Annual Report - EuroPacific Growth Fund - American Funds

Annual Report - EuroPacific Growth Fund - American Funds

Annual Report - EuroPacific Growth Fund - American Funds

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

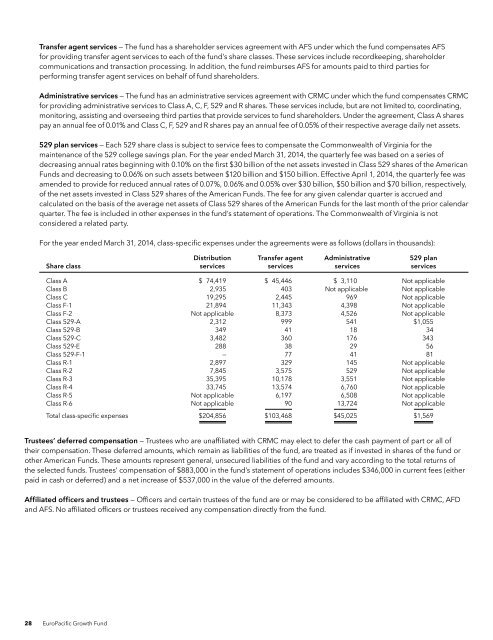

Transfer agent services — The fund has a shareholder services agreement with AFS under which the fund compensates AFSfor providing transfer agent services to each of the fund’s share classes. These services include recordkeeping, shareholdercommunications and transaction processing. In addition, the fund reimburses AFS for amounts paid to third parties forperforming transfer agent services on behalf of fund shareholders.Administrative services — The fund has an administrative services agreement with CRMC under which the fund compensates CRMCfor providing administrative services to Class A, C, F, 529 and R shares. These services include, but are not limited to, coordinating,monitoring, assisting and overseeing third parties that provide services to fund shareholders. Under the agreement, Class A sharespay an annual fee of 0.01% and Class C, F, 529 and R shares pay an annual fee of 0.05% of their respective average daily net assets.529 plan services — Each 529 share class is subject to service fees to compensate the Commonwealth of Virginia for themaintenance of the 529 college savings plan. For the year ended March 31, 2014, the quarterly fee was based on a series ofdecreasing annual rates beginning with 0.10% on the first $30 billion of the net assets invested in Class 529 shares of the <strong>American</strong><strong>Fund</strong>s and decreasing to 0.06% on such assets between $120 billion and $150 billion. Effective April 1, 2014, the quarterly fee wasamended to provide for reduced annual rates of 0.07%, 0.06% and 0.05% over $30 billion, $50 billion and $70 billion, respectively,of the net assets invested in Class 529 shares of the <strong>American</strong> <strong>Fund</strong>s. The fee for any given calendar quarter is accrued andcalculated on the basis of the average net assets of Class 529 shares of the <strong>American</strong> <strong>Fund</strong>s for the last month of the prior calendarquarter. The fee is included in other expenses in the fund’s statement of operations. The Commonwealth of Virginia is notconsidered a related party.For the year ended March 31, 2014, class-specific expenses under the agreements were as follows (dollars in thousands):Distribution Transfer agent Administrative 529 planShare class services services services servicesClass A $ 74,419 $ 45,446 $ 3,110 Not applicableClass B 2,935 403 Not applicable Not applicableClass C 19,295 2,445 969 Not applicableClass F-1 21,894 11,343 4,398 Not applicableClass F-2 Not applicable 8,373 4,526 Not applicableClass 529-A 2,312 999 541 $1,055Class 529-B 349 41 18 34Class 529-C 3,482 360 176 343Class 529-E 288 38 29 56Class 529-F-1 — 77 41 81Class R-1 2,897 329 145 Not applicableClass R-2 7,845 3,575 529 Not applicableClass R-3 35,395 10,178 3,551 Not applicableClass R-4 33,745 13,574 6,760 Not applicableClass R-5 Not applicable 6,197 6,508 Not applicableClass R-6 Not applicable 90 13,724 Not applicableTotal class-specific expenses $204,856 $103,468 $45,025 $1,569Trustees’ deferred compensation — Trustees who are unaffiliated with CRMC may elect to defer the cash payment of part or all oftheir compensation. These deferred amounts, which remain as liabilities of the fund, are treated as if invested in shares of the fund orother <strong>American</strong> <strong>Fund</strong>s. These amounts represent general, unsecured liabilities of the fund and vary according to the total returns ofthe selected funds. Trustees’ compensation of $883,000 in the fund’s statement of operations includes $346,000 in current fees (eitherpaid in cash or deferred) and a net increase of $537,000 in the value of the deferred amounts.Affiliated officers and trustees — Officers and certain trustees of the fund are or may be considered to be affiliated with CRMC, AFDand AFS. No affiliated officers or trustees received any compensation directly from the fund.28 <strong>EuroPacific</strong> <strong>Growth</strong> <strong>Fund</strong>