Pinewood Shepperton plc Annual Report ... - Pinewood Studios

Pinewood Shepperton plc Annual Report ... - Pinewood Studios

Pinewood Shepperton plc Annual Report ... - Pinewood Studios

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

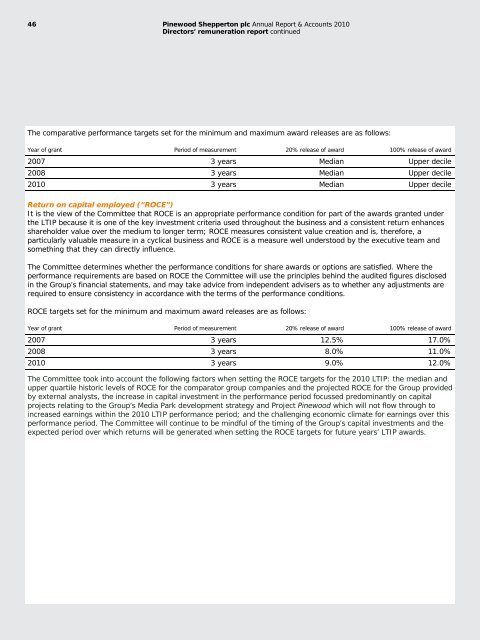

46 <strong>Pinewood</strong> <strong>Shepperton</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> & Accounts 2010Directors’ remuneration report continuedThe comparative performance targets set for the minimum and maximum award releases are as follows:Year of grant Period of measurement 20% release of award 100% release of award2007 3 years Median Upper decile2008 3 years Median Upper decile2010 3 years Median Upper decileReturn on capital employed (“ROCE”)It is the view of the Committee that ROCE is an appropriate performance condition for part of the awards granted underthe LTIP because it is one of the key investment criteria used throughout the business and a consistent return enhancesshareholder value over the medium to longer term; ROCE measures consistent value creation and is, therefore, aparticularly valuable measure in a cyclical business and ROCE is a measure well understood by the executive team andsomething that they can directly influence.The Committee determines whether the performance conditions for share awards or options are satisfied. Where theperformance requirements are based on ROCE the Committee will use the principles behind the audited figures disclosedin the Group’s financial statements, and may take advice from independent advisers as to whether any adjustments arerequired to ensure consistency in accordance with the terms of the performance conditions.ROCE targets set for the minimum and maximum award releases are as follows:Year of grant Period of measurement 20% release of award 100% release of award2007 3 years 12.5% 17.0%2008 3 years 8.0% 11.0%2010 3 years 9.0% 12.0%The Committee took into account the following factors when setting the ROCE targets for the 2010 LTIP: the median andupper quartile historic levels of ROCE for the comparator group companies and the projected ROCE for the Group providedby external analysts, the increase in capital investment in the performance period focussed predominantly on capitalprojects relating to the Group’s Media Park development strategy and Project <strong>Pinewood</strong> which will not flow through toincreased earnings within the 2010 LTIP performance period; and the challenging economic climate for earnings over thisperformance period. The Committee will continue to be mindful of the timing of the Group’s capital investments and theexpected period over which returns will be generated when setting the ROCE targets for future years’ LTIP awards.