

be Acquired<br />

properties (A)<br />

% of Property<br />

Portfolio by<br />

Market Value<br />

Total Market<br />

Value of the<br />

Property<br />

Portfolio (A)<br />

% of Total<br />

Market Value<br />

of the Property<br />

Portfolio<br />

Germany 104,700,000 21% 127,080,000 26% 231,780,000 47%<br />

France 131,240,000 27% 22,100,000 5% 153,340,000 31%<br />

Spain 26,750,000 5% 11,250,000 2% 38,000,000 8%<br />

Netherlands — 0% 25,050,000 5% 25,050,000 5%<br />

Belgium 18,500,000 4% — 0% 18,500,000 4%<br />

Czech Republic — 0% 12,900,000 3% 12,900,000 3%<br />

Poland — 0% 8,750,000 2% 8,750,000 2%<br />

Total 281,190,000 58% 207,130,000 42% 488,320,000 100%<br />

Sector Spread<br />

The office portfolio contains multi-tenanted office buildings and office complexes, the logistics<br />

portfolio contains warehouses and distribution facilities and the retail portfolio (which consists of<br />

Committed to be Acquired properties) contains shopping centres and out-of-town retail properties.<br />

The sectoral weightings of the Property Portfolio (including acquired properties and Committed to be<br />

Acquired properties) are as follows:<br />

Sector<br />

Market Value<br />

of acquired<br />

properties (A)<br />

% of Property<br />

Portfolios by<br />

Market Value<br />

Market value of<br />

Committed to<br />

be Acquired<br />

properties (A)<br />

% of Property<br />

Portfolio by<br />

Market Value<br />

Total Market<br />

Value of<br />

Property<br />

Portfolio (A)<br />

% of Total<br />

Market Value<br />

of the<br />

Property<br />

Portfoilo<br />

Office 210,100,000 43% 22,100,000 5% 232,200,000 48%<br />

Logistics 71,090,000 15% 93,450,000 19% 164,540,000 34%<br />

Retail — 0% 91,580,000 19% 91,580,000 19%<br />

Total 281,190,000 58% 207,130,000 42% 488,320,000 100%<br />

Office sector<br />

The office portfolio consists of 7 properties (6 acquired; 1 Committed to be Acquired) and represents<br />

48% of the Market Value of the Property Portfolio. As at the date of this Prospectus, the acquired<br />

and Committed to be Acquired office properties were 95 per cent. leased by area to 25 tenants.<br />

Approximately 47 per cent. of the Net Annual Rent for the Property Portfolio valued as at 30<br />

September 2006 can be attributed to acquired and Committed to be Acquired office properties.<br />

The Group has acquired a large office property in Heusenstamm, (near Frankfurt), Germany which is<br />

fully leased to a subsidiary of Deutsche Telekom (the obligations of which Deutsche Telekom has<br />

assured) expiring in December 2020. This office property represents the largest asset by Market Value<br />

in the Property Portfolio. The property contributes approximately 17 per cent. of the Group’s Net<br />

Annual Rent. The Group has also acquired office properties in Lyon and Grenoble, France which<br />

contribute approximately 14 per cent. of the Group’s Net Annual Rent and are leased to 7 tenants.<br />

In addition the Group has acquired an office property located in Leuven, Belgium leased to 13<br />

tenants.<br />

The Group has Committed to Acquire one office property located in Villeurbanne in France which is<br />

expected to contribute 4 per cent. of the Company’s Net Annual Rent, and is currently leased to 1<br />

tenant.<br />

Logistics sector<br />

The logistics portfolio consists of 10 properties (4 acquired; 6 Committed to be Acquired), 9 of which<br />

have been, or are expected to be, acquired from Eurinpro International SA. As at the date of this<br />

Prospectus, the acquired and Committed to be Acquired logistics properties were 98 per cent. leased<br />

58