Download PDF - Severstal

Download PDF - Severstal

Download PDF - Severstal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

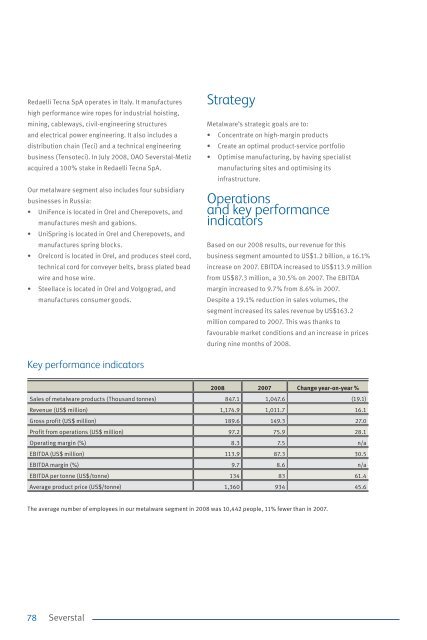

Redaelli Tecna SpA operates in Italy. It manufactureshigh performance wire ropes for industrial hoisting,mining, cableways, civil-engineering structuresand electrical power engineering. It also includes adistribution chain (Teci) and a technical engineeringbusiness (Tensoteci). In July 2008, OAO <strong>Severstal</strong>-Metizacquired a 100% stake in Redaelli Tecna SpA.Our metalware segment also includes four subsidiarybusinesses in Russia:• UniFence is located in Orel and Cherepovets, andmanufactures mesh and gabions.• UniSpring is located in Orel and Cherepovets, andmanufactures spring blocks.• Orelcord is located in Orel, and produces steel cord,technical cord for conveyer belts, brass plated beadwire and hose wire.• Steellace is located in Orel and Volgograd, andmanufactures consumer goods.Key performance indicatorsStrategyMetalware’s strategic goals are to:• Concentrate on high-margin products• Create an optimal product-service portfolio• Optimise manufacturing, by having specialistmanufacturing sites and optimising itsinfrastructure.Operationsand key performanceindicatorsBased on our 2008 results, our revenue for thisbusiness segment amounted to US$1.2 billion, a 16.1%increase on 2007. EBITDA increased to US$113.9 millionfrom US$87.3 million, a 30.5% on 2007. The EBITDAmargin increased to 9.7% from 8.6% in 2007.Despite a 19.1% reduction in sales volumes, thesegment increased its sales revenue by US$163.2million compared to 2007. This was thanks tofavourable market conditions and an increase in pricesduring nine months of 2008.2008 2007 Change year-on-year %Sales of metalware products (Thousand tonnes) 847.1 1,047.6 (19.1)Revenue (US$ million) 1,174.9 1,011.7 16.1Gross profit (US$ million) 189.6 149.3 27.0Profit from operations (US$ million) 97.2 75.9 28.1Operating margin (%) 8.3 7.5 n/aEBITDA (US$ million) 113.9 87.3 30.5EBITDA margin (%) 9.7 8.6 n/aEBITDA per tonne (US$/tonne) 134 83 61.4Average product price (US$/tonne) 1,360 934 45.6The average number of employees in our metalware segment in 2008 was 10,442 people, 11% fewer than in 2007.Sales and marketingKey markets and industriesOur metalware segment sells its products in Russia(accounting for 64.1% of revenues), Ukraine, GreatBritain, Italy and other European and CIS countries. In2008, our Russian sales grew by 18.8% compared to2007, while sales to other countries grew by 11.5%.The growth in Russian sales in the nine months of 2008was primarily due to:• The substantial growth in prices (the average pricefor the segment’s products was US$1,360 per tonnein 2008, 45.6% higher than in 2007);• Improvements in our product mix – with a greaterfocus on high-value-added products;• Cutting back on production of goods with lowprofitability, and;• Increased metalware consumption in theconstruction sector.In the last quarter of 2008, sales revenue decreasedas a result of negative changes in global economicconditions. In addition, the end of the year wascharacterised by typical seasonal production decline.Both factors resulted in lower consumer demand in thesegment’s key markets of construction, automotiveand machinery construction. This led to a 19% drop inshipments of finished product, from 1,047.3 thousandtonnes in 2007 to 847.1 thousand tonnes in 2008.Increasing levels of imported metalware productsfrom Ukraine, South East Asia and China, present uswith a significant challenge. Our metalware segmentis working to mitigate this by taking an active role ininitiating protective anti-dumping measures.Carrington Wire Ltd. occupies a leading position in theUK wire and wire products market (with 23% of themarket). It is one of the sector’s key players in Europe,alongside Redaelli Tecna S.p.a., the world market leaderin speciality wire ropes.Sales by industry in Russia andthe Belarus RepublicAutomotive industry 27%Mining industry 15%Russian railway 12%Construction 11%With a diversified demand for metalware products,overall sales for the year were stable. In Russia, thebulk of sales were to the automotive industry (27%),the mining industry (15%), the Russian railway (12%),the construction industry (11%), metalware production(9%), cable production (2%), and other industries(24%).Capital expendituresMetalware production 9%Cable production 2%Other24%We invested US$31.5 million in our metalwarebusiness in 2008, US$1.6 million more than in 2007.Our investment programmes were focused primarilyon infrastructure optimisation projects, improvinginternal efficiency, reducing costs, and developing newproducts to help our clients reduce their costs.78 79