ANNUAL REPORT ARCELOR 2003 - paperJam

ANNUAL REPORT ARCELOR 2003 - paperJam

ANNUAL REPORT ARCELOR 2003 - paperJam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

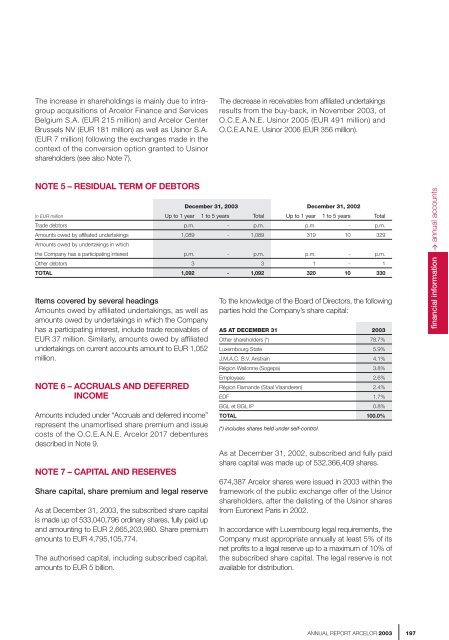

The increase in shareholdings is mainly due to intragroupacquisitions of Arcelor Finance and ServicesBelgium S.A. (EUR 215 million) and Arcelor CenterBrussels NV (EUR 181 million) as well as Usinor S.A.(EUR 7 million) following the exchanges made in thecontext of the conversion option granted to Usinorshareholders (see also Note 7).The decrease in receivables from affiliated undertakingsresults from the buy-back, in November <strong>2003</strong>, ofO.C.E.A.N.E. Usinor 2005 (EUR 491 million) andO.C.E.A.N.E. Usinor 2006 (EUR 356 million).NOTE 5 – RESIDUAL TERM OF DEBTORSDecember 31, <strong>2003</strong> December 31, 2002In EUR million Up to 1 year 1 to 5 years Total Up to 1 year 1 to 5 years TotalTrade debtors p.m. - p.m. p.m. - p.m.Amounts owed by affiliated undertakings 1,089 - 1,089 319 10 329Amounts owed by undertakings in whichthe Company has a participating interest p.m. - p.m. p.m. - p.m.Other debtors 3 3 1 - 1TOTAL 1,092 - 1,092 320 10 330Items covered by several headingsAmounts owed by affiliated undertakings, as well asamounts owed by undertakings in which the Companyhas a participating interest, include trade receivables ofEUR 37 million. Similarly, amounts owed by affiliatedundertakings on current accounts amount to EUR 1,052million.NOTE 6 – ACCRUALS AND DEFERREDINCOMEAmounts included under “Accruals and deferred income”represent the unamortised share premium and issuecosts of the O.C.E.A.N.E. Arcelor 2017 debenturesdescribed in Note 9.NOTE 7 – CAPITAL AND RESERVESShare capital, share premium and legal reserveAs at December 31, <strong>2003</strong>, the subscribed share capitalis made up of 533,040,796 ordinary shares, fully paid upand amounting to EUR 2,665,203,980. Share premiumamounts to EUR 4,795,105,774.The authorised capital, including subscribed capital,amounts to EUR 5 billion.To the knowledge of the Board of Directors, the followingparties hold the Company’s share capital:AS AT DECEMBER 31 <strong>2003</strong>Other shareholders (*) 78.7%Luxembourg State 5.9%J.M.A.C. B.V. Aristrain 4.1%Région Wallonne (Sogepa) 3.8%Employees 2.6%Région Flamande (Staal Vlaanderen) 2.4%EDF 1.7%BGL et BGL IP 0.8%TOTAL 100.0%(*) includes shares held under self-control.As at December 31, 2002, subscribed and fully paidshare capital was made up of 532,366,409 shares.674,387 Arcelor shares were issued in <strong>2003</strong> within theframework of the public exchange offer of the Usinorshareholders, after the delisting of the Usinor sharesfrom Euronext Paris in 2002.In accordance with Luxembourg legal requirements, theCompany must appropriate annually at least 5% of itsnet profits to a legal reserve up to a maximum of 10% ofthe subscribed share capital. The legal reserve is notavailable for distribution.financial information > annual accounts<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>ARCELOR</strong> <strong>2003</strong> 197