You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7. Prepayments<br />

Prepayments represent fees that have been charged to the Group for future committed acquisitions<br />

(see also note 23). These fees will eventually be added to the capitalized acquisition cost of the<br />

properties once acquired.<br />

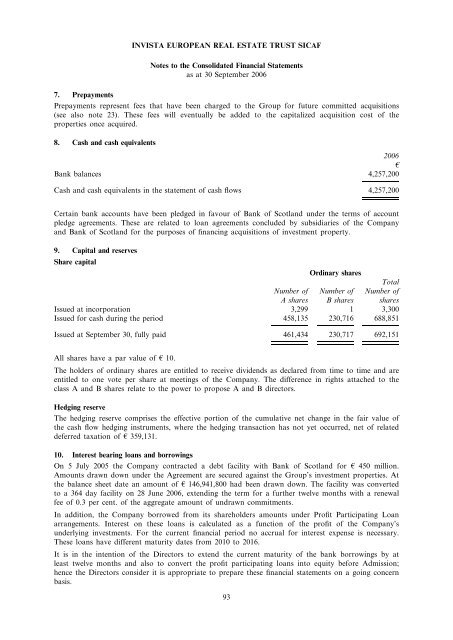

8. Cash and cash equivalents<br />

2006<br />

B<br />

Bank balances 4,257,200<br />

Cash and cash equivalents in the statement of cash flows 4,257,200<br />

Certain bank accounts have been pledged in favour of Bank of Scotland under the terms of account<br />

pledge agreements. These are related to loan agreements concluded by subsidiaries of the Company<br />

and Bank of Scotland for the purposes of financing acquisitions of investment property.<br />

9. Capital and reserves<br />

Share capital<br />

Ordinary shares<br />

Number of Number of<br />

Total<br />

Number of<br />

A shares B shares shares<br />

Issued at incorporation 3,299 1 3,300<br />

Issued for cash during the period 458,135 230,716 688,851<br />

Issued at September 30, fully paid 461,434 230,717 692,151<br />

All shares have a par value of A 10.<br />

INVISTA EUROPEAN REAL ESTATE TRUST SICAF<br />

Notes to the Consolidated Financial Statements<br />

as at 30 September 2006<br />

The holders of ordinary shares are entitled to receive dividends as declared from time to time and are<br />

entitled to one vote per share at meetings of the Company. The difference in rights attached to the<br />

class A and B shares relate to the power to propose A and B directors.<br />

Hedging reserve<br />

The hedging reserve comprises the effective portion of the cumulative net change in the fair value of<br />

the cash flow hedging instruments, where the hedging transaction has not yet occurred, net of related<br />

deferred taxation of A 359,131.<br />

10. Interest bearing loans and borrowings<br />

On 5 July 2005 the Company contracted a debt facility with Bank of Scotland for A 450 million.<br />

Amounts drawn down under the Agreement are secured against the Group’s investment properties. At<br />

the balance sheet date an amount of A 146,941,800 had been drawn down. The facility was converted<br />

to a 364 day facility on 28 June 2006, extending the term for a further twelve months with a renewal<br />

fee of 0.3 per cent. of the aggregate amount of undrawn commitments.<br />

In addition, the Company borrowed from its shareholders amounts under Profit Participating Loan<br />

arrangements. Interest on these loans is calculated as a function of the profit of the Company’s<br />

underlying investments. For the current financial period no accrual for interest expense is necessary.<br />

These loans have different maturity dates from 2010 to 2016.<br />

It is in the intention of the Directors to extend the current maturity of the bank borrowings by at<br />

least twelve months and also to convert the profit participating loans into equity before Admission;<br />

hence the Directors consider it is appropriate to prepare these financial statements on a going concern<br />

basis.<br />

93