2013 - ICC India

2013 - ICC India

2013 - ICC India

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

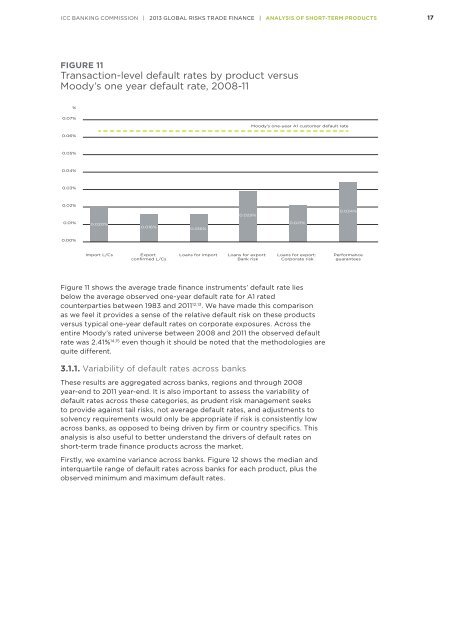

<strong>ICC</strong> BANKING COMMISSION | <strong>2013</strong> GLOBAL RISKS TRADE FINANCE | ANALYSIS OF SHORT-TERM PRODUCTS 17FIGURE 11Transaction-level default rates by product versusMoody’s one year default rate, 2008-11%0.07%0.06%Moody’s one-year A1 customer default rate0.05%0.04%0.03%0.02%0.029%0.034%0.01%0.020%0.016%0.016%0.021%0.00%Import L/CsExportconfirmed L/CsLoans for importLoans for export:Bank riskLoans for export:Corporate riskPerformanceguaranteesFigure 11 shows the average trade finance instruments’ default rate liesbelow the average observed one-year default rate for A1 ratedcounterparties between 1983 and 2011 12,13 . We have made this comparisonas we feel it provides a sense of the relative default risk on these productsversus typical one-year default rates on corporate exposures. Across theentire Moody’s rated universe between 2008 and 2011 the observed defaultrate was 2.41% 14,15 even though it should be noted that the methodologies arequite different.3.1.1. Variability of default rates across banksThese results are aggregated across banks, regions and through 2008year-end to 2011 year-end. It is also important to assess the variability ofdefault rates across these categories, as prudent risk management seeksto provide against tail risks, not average default rates, and adjustments tosolvency requirements would only be appropriate if risk is consistently lowacross banks, as opposed to being driven by firm or country specifics. Thisanalysis is also useful to better understand the drivers of default rates onshort-term trade finance products across the market.Firstly, we examine variance across banks. Figure 12 shows the median andinterquartile range of default rates across banks for each product, plus theobserved minimum and maximum default rates.