Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

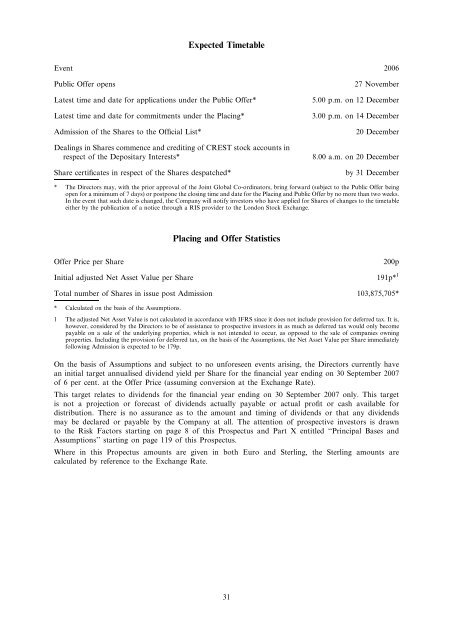

Expected Timetable<br />

Event 2006<br />

Public Offer opens 27 November<br />

Latest time and date for applications under the Public Offer* 5.00 p.m. on 12 December<br />

Latest time and date for commitments under the Placing* 3.00 p.m. on 14 December<br />

Admission of the Shares to the Official List* 20 December<br />

Dealings in Shares commence and crediting of CREST stock accounts in<br />

respect of the Depositary Interests* 8.00 a.m. on 20 December<br />

Share certificates in respect of the Shares despatched* by 31 December<br />

* The Directors may, with the prior approval of the Joint Global Co-ordinators, bring forward (subject to the Public Offer being<br />

open for a minimum of 7 days) or postpone the closing time and date for the Placing and Public Offer by no more than two weeks.<br />

In the event that such date is changed, the Company will notify investors who have applied for Shares of changes to the timetable<br />

either by the publication of a notice through a RIS provider to the London Stock Exchange.<br />

Placing and Offer Statistics<br />

Offer Price per Share 200p<br />

Initial adjusted Net Asset Value per Share 191p* 1<br />

Total number of Shares in issue post Admission 103,875,705*<br />

* Calculated on the basis of the Assumptions.<br />

1 The adjusted Net Asset Value is not calculated in accordance with IFRS since it does not include provision for deferred tax. It is,<br />

however, considered by the Directors to be of assistance to prospective investors in as much as deferred tax would only become<br />

payable on a sale of the underlying properties, which is not intended to occur, as opposed to the sale of companies owning<br />

properties. Including the provision for deferred tax, on the basis of the Assumptions, the Net Asset Value per Share immediately<br />

following Admission is expected to be 179p.<br />

On the basis of Assumptions and subject to no unforeseen events arising, the Directors currently have<br />

an initial target annualised dividend yield per Share for the financial year ending on 30 September 2007<br />

of 6 per cent. at the Offer Price (assuming conversion at the Exchange Rate).<br />

This target relates to dividends for the financial year ending on 30 September 2007 only. This target<br />

is not a projection or forecast of dividends actually payable or actual profit or cash available for<br />

distribution. There is no assurance as to the amount and timing of dividends or that any dividends<br />

may be declared or payable by the Company at all. The attention of prospective investors is drawn<br />

to the Risk Factors starting on page 8 of this Prospectus and Part X entitled ‘‘Principal Bases and<br />

Assumptions’’ starting on page 119 of this Prospectus.<br />

Where in this Propectus amounts are given in both Euro and Sterling, the Sterling amounts are<br />

calculated by reference to the Exchange Rate.<br />

31