2013 - ICC India

2013 - ICC India

2013 - ICC India

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

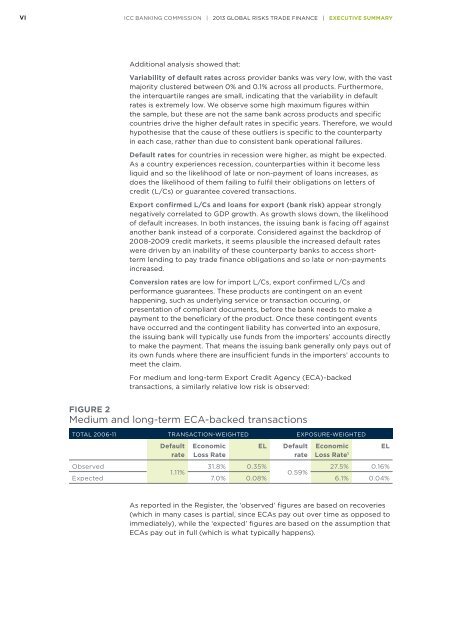

VI<strong>ICC</strong> BANKING COMMISSION | <strong>2013</strong> GLOBAL RISKS TRADE FINANCE | EXECUTIVE SUMMARYAdditional analysis showed that:Variability of default rates across provider banks was very low, with the vastmajority clustered between 0% and 0.1% across all products. Furthermore,the interquartile ranges are small, indicating that the variability in defaultrates is extremely low. We observe some high maximum figures withinthe sample, but these are not the same bank across products and specificcountries drive the higher default rates in specific years. Therefore, we wouldhypothesise that the cause of these outliers is specific to the counterpartyin each case, rather than due to consistent bank operational failures.Default rates for countries in recession were higher, as might be expected.As a country experiences recession, counterparties within it become lessliquid and so the likelihood of late or non-payment of loans increases, asdoes the likelihood of them failing to fulfil their obligations on letters ofcredit (L/Cs) or guarantee covered transactions.Export confirmed L/Cs and loans for export (bank risk) appear stronglynegatively correlated to GDP growth. As growth slows down, the likelihoodof default increases. In both instances, the issuing bank is facing off againstanother bank instead of a corporate. Considered against the backdrop of2008-2009 credit markets, it seems plausible the increased default rateswere driven by an inability of these counterparty banks to access shorttermlending to pay trade finance obligations and so late or non-paymentsincreased.Conversion rates are low for import L/Cs, export confirmed L/Cs andperformance guarantees. These products are contingent on an eventhappening, such as underlying service or transaction occuring, orpresentation of compliant documents, before the bank needs to make apayment to the beneficiary of the product. Once these contingent eventshave occurred and the contingent liability has converted into an exposure,the issuing bank will typically use funds from the importers’ accounts directlyto make the payment. That means the issuing bank generally only pays out ofits own funds where there are insufficient funds in the importers’ accounts tomeet the claim.For medium and long-term Export Credit Agency (ECA)-backedtransactions, a similarly relative low risk is observed:FIGURE 2Medium and long-term ECA-backed transactionsTOTAL 2006-11 TRANSACTION-WEIGHTED EXPOSURE-WEIGHTEDDefaultrateEconomicLoss RateELDefaultrateEconomicLoss Rate 1Observed31.8% 0.35%27.5% 0.16%1.11%0.59%Expected 7.0% 0.08% 6.1% 0.04%ELAs reported in the Register, the ‘observed’ figures are based on recoveries(which in many cases is partial, since ECAs pay out over time as opposed toimmediately), while the ‘expected’ figures are based on the assumption thatECAs pay out in full (which is what typically happens).