Annual Report and Accounts 11/12 - Glasgow School of Art

Annual Report and Accounts 11/12 - Glasgow School of Art

Annual Report and Accounts 11/12 - Glasgow School of Art

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

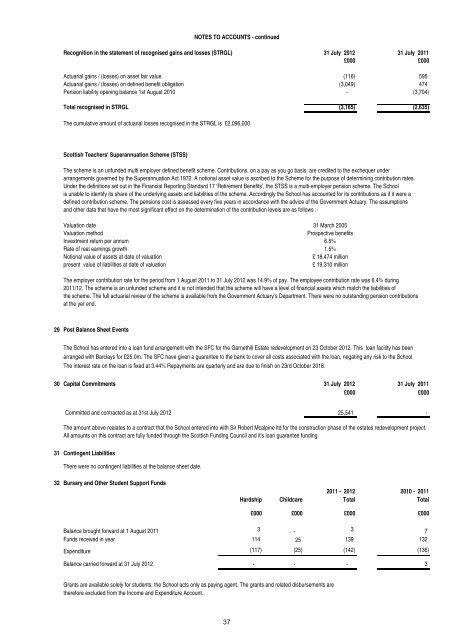

NOTES TO ACCOUNTS - continuedRecognition in the statement <strong>of</strong> recognised gains <strong>and</strong> losses (STRGL) 31 July 20<strong>12</strong> 31 July 20<strong>11</strong>£000 £000Actuarial gains / (losses) on asset fair value (<strong>11</strong>6) 595Actuarial gains / (losses) on defined benefit obligation (3,049) 474Pension liability opening balance 1st August 2010 - (3,704)Total recognised in STRGL (3,165) (2,635)The cumulative amount <strong>of</strong> actuarial losses recognised in the STRGL is £2,096,000Scottish Teachers' Superannuation Scheme (STSS)The scheme is an unfunded multi employer defined benefit scheme. Contributions, on a pay as you go basis, are credited to the exchequer underarrangements governed by the Superannuation Act 1972. A notional asset value is ascribed to the Scheme for the purpose <strong>of</strong> determining contribution rates.Under the definitions set out in the Financial <strong>Report</strong>ing St<strong>and</strong>ard 17 ‘Retirement Benefits’, the STSS is a multi-employer pension scheme. The <strong>School</strong>is unable to identify its share <strong>of</strong> the underlying assets <strong>and</strong> liabilities <strong>of</strong> the scheme. Accordingly the <strong>School</strong> has accounted for its contributions as if it were adefined contribution scheme. The pensions cost is assessed every five years in accordance with the advice <strong>of</strong> the Government Actuary. The assumptions<strong>and</strong> other data that have the most significant effect on the determination <strong>of</strong> the contribution levels are as follows :-Valuation date 31 March 2005Valuation methodProspective benefitsInvestment return per annum 6.5%Rate <strong>of</strong> real earnings growth 1.5%Notional value <strong>of</strong> assets at date <strong>of</strong> valuation£ 18,474 millionpresent value <strong>of</strong> liabilities at date <strong>of</strong> valuation£ 19,310 millionThe employer contribution rate for the period from 1 August 20<strong>11</strong> to 31 July 20<strong>12</strong> was 14.9% <strong>of</strong> pay. The employee contribution rate was 6.4% during20<strong>11</strong>/<strong>12</strong>. The scheme is an unfunded scheme <strong>and</strong> it is not intended that the scheme will have a level <strong>of</strong> financial assets which match the liabilities <strong>of</strong>the scheme. The full actuarial review <strong>of</strong> the scheme is available from the Government Actuary’s Department. There were no outst<strong>and</strong>ing pension contributionsat the yer end.29 Post Balance Sheet EventsThe <strong>School</strong> has entered into a loan fund arrangement with the SFC for the Garnethill Estate redevelopment on 23 October 20<strong>12</strong>. This loan facility has beenarranged with Barclays for £25.0m. The SFC have given a guarantee to the bank to cover all costs associated with the loan, negating any risk to the <strong>School</strong>.The interest rate on the loan is fixed at 3.44% Repayments are quarterly <strong>and</strong> are due to finish on 23rd October 2018.30 Capital Commitments 31 July 20<strong>12</strong> 31 July 20<strong>11</strong>£000 £000Committed <strong>and</strong> contracted as at 31st July 20<strong>12</strong> 25,541 -The amount above realates to a contract that the <strong>School</strong> entered into with Sir Robert Mcalpine ltd for the construction phase <strong>of</strong> the estates redevelopment project.All amounts on this contract are fully funded through the Scottish Funding Council <strong>and</strong> it's loan guarantee funding31 Contingent LiabilitiesThere were no contingent liabilities at the balance sheet date.32 Bursary <strong>and</strong> Other Student Support Funds20<strong>11</strong> - 20<strong>12</strong> 2010 - 20<strong>11</strong>Hardship Childcare Total Total£000 £000 £000 £000Balance brought forward at 1 August 20<strong>11</strong> 3 - 3 7Funds received in year <strong>11</strong>4 25 139 132Expenditure (<strong>11</strong>7) (25) (142) (136)Balance carried forward at 31 July 20<strong>12</strong> - - - 3Grants are available solely for students; the <strong>School</strong> acts only as paying agent. The grants <strong>and</strong> related disbursements aretherefore excluded from the Income <strong>and</strong> Expenditure Account.37