BTJ 5/2011 - Baltic Press

BTJ 5/2011 - Baltic Press

BTJ 5/2011 - Baltic Press

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

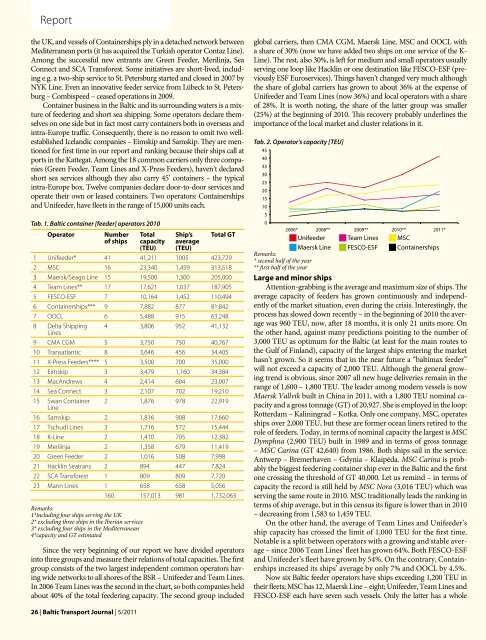

Reportthe UK, and vessels of Containerships ply in a detached network betweenMediterranean ports (it has acquired the Turkish operator Contaz Line).Among the successful new entrants are Green Feeder, Merilinja, SeaConnect and SCA Transforest. Some initiatives are short-lived, includinge.g. a two-ship service to St. Petersburg started and closed in 2007 byNYK Line. Even an innovative feeder service from Lübeck to St. Petersburg– Combispeed – ceased operations in 2009.Container business in the <strong>Baltic</strong> and its surrounding waters is a mixtureof feedering and short sea shipping. Some operators declare themselveson one side but in fact most carry containers both in overseas andintra-Europe traffic. Consequently, there is no reason to omit two wellestablishedIcelandic companies – Eimskip and Samskip. They are mentionedfor first time in our report and ranking because their ships call atports in the Kattegat. Among the 18 common carriers only three companies(Green Feeder, Team Lines and X-<strong>Press</strong> Feeders), haven’t declaredshort sea services although they also carry 45’ containers – the typicalintra-Europe box. Twelve companies declare door-to-door services andoperate their own or leased containers. Two operators: Containershipsand Unifeeder, have fleets in the range of 15,000 units each.global carriers, then CMA CGM, Maersk Line, MSC and OOCL witha share of 30% (now we have added two ships on one service of the K-Line). The rest, also 30%, is left for medium and small operators usuallyserving one loop like Hacklin or one destination like FESCO-ESF (previouslyESF Euroservices). Things haven’t changed very much althoughthe share of global carriers has grown to about 36% at the expense ofUnifeeder and Team Lines (now 36%) and local operators with a shareof 28%. It is worth noting, the share of the latter group was smaller(25%) at the beginning of 2010. This recovery probably underlines theimportance of the local market and cluster relations in it.Tab. 2. Operator’s capacity [TEU]Tab. 1. <strong>Baltic</strong> container [feeder] operators 2010OperatorNumberof shipsTotalcapacity(TEU)Ship’saverage(TEU)Total GT1 Unifeeder* 41 41,211 1005 423,7292 MSC 16 23,340 1,459 313,5183 Maersk/Seago Line 15 19,500 1,300 205,0004 Team Lines** 17 17,621 1,037 187,9055 FESCO-ESF 7 10,164 1,452 110,4946 Containerships*** 9 7,882 877 81,8427 OOCL 6 5,488 915 63,2488 Delta Shipping 4 3,806 952 41,132Lines9 CMA CGM 5 3,750 750 40,76710 Transatlantic 8 3,646 456 34,40511 X-<strong>Press</strong> Feeders**** 5 3,500 700 35,00012 Eimskip 3 3,479 1,160 34,38413 MacAndrews 4 2,414 604 23,00714 Sea Connect 3 2,107 702 19,21015 Swan Container 2 1,876 978 22,919Line16 Samskip 2 1,816 908 17,66017 Tschudi Lines 3 1,716 572 15,44418 K-Line 2 1,410 705 12,38219 Merilinja 2 1,358 679 11,41920 Green Feeder 2 1,016 508 7,99821 Hacklin Seatrans 2 894 447 7,82422 SCA Transforest 1 809 809 7,72023 Mann Lines 1 658 658 5,056160 157,013 981 1,732,063Remarks:1*including four ships serving the UK2* excluding three ships in the Iberian services3* excluding four ships in the Mediterranean4*capacity and GT estimatedSince the very beginning of our report we have divided operatorsinto three groups and measure their relations of total capacities. The firstgroup consists of the two largest independent common operators havingwide networks to all shores of the BSR – Unifeeder and Team Lines.In 2006 Team Lines was the second in the chart, so both companies heldabout 40% of the total feedering capacity. The second group includedRemarks:* second half of the year** first half of the yearLarge and minor shipsAttention-grabbing is the average and maximum size of ships. Theaverage capacity of feeders has grown continuously and independentlyof the market situation, even during the crisis. Interestingly, theprocess has slowed down recently – in the beginning of 2010 the averagewas 960 TEU, now, after 18 months, it is only 21 units more. Onthe other hand, against many predictions pointing to the number of3,000 TEU as optimum for the <strong>Baltic</strong> (at least for the main routes tothe Gulf of Finland), capacity of the largest ships entering the markethasn’t grown. So it seems that in the near future a “baltimax feeder”will not exceed a capacity of 2,000 TEU. Although the general growingtrend is obvious, since 2007 all new huge deliveries remain in therange of 1,600 – 1,800 TEU. The leader among modern vessels is nowMaersk Vallvik built in China in <strong>2011</strong>, with a 1,800 TEU nominal capacityand a gross tonnage (GT) of 20,927. She is employed in the loop:Rotterdam – Kaliningrad – Kotka. Only one company, MSC, operatesships over 2,000 TEU, but these are former ocean liners retired to therole of feeders. Today, in terms of nominal capacity the largest is MSCDymphna (2,900 TEU) built in 1989 and in terms of gross tonnage– MSC Carina (GT 42,640) from 1986. Both ships sail in the service:Antwerp – Bremerhaven – Gdynia – Klaipėda. MSC Carina is probablythe biggest feedering container ship ever in the <strong>Baltic</strong> and the firstone crossing the threshold of GT 40,000. Let us remind – in terms ofcapacity the record is still held by MSC Nora (3,016 TEU) which wasserving the same route in 2010. MSC traditionally leads the ranking interms of ship average, but in this census its figure is lower than in 2010– decreasing from 1,583 to 1,459 TEU.On the other hand, the average of Team Lines and Unifeeder’sship capacity has crossed the limit of 1,000 TEU for the first time.Notable is a split between operators with a growing and stable average– since 2006 Team Lines’ fleet has grown 64%. Both FESCO-ESFand Unifeeder’s fleet have grown by 54%. On the contrary, Containershipsincreased its ships’ average by only 7% and OOCL by 4.5%.Now six <strong>Baltic</strong> feeder operators have ships exceeding 1,200 TEU intheir fleets; MSC has 12, Maersk Line – eight; Unifeeder, Team Lines andFESCO-ESF each have seven such vessels. Only the latter has a whole26 | <strong>Baltic</strong> Transport Journal | 5/<strong>2011</strong>