401(k) Hardship Withdrawal Request State of Tennessee 401(k ...

401(k) Hardship Withdrawal Request State of Tennessee 401(k ...

401(k) Hardship Withdrawal Request State of Tennessee 401(k ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

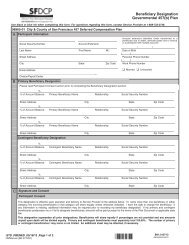

Last Name First Name MI Social Security Number❑ Principal Residence Repair - expenses for repair <strong>of</strong> damage to the employee’s principal residence that qualifies for the casualtydeduction (as defined in IRC 165, determined without regard to whether the loss exceeds 10% <strong>of</strong> adjusted gross income) if permittedby the PlanRequired Documentation - Copies <strong>of</strong> invoices and/or receipts showing the cost <strong>of</strong> repair after taking into account anyreimbursement from your insurance company. For the insurance information, include a statement from the insurance company.<strong>Hardship</strong> AmountThe withdrawal will be prorated across all available money sources available for hardship withdrawals under your Plan.If the amount requested exceeds available funds or exceeds limits imposed by IRC, regulations and/or Plan terms, we will process thehardship for the maximum amount available.$ ❑ Net AmountDistribution Delivery❑ Check❑ Express Delivery - $25.00 non-refundable charge will be deducted from your distribution amount. If both Non-Roth and Rothmoney sources are allowed by your Plan and distributed, $25.00 will be deducted from each check, totaling $50.00. Express deliveryavailable Monday through Friday only. Check will be sent by USPS Express if address is a P.O. Box and could take 2-3 businessdays for delivery.❑ ACH - $15.00 non-refundable charge will be deducted from your distribution amount. ACH credit can only be made into a United<strong>State</strong>s financial institution. Any requests received referencing a foreign financial institution or referencing a United <strong>State</strong>s financialinstitution with a further credit to an account associated with a foreign financial institution will be rejected. If both Non-Roth andRoth money sources are allowed by your Plan and distributed, $15.00 will be deducted from the Non-Roth and Roth moneysources, totaling $30.00.❑ Checking Account - must attach preprinted voided check❑ Savings Account - must attach a letter on financial institution letterhead signed by a representative <strong>of</strong> the financial institution thatincludes your name, savings account number and ABA routing numberFinancial Institution Name Account Number ABA Routing NumberFinancial Institution Mailing Address City <strong>State</strong>/Zip Code][Form 11 ][GWRS FDSTHD ][12/07/12 ][Page 2 <strong>of</strong> 6][GP22][/306025589][A01:112912