Bama Gruppen

Bama Gruppen

Bama Gruppen

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

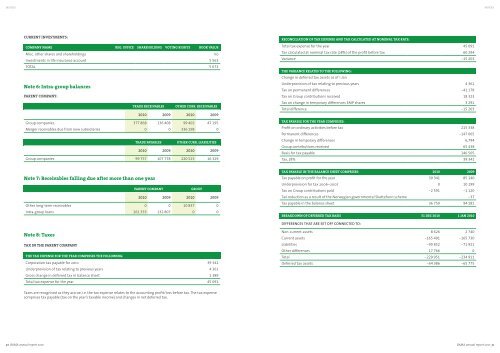

notesnotesCurrent investments:Company name Reg. office Shareholding Voting rights Book valueMisc. other shares and shareholdings 110Investments in life insurance account 5 563TOTAL 5 673Note 6: Intra-group balancesParent company:Trade receivables Other curr. receivables2010 2009 2010 2009Group companies 377 868 136 408 99 402 47 195Merger receivables due from new subsidiaries 0 0 336 198 0Trade payables Other curr. liabilities2010 2009 2010 2009Group companies 99 757 107 778 220 523 16 329Reconciliation of tax expense and tax calculated at nominal tax rate:Total tax expense for the year 45 091Tax calculated at nominal tax rate (28%) of the profit before tax 60 294Variance -15 203The variance relates to the following:Change in deferred tax assets as of 1 JanUnderprovision of tax relating to previous years 4 361Tax on permanent differences -41 178Tax on Group contributions received 18 323Tax on change in temporary differences EMP shares 3 291Total difference -15 203Tax payable for the year comprises:Profit on ordinary activities before tax 215 338Permanent differences -147 065Change in temporary differences 6,794Group contributions received 65 438Basis for tax payable 140 505Tax, 28% 39 341Note 7: Receivables falling due after more than one yearParent company Group2010 2009 2010 2009Other long-term receivables 0 0 10 837 0Intra-group loans 261 333 132 807 0 0Tax payable in the balance sheet comprises: 2010 2009Tax payable on profit for the year 39 341 85 140Underprovision for tax 2006–2007 0 10 199Tax on Group contributions paid -2 591 -1 120Tax reduction as a result of the Norwegian governmental Skattefunn scheme -37Tax payable in the balance sheet 36 750 94 181Breakdown of deferred tax basis 31 Dec 2010 1 Jan 2010Differences that are set off connected to:Note 8: TaxesTAX IN THE PARENT COMPANYThe tax expense for the year comprises the following:Corporation tax payable for 2010 39 341Underprovision of tax relating to previous years 4 361Gross change in deferred tax in balance sheet 1 389Total tax expense for the year 45 091Non-current assets 8 626 2 740Current assets -165 491 -165 730Liabilities -90 852 -71 921Other differences 17 766 0Total -229 951 -234 911Deferred tax assets -64 386 -65 775Taxes are recognised as they accrue, i.e. the tax expense relates to the accounting profit/loss before tax. The tax expensecomprises tax payable (tax on the year’s taxable income) and changes in net deferred tax.50 BAMA annual report 2010BAMA annual report 2010 51