- Page 1:

ANNUAL REPORT ARCELOR 2003ANNUAL RE

- Page 4 and 5:

Message from the Chairman ofthe Boa

- Page 6 and 7:

Message from the Chairman ofthe Man

- Page 8 and 9:

Does this mean that the Group is en

- Page 10 and 11:

8ANNUAL REPORT ARCELOR 2003

- Page 12 and 13:

Portrait of the GroupArcelor was bo

- Page 14 and 15:

The Arcelor/Nippon Steel Corporatio

- Page 16 and 17:

Key Figures for 2003Revenues (1) Re

- Page 18 and 19:

2003 highlightsOn January 24, 2003,

- Page 20 and 21:

Corporate GovernanceBoard of Direct

- Page 22 and 23:

Report of the Chairman of the Board

- Page 24 and 25:

Role and authority of the Board of

- Page 26 and 27:

4.2. The Audit Committee andthe App

- Page 28 and 29:

AuthorityThe powers of the Manageme

- Page 30 and 31:

B. Internal Control Procedures1. GO

- Page 32 and 33:

3.3. Internal control procedures go

- Page 34 and 35:

Information regarding capital, mark

- Page 36 and 37:

Market informationListingArcelor sh

- Page 38 and 39:

Information policyArcelor intends t

- Page 40 and 41:

38ANNUAL REPORT ARCELOR 2003

- Page 42 and 43:

table of contents >Flat Carbon Stee

- Page 44 and 45:

Within this context, and in order t

- Page 46 and 47:

3.3. Packaging steelsThe packaging

- Page 48 and 49:

table of contents >Long Carbon Stee

- Page 50 and 51:

3. THE SECTOR’S PRODUCTS ANDMARKE

- Page 52 and 53:

table of contents >Stainless Steels

- Page 54 and 55:

The distribution of the UGINE & ALZ

- Page 56 and 57:

The adaptation plan - industrial re

- Page 58 and 59:

table of contents >Distribution-Pro

- Page 60 and 61:

2. ORGANISATION OF THE SECTORThe ye

- Page 62 and 63:

Other ActivitiesThe “Other Activi

- Page 64 and 65:

62ANNUAL REPORT ARCELOR 2003

- Page 66 and 67:

Group Consolidated Management Repor

- Page 68 and 69:

Trends in global crude steel produc

- Page 70 and 71:

Financial highlights for the GroupI

- Page 72 and 73:

Return on capital employed (ROCE) b

- Page 74 and 75:

BUSINESS BY SECTORFlat Carbon Steel

- Page 76 and 77:

Even though shipments in 2003 in th

- Page 78 and 79:

From a financial standpoint, and ex

- Page 80 and 81:

The Trading and Distribution busine

- Page 82 and 83:

- in September 2003, the sale of th

- Page 84 and 85:

The market tightness provoked by th

- Page 86 and 87:

Risk ManagementGeneral legal risks

- Page 88 and 89:

Group purchasing performanceIn addi

- Page 90 and 91:

88ANNUAL REPORT ARCELOR 2003

- Page 92 and 93:

Implementation of the Sustainable D

- Page 94 and 95:

Arcelor’s principles Principal ac

- Page 96 and 97:

Organisation of Sustainable Develop

- Page 98 and 99:

indicators 2002 2003Principle 4 - O

- Page 100 and 101:

Group profitabilityObjectives• Av

- Page 102 and 103:

Arcelor Health and Safety policyArc

- Page 104 and 105:

Safety certificationsSeveral Arcelo

- Page 106 and 107:

Arcelor Environmental PolicyArcelor

- Page 108 and 109:

Implementation of a monitoring plan

- Page 110 and 111:

Dialogue with all stakeholdersObjec

- Page 112 and 113:

Dialogue with societyArcelor partic

- Page 114 and 115:

Development of individual interview

- Page 116 and 117:

Scientific CouncilChairman:• Marc

- Page 118 and 119:

Corporate governanceObjectives• E

- Page 120 and 121:

SponsorshipEvery year, the various

- Page 122 and 123: Durability: Manufacturers are now a

- Page 124 and 125: 122ANNUAL REPORT ARCELOR 2003

- Page 126 and 127: GENERAL INFORMATION ABOUTARCELORCor

- Page 128 and 129: Cold-rolled flat products: In 2001,

- Page 130 and 131: Safeguard clause• United States:

- Page 132 and 133: 130ANNUAL REPORT ARCELOR 2003

- Page 134 and 135: Consolidated financial statementsof

- Page 136 and 137: CONSOLIDATED CASH FLOW STATEMENTIn

- Page 138 and 139: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 140 and 141: Assets intended to be disposed of o

- Page 142 and 143: AmortisationAmortisation is recogni

- Page 144 and 145: 13) EquityRepurchase of share capit

- Page 146 and 147: 18) Other provisionsA provision is

- Page 148 and 149: The major changes in the consolidat

- Page 150 and 151: NOTE 4 - INTANGIBLE ASSETSGoodwill

- Page 152 and 153: NOTE 5 - PROPERTY, PLANT AND EQUIPM

- Page 154 and 155: NOTE 7 - OTHER INVESTMENTSThe main

- Page 156 and 157: NOTE 13 - EQUITY13.1 Issued capital

- Page 158 and 159: NOTE 15 - MINORITY INTERESTSIn the

- Page 160 and 161: 16.6 Detail of main individual long

- Page 162 and 163: 17.2.2 Additional pension plansFran

- Page 164 and 165: 17.2.3 Leaving indemnities (continu

- Page 166 and 167: 18.2 Early retirement plansAn actua

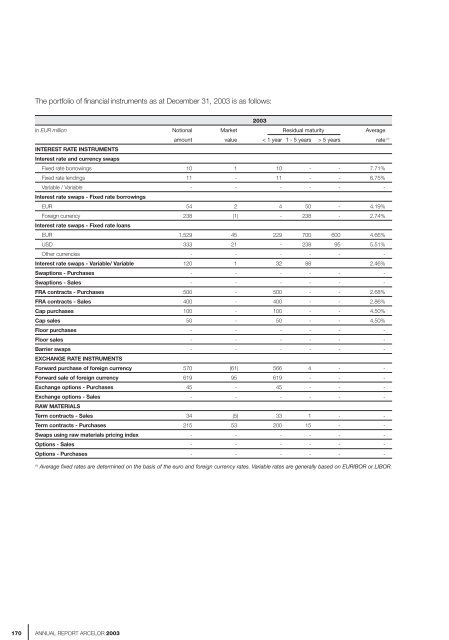

- Page 168 and 169: NOTE 22 - NET FINANCING RESULTIn EU

- Page 170 and 171: NOTE 24 - RELATED PARTY DISCLOSURES

- Page 174 and 175: NOTE 26 - COMMITMENTS GIVEN AND REC

- Page 176 and 177: 27.1 Breakdown by activity (continu

- Page 178 and 179: 27.2 Geographical breakdown(Figures

- Page 180 and 181: NOTE 29 - RECONCILIATION OF THE ARC

- Page 182 and 183: Company name Consolidation Country

- Page 184 and 185: Company name Consolidation Country

- Page 186 and 187: Company name Consolidation Country

- Page 188 and 189: Company name Consolidation Country

- Page 190 and 191: Company name Consolidation Country

- Page 192 and 193: Audit31, Allée Scheffer Telephone

- Page 194 and 195: Annual accounts Arcelor S.A.ANNUAL

- Page 196 and 197: INCOME STATEMENT FROM JANUARY 1 TO

- Page 198 and 199: NOTE 3 - STATEMENT OF TANGIBLE FIXE

- Page 200 and 201: NOTE 8 - PROVISIONS FOR LIABILITIES

- Page 202 and 203: NOTE 14 - DIRECTORS’ REMUNERATION

- Page 204 and 205: Arcelor Ordinary General Meeting on

- Page 206 and 207: GlossaryAnnealing:The heat treatmen

- Page 208 and 209: How steel is made?a 3-stage process

- Page 210 and 211: Arcelor’s main steel-manufacturin

- Page 212 and 213: NOTES210ANNUAL REPORT ARCELOR 2003

- Page 214: Concept and realization133, avenue