Pinewood Shepperton plc Annual Report ... - Pinewood Studios

Pinewood Shepperton plc Annual Report ... - Pinewood Studios

Pinewood Shepperton plc Annual Report ... - Pinewood Studios

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

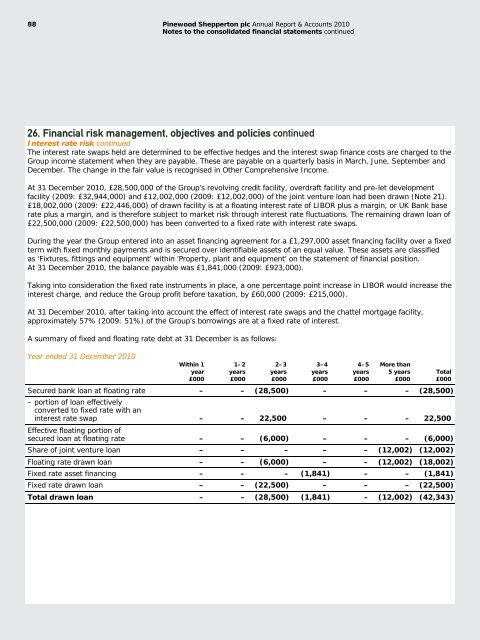

88 <strong>Pinewood</strong> <strong>Shepperton</strong> <strong>plc</strong> <strong>Annual</strong> <strong>Report</strong> & Accounts 2010Notes to the consolidated financial statements continued26. Financial risk management, objectives and policies continuedInterest rate risk continuedThe interest rate swaps held are determined to be effective hedges and the interest swap finance costs are charged to theGroup income statement when they are payable. These are payable on a quarterly basis in March, June, September andDecember. The change in the fair value is recognised in Other Comprehensive Income.At 31 December 2010, £28,500,000 of the Group’s revolving credit facility, overdraft facility and pre-let developmentfacility (2009: £32,944,000) and £12,002,000 (2009: £12,002,000) of the joint venture loan had been drawn (Note 21).£18,002,000 (2009: £22,446,000) of drawn facility is at a floating interest rate of LIBOR plus a margin, or UK Bank baserate plus a margin, and is therefore subject to market risk through interest rate fluctuations. The remaining drawn loan of£22,500,000 (2009: £22,500,000) has been converted to a fixed rate with interest rate swaps.During the year the Group entered into an asset financing agreement for a £1,297,000 asset financing facility over a fixedterm with fixed monthly payments and is secured over identifiable assets of an equal value. These assets are classifiedas ‘Fixtures, fittings and equipment’ within ‘Property, plant and equipment’ on the statement of financial position.At 31 December 2010, the balance payable was £1,841,000 (2009: £923,000).Taking into consideration the fixed rate instruments in place, a one percentage point increase in LIBOR would increase theinterest charge, and reduce the Group profit before taxation, by £60,000 (2009: £215,000).At 31 December 2010, after taking into account the effect of interest rate swaps and the chattel mortgage facility,approximately 57% (2009: 51%) of the Group’s borrowings are at a fixed rate of interest.A summary of fixed and floating rate debt at 31 December is as follows:Year ended 31 December 2010Within 1year£0001–2years£0002–3years£0003–4years£0004–5years£000More than5 years£000Secured bank loan at floating rate – – (28,500) – – – (28,500)– portion of loan effectivelyconverted to fixed rate with aninterest rate swap – – 22,500 – – – 22,500Effective floating portion ofsecured loan at floating rate – – (6,000) – – – (6,000)Share of joint venture loan – – – – – (12,002) (12,002)Floating rate drawn loan – – (6,000) – – (12,002) (18,002)Fixed rate asset financing – – – (1,841) – – (1,841)Fixed rate drawn loan – – (22,500) – – – (22,500)Total drawn loan – – (28,500) (1,841) – (12,002) (42,343)Total£000