Download PDF - Severstal

Download PDF - Severstal

Download PDF - Severstal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

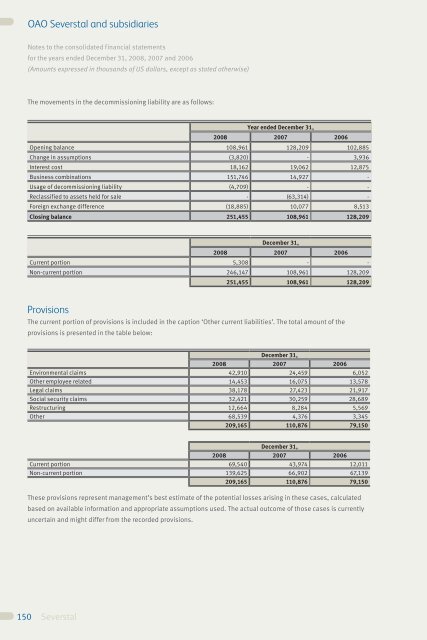

OAO <strong>Severstal</strong> and subsidiariesOAO <strong>Severstal</strong> and subsidiariesNotes to the consolidated financial statementsfor the years ended December 31, 2008, 2007 and 2006(Amounts expressed in thousands of US dollars, except as stated otherwise)Notes to the consolidated financial statementsfor the years ended December 31, 2008, 2007 and 2006(Amounts expressed in thousands of US dollars, except as stated otherwise)The movements in the decommissioning liability are as follows:The movements in the provisions are as follows:Year ended December 31,Year ended December 31,2008 2007 2006Opening balance 108,961 128,209 102,885Change in assumptions (3,820) - 3,936Interest cost 18,162 19,062 12,875Business combinations 151,746 14,927 -Usage of decommissioning liability (4,709) - -Reclassified to assets held for sale - (63,314) -Foreign exchange difference (18,885) 10,077 8,513Closing balance 251,455 108,961 128,209December 31,2008 2007 2006Current portion 5,308 - -Non-current portion 246,147 108,961 128,209251,455 108,961 128,209ProvisionsThe current portion of provisions is included in the caption ‘Other current liabilities’. The total amount of theprovisions is presented in the table below:December 31,2008 2007 2006Environmental claims 42,910 24,459 6,052Other employee related 14,453 16,075 13,578Legal claims 38,178 27,423 21,917Social security claims 32,421 30,259 28,689Restructuring 12,664 8,284 5,569Other 68,539 4,376 3,345209,165 110,876 79,150December 31,2008 2007 2006Current portion 69,540 43,974 12,011Non-current portion 139,625 66,902 67,139209,165 110,876 79,150These provisions represent management’s best estimate of the potential losses arising in these cases, calculatedbased on available information and appropriate assumptions used. The actual outcome of those cases is currentlyuncertain and might differ from the recorded provisions.2008 2007 2006Opening balance 110,876 79,150 68,346Charge to the income statement 95,875 32,907 18,470Business combinations 37,916 781 -Usage of provisions (27,648) (5,821) (15,205)Business de-combinations - (6,321) (24)Foreign exchange difference (7,854) 10,180 7,563Closing balance 209,165 110,876 79,150Restructured tax liabilitiesOAO Vorkutaugol and OAO Mine Vorgashorskaya had significant amounts of taxes in arrears, when they wereacquired by the Group’s Majority Shareholder in June 2003.In November 2005, certain subsidiaries in the Mining segment signed restructuring agreements with the taxauthorities for the taxes in arrears. In accordance with these agreements, the principal amounts of taxes, andfines thereon and 15% of tax interest are payable by instalments over four years. If those payments are made onschedule, the remaining 85% of tax interest liability as at the date of restructuring will be forgiven. Over the pastyears the Group has been making payments in accordance with the agreed schedules and intends to completethe settlement of the restructured taxes in 2009. Restructured tax liabilities are subject to interest rate of 5% perannum, which is included in the caption “Interest expense” since the moment of restructuring.Accordingly, net gain on restructuring of tax liabilities is shown in the income statement as following:Year ended December 31,2008 2007 2006Gain on restructuring of tax liabilities - - 14,669- - 14,669Current portion of restructured tax liabilities is included in the caption ‘Other taxes and social security payable’. Thetotal amount of the restructured taxes is presented in the table below:Year ended December 31,2008 2007 2006Current portion 21,834 20,960 43,553Non-current portion 758 24,978 67,73122,592 45,938 111,28428. Share capitalThe Parent Company’s share capital consists of ordinary shares with a nominal value of RUR 0.01 each. Authorizedshare capital of <strong>Severstal</strong> at December 31, 2008, 2007 and 2006 comprised 1,007,701,355 issued and fully paidshares.The nominal amount of initial share capital was converted into US dollars using exchange rates during the Sovietperiod, when the Government contributed the original capital funds to the enterprise. These capital funds were150151