78 <strong>Pinewood</strong> <strong>Shepperton</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> & Accounts 2010Notes to the consolidated financial statements continued20. Share capital and reserves continuedIssued, called up and fully paid2010 2009No. £000 No. £000Ordinary shares of 10p each 46,104,906 4,610 45,944,791 4,594Shares issued under the <strong>Pinewood</strong> <strong>Shepperton</strong> <strong>plc</strong>Sharesave scheme:10p ordinary shares issued on 14 September 2009 101,990 1010p ordinary shares issued on 30 October 2009 58,125 610p ordinary shares issued on 31 March 2010 127,100 13 – –46,232,006 4,623 46,104,906 4,610The holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one voteper share at the general meetings of the Company.Share option schemesThe Group has one share-based payment plan under which options to subscribe for the Group’s shares have beengranted. At 31 December 2010, 352,898 shares were outstanding (2009: 356,679). Details of this scheme can be foundin Note 13.Long-term incentive planThe Group has a long-term incentive plan under which awards for the Group’s shares have been granted to certainexecutives and senior employees. At 31 December 2010, 1,882,448 share awards were outstanding (2009: 1,299,461).Details of this scheme can be found in Note 13.Nature and purpose of reserveReserve for own sharesIncluded within the cash capital account are the costs of <strong>Pinewood</strong> <strong>Shepperton</strong> <strong>plc</strong> shares purchased in the market andheld by the <strong>Pinewood</strong> <strong>Shepperton</strong> <strong>plc</strong> Employee Benefit Trust to satisfy future exercise of awards under the Companyshare option scheme. As at 31 December 2010 the Company held 127,100 (2009: nil) of its own shares at an averagecost of 10p per share. The market value of these shares at 31 December 2010 was £187,473 (2009: nil).Share premium reserveThe share premium increased by nil (2009: nil) in the year as a result of the issue of share issues noted in the tableabove.Capital redemption reserveThe capital redemption reserve arose as a result of the repurchase of shares in 2001.Merger reserveOn acquiring <strong>Shepperton</strong> <strong>Studios</strong> Limited the Group issued ordinary shares as part of the consideration. Merger relief wastaken in accordance with Section 131 of the Companies Act 1985 (since succeeded by Section 612 of the Companies Act2006), and hence £348,000 was credited to the merger reserve.Fair value of cash flow hedge reserveThe cash flow hedge reserve is used to record the fair value gains or losses, and related deferred tax, on the hedginginstruments used by the Group to manage interest rate risk. The cash flow hedges are determined to be effective hedges.

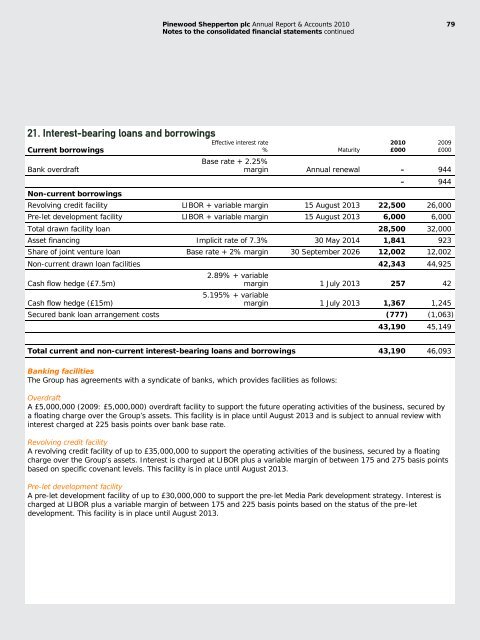

<strong>Pinewood</strong> <strong>Shepperton</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> & Accounts 2010 79Notes to the consolidated financial statements continued21. Interest-bearing loans and borrowingsEffective interest rate% MaturityCurrent borrowingsBase rate + 2.25%Bank overdraftmargin <strong>Annual</strong> renewal – 944– 944Non-current borrowingsRevolving credit facility LIBOR + variable margin 15 August 2013 22,500 26,000Pre-let development facility LIBOR + variable margin 15 August 2013 6,000 6,000Total drawn facility loan 28,500 32,000Asset financing Implicit rate of 7.3% 30 May 2014 1,841 923Share of joint venture loan Base rate + 2% margin 30 September 2026 12,002 12,002Non-current drawn loan facilities 42,343 44,925Cash flow hedge (£7.5m)2.89% + variablemargin 1 July 2013 257 42Cash flow hedge (£15m)5.195% + variablemargin 1 July 2013 1,367 1,245Secured bank loan arrangement costs (777) (1,063)43,190 45,1492010£0002009£000Total current and non-current interest-bearing loans and borrowings 43,190 46,093Banking facilitiesThe Group has agreements with a syndicate of banks, which provides facilities as follows:OverdraftA £5,000,000 (2009: £5,000,000) overdraft facility to support the future operating activities of the business, secured bya floating charge over the Group’s assets. This facility is in place until August 2013 and is subject to annual review withinterest charged at 225 basis points over bank base rate.Revolving credit facilityA revolving credit facility of up to £35,000,000 to support the operating activities of the business, secured by a floatingcharge over the Group’s assets. Interest is charged at LIBOR plus a variable margin of between 175 and 275 basis pointsbased on specific covenant levels. This facility is in place until August 2013.Pre-let development facilityA pre-let development facility of up to £30,000,000 to support the pre-let Media Park development strategy. Interest ischarged at LIBOR plus a variable margin of between 175 and 225 basis points based on the status of the pre-letdevelopment. This facility is in place until August 2013.