Pinewood Shepperton plc Annual Report ... - Pinewood Studios

Pinewood Shepperton plc Annual Report ... - Pinewood Studios

Pinewood Shepperton plc Annual Report ... - Pinewood Studios

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

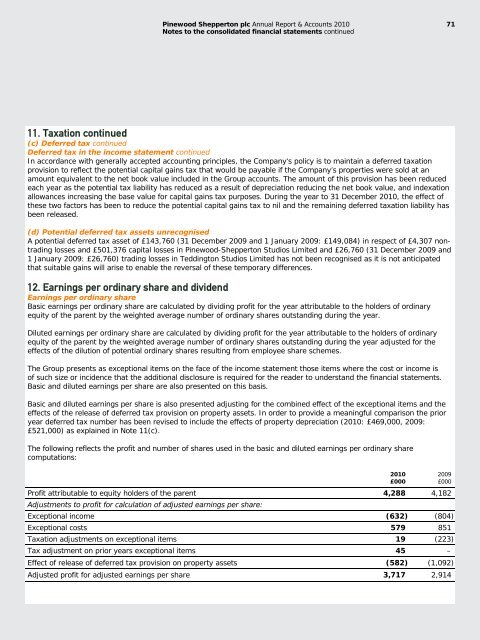

<strong>Pinewood</strong> <strong>Shepperton</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> & Accounts 2010 71Notes to the consolidated financial statements continued11. Taxation continued(c) Deferred tax continuedDeferred tax in the income statement continuedIn accordance with generally accepted accounting principles, the Company‘s policy is to maintain a deferred taxationprovision to reflect the potential capital gains tax that would be payable if the Company’s properties were sold at anamount equivalent to the net book value included in the Group accounts. The amount of this provision has been reducedeach year as the potential tax liability has reduced as a result of depreciation reducing the net book value, and indexationallowances increasing the base value for capital gains tax purposes. During the year to 31 December 2010, the effect ofthese two factors has been to reduce the potential capital gains tax to nil and the remaining deferred taxation liability hasbeen released.(d) Potential deferred tax assets unrecognisedA potential deferred tax asset of £143,760 (31 December 2009 and 1 January 2009: £149,084) in respect of £4,307 nontradinglosses and £501,376 capital losses in <strong>Pinewood</strong>-<strong>Shepperton</strong> <strong>Studios</strong> Limited and £26,760 (31 December 2009 and1 January 2009: £26,760) trading losses in Teddington <strong>Studios</strong> Limited has not been recognised as it is not anticipatedthat suitable gains will arise to enable the reversal of these temporary differences.12. Earnings per ordinary share and dividendEarnings per ordinary shareBasic earnings per ordinary share are calculated by dividing profit for the year attributable to the holders of ordinaryequity of the parent by the weighted average number of ordinary shares outstanding during the year.Diluted earnings per ordinary share are calculated by dividing profit for the year attributable to the holders of ordinaryequity of the parent by the weighted average number of ordinary shares outstanding during the year adjusted for theeffects of the dilution of potential ordinary shares resulting from employee share schemes.The Group presents as exceptional items on the face of the income statement those items where the cost or income isof such size or incidence that the additional disclosure is required for the reader to understand the financial statements.Basic and diluted earnings per share are also presented on this basis.Basic and diluted earnings per share is also presented adjusting for the combined effect of the exceptional items and theeffects of the release of deferred tax provision on property assets. In order to provide a meaningful comparison the prioryear deferred tax number has been revised to include the effects of property depreciation (2010: £469,000, 2009:£521,000) as explained in Note 11(c).The following reflects the profit and number of shares used in the basic and diluted earnings per ordinary sharecomputations:Profit attributable to equity holders of the parent 4,288 4,182Adjustments to profit for calculation of adjusted earnings per share:Exceptional income (632) (804)Exceptional costs 579 851Taxation adjustments on exceptional items 19 (223)Tax adjustment on prior years exceptional items 45 –Effect of release of deferred tax provision on property assets (582) (1,092)Adjusted profit for adjusted earnings per share 3,717 2,9142010£0002009£000