Annual Report - EuroPacific Growth Fund - American Funds

Annual Report - EuroPacific Growth Fund - American Funds

Annual Report - EuroPacific Growth Fund - American Funds

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

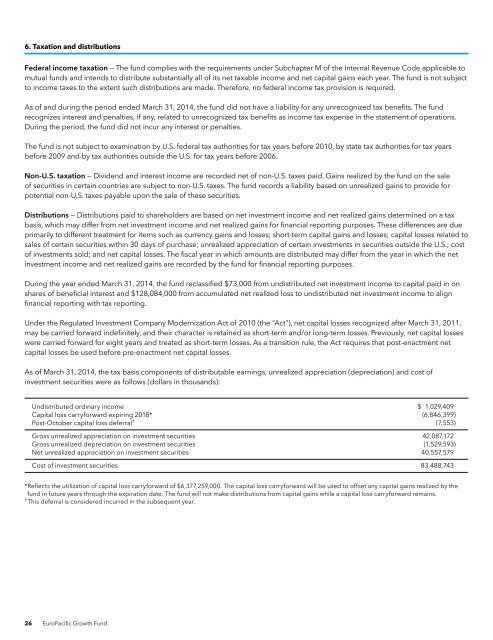

6. Taxation and distributionsFederal income taxation — The fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable tomutual funds and intends to distribute substantially all of its net taxable income and net capital gains each year. The fund is not subjectto income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.As of and during the period ended March 31, 2014, the fund did not have a liability for any unrecognized tax benefits. The fundrecognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations.During the period, the fund did not incur any interest or penalties.The fund is not subject to examination by U.S. federal tax authorities for tax years before 2010, by state tax authorities for tax yearsbefore 2009 and by tax authorities outside the U.S. for tax years before 2006.Non-U.S. taxation — Dividend and interest income are recorded net of non-U.S. taxes paid. Gains realized by the fund on the saleof securities in certain countries are subject to non-U.S. taxes. The fund records a liability based on unrealized gains to provide forpotential non-U.S. taxes payable upon the sale of these securities.Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a taxbasis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are dueprimarily to different treatment for items such as currency gains and losses; short-term capital gains and losses; capital losses related tosales of certain securities within 30 days of purchase; unrealized appreciation of certain investments in securities outside the U.S.; costof investments sold; and net capital losses. The fiscal year in which amounts are distributed may differ from the year in which the netinvestment income and net realized gains are recorded by the fund for financial reporting purposes.During the year ended March 31, 2014, the fund reclassified $73,000 from undistributed net investment income to capital paid in onshares of beneficial interest and $128,084,000 from accumulated net realized loss to undistributed net investment income to alignfinancial reporting with tax reporting.Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), net capital losses recognized after March 31, 2011,may be carried forward indefinitely, and their character is retained as short-term and/or long-term losses. Previously, net capital losseswere carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment netcapital losses be used before pre-enactment net capital losses.As of March 31, 2014, the tax basis components of distributable earnings, unrealized appreciation (depreciation) and cost ofinvestment securities were as follows (dollars in thousands):Undistributed ordinary income $ 1,029,409Capital loss carryforward expiring 2018* (6,846,399)Post-October capital loss deferral † (7,553)Gross unrealized appreciation on investment securities 42,087,172Gross unrealized depreciation on investment securities (1,529,593)Net unrealized appreciation on investment securities 40,557,579Cost of investment securities 83,488,743*Reflects the utilization of capital loss carryforward of $6,377,259,000. The capital loss carryforward will be used to offset any capital gains realized by thefund in future years through the expiration date. The fund will not make distributions from capital gains while a capital loss carryforward remains.†This deferral is considered incurred in the subsequent year.26 <strong>EuroPacific</strong> <strong>Growth</strong> <strong>Fund</strong>