You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

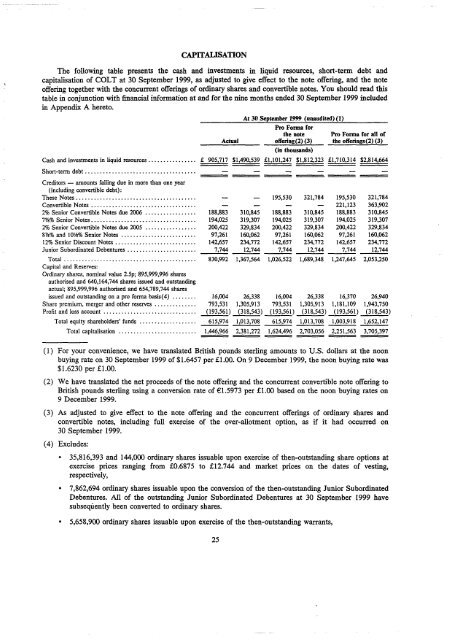

CAPITALISATION<br />

The following table presents the cash and investments in liquid resources, short-term debt and<br />

capitalisation of <strong>COLT</strong> at 30 September 1999, as adjusted to give effect to the note offering, and the note<br />

offering together with the concurrent offerings of ordinary shares and convertible notes. You should read this<br />

table in conjunction with financial information at and for the nine months ended 30 September 1999 included<br />

in Appendix A hereto.<br />

At 30 September 1999 (unaudited) (1)<br />

Pro Forma for<br />

the note Pro Forma for all of<br />

A c t u a l o f f e r i n g ( 2 ) ( 3 ) t h e offerings(2) (3)<br />

(in thousands)<br />

Cash and investments in liquid resources £ 905,717 $1,490,539 £1,101,247 $1,812,323 £1,710,314 $2,814,664<br />

Short-term debt — — — — — —<br />

Creditors — amounts falling due in more than one year<br />

(including convertible debt):<br />

These Notes — — 195,530 321,784 195,530 321,784<br />

Convertible Notes — — — — 221,123 363,902<br />

2% Senior Convertible Notes due 2006 188,883 310,845 188,883 310,845 188,883 310,845<br />

7 5/8% Senior Notes 194,025 319,307 194,025 319,307 194,025 319,307<br />

2% Senior Convertible Notes due 2005 200,422 329,834 200,422 329,834 200,422 329,834<br />

8 2/8% and 10 1/8% Senior Notes 97,261 160,062 97,261 160,062 97,261 160,062<br />

12% Senior Discount Notes 142,657 234,772 142,657 234,772 142,657 234,772<br />

Junior Subordinated Debentures 7,744 12,744 7,744 12,744 7,744 12,744<br />

Total 830,992 1,367,564 1,026,522 1,689,348 1,247,645 2,053,250<br />

Capital and Reserves:<br />

Ordinary shares, nominal value 2.5p; 895,999,996 shares<br />

authorised and 640,164,744 shares issued and outstanding<br />

actual; 895,999,996 authorised and 654,789,744 shares<br />

issued and outstanding on a pro forma basis(4) 16,004 26,338 16,004 26,338 16,370 26,940<br />

Share premium, merger and other reserves 793,531 1,305,913 793,531 1,305,913 1,181,109 1,943,750<br />

Profit and loss account (193,561) (318,543) (193,561) (318,543) (193,561) (318,543)<br />

Total equity shareholders' funds 615,974 1,013,708 615,974 1,013,708 1,003,918 1,652,147<br />

Total capitalisation 1,446,966 2,381,272 1,624,496 2,703,056 2,251,563 3,705,397<br />

(1) For your convenience, we have translated British pounds sterling amounts to U.S. dollars at the noon<br />

buying rate on 30 September 1999 of $1.6457 per £1.00. On 9 December 1999, the noon buying rate was<br />

$1.6230 per £1.00.<br />

(2) We have translated the net proceeds of the note offering and the concurrent convertible note offering to<br />

British pounds sterling using a conversion rate of €1.5973 per £1.00 based on the noon buying rates on<br />

9 December 1999.<br />

(3) As adjusted to give effect to the note offering and the concurrent offerings of ordinary shares and<br />

convertible notes, including full exercise of the over-allotment option, as if it had occurred on<br />

30 September 1999.<br />

(4) Excludes:<br />

• 35,816,393 and 144,000 ordinary shares issuable upon exercise of then-outstanding share options at<br />

exercise prices ranging from £0.6875 to £12.744 and market prices on the dates of vesting,<br />

respectively,<br />

• 7,862,694 ordinary shares issuable upon the conversion of the then-outstanding Junior Subordinated<br />

Debentures. All of the outstanding Junior Subordinated Debentures at 30 September 1999 have<br />

subsequently been converted to ordinary shares.<br />

• 5,658,900 ordinary shares issuable upon exercise of the then-outstanding warrants,<br />

25