2013 - ICC India

2013 - ICC India

2013 - ICC India

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

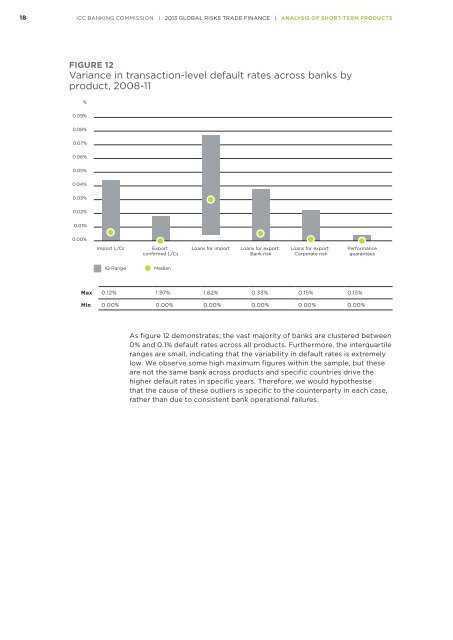

18<strong>ICC</strong> BANKING COMMISSION | <strong>2013</strong> GLOBAL RISKS TRADE FINANCE | ANALYSIS OF SHORT-TERM PRODUCTSFIGURE 12Variance in transaction-level default rates across banks byproduct, 2008-11%0.09%0.08%0.07%0.06%0.05%0.04%0.03%0.02%0.01%0.00%Import L/CsExportconfirmed L/CsLoans for importLoans for export:Bank riskLoans for export:Corporate riskPerformanceguaranteesIQ RangeMedianMax 0.12% 1.97% 1.62% 0.33% 0.15% 0.15%Min 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%As figure 12 demonstrates, the vast majority of banks are clustered between0% and 0.1% default rates across all products. Furthermore, the interquartileranges are small, indicating that the variability in default rates is extremelylow. We observe some high maximum figures within the sample, but theseare not the same bank across products and specific countries drive thehigher default rates in specific years. Therefore, we would hypothesisethat the cause of these outliers is specific to the counterparty in each case,rather than due to consistent bank operational failures.