Financial Statements - The United Basalt Products Ltd

Financial Statements - The United Basalt Products Ltd

Financial Statements - The United Basalt Products Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Financial</strong> <strong>Statements</strong><br />

Year ended June 30, 2009 (cont’d...)<br />

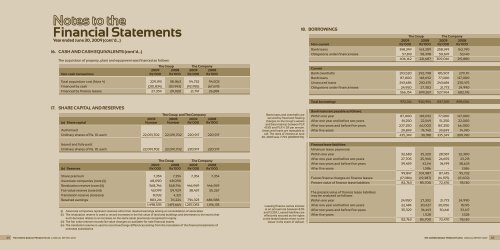

16. CASH AND CASH EQUIVALENTS (cont’d...)<br />

<strong>The</strong> acquisition of property, plant and equipment was financed as follows:<br />

<strong>The</strong> Group <strong>The</strong> Company<br />

2009 2008 2009 2008<br />

Non-cash transactions Rs’000 Rs’000 Rs’000 Rs’000<br />

Total acquisition cost (Note 4) 229,193 181,863 114,732 94,503<br />

Financed by cash (201,834) (151,943) (92,985) (67,619)<br />

Financed by finance leases 27,359 29,920 21,747 26,884<br />

17. SHARE CAPITAL AND RESERVES<br />

<strong>The</strong> Group and <strong>The</strong> Company<br />

2009 2008 2009 2008<br />

(a) Share capital Number Number Rs’000 Rs’000<br />

Authorised:<br />

Ordinary shares of Rs. 10. each 22,091,702 22,091,702 220,917 220,917<br />

Issued and fully paid:<br />

Ordinary shares of Rs. 10. each 22,091,702 22,091,702 220,917 220,917<br />

<strong>The</strong> Group <strong>The</strong> Company<br />

2009 2008 2009 2008<br />

(b) Reserves Rs’000 Rs’000 Rs’000 Rs’000<br />

Share premium 7,354 7,354 7,354 7,354<br />

Associate companies (note (i)) 68,090 68,090 - -<br />

Revaluation reserve (note (ii)) 568,746 568,746 446,969 446,969<br />

Fair value reserve (note (iii)) 43,099 59,929 38,437 55,267<br />

Translation reserve (note (iv)) 8,032 4,321 - -<br />

Retained earnings 803,214 711,224 794,323 686,588<br />

1,498,535 1,419,664 1,287,083 1,196,178<br />

(i) Associate companies represent reserves other than retained earnings arising on consolidation of associates.<br />

(ii) <strong>The</strong> revaluation reserve is used to record increases in the fair value of land and buildings and decreases to the extent that<br />

such decrease relates to an increase on the same asset previously recognised in equity.<br />

(iii) <strong>The</strong> fair value reserve records fair value changes on available-for-sale financial assets.<br />

(iv) <strong>The</strong> translation reserve is used to record exchange differences arising from the translation of the financial statements of<br />

overseas subsidiaries.<br />

Bank loans and overdrafts are<br />

secured by fixed and floating<br />

charges on the Group’s assets<br />

and bear interest between PLR<br />

+0.5% and PLR +1.5% per annum.<br />

Unsecured loans are repayable at<br />

call. <strong>The</strong> rates of interest at June<br />

30, 2009 was 7.75% (2008:10.5%).<br />

Leasing finance carries interest<br />

at an annual rate between 8.5%<br />

and 13.25%. Leased liabilities are<br />

effectively secured as the rights<br />

to the leased assets revert to the<br />

lessor in the event of default.<br />

18. BORROWINGS<br />

<strong>The</strong> Group <strong>The</strong> Company<br />

2009 2008 2009 2008<br />

Non-current Rs’000 Rs’000 Rs’000 Rs’000<br />

Bank loans 348,349 163,289 258,349 162,740<br />

Obligations under finance lease 57,813 58,398 50,697 53,140<br />

406,162 221,687 309,046 215,880<br />

Current<br />

Bank overdrafts 210,520 292,798 185,507 279,711<br />

Bank loans 87,000 148,692 77,000 147,000<br />

Unsecured loans 243,684 230,475 243,684 230,475<br />

Obligations under finance lease 24,950 27,302 21,773 24,990<br />

566,154 699,267 527,964 682,176<br />

Total borrowings 972,316 920,954 837,010 898,056<br />

Bank loans are payable as follows:<br />

Within one year 87,000 148,692 77,000 147,000<br />

After one year and before two years 81,250 22,549 51,250 22,000<br />

After two years and before five years 227,250 66,000 167,250 66,000<br />

After five years 39,849 74,740 39,849 74,740<br />

435,349 311,981 335,349 309,740<br />

Finance lease liabilities:<br />

Minimum lease payments:<br />

Within one year 32,683 35,320 28,587 32,300<br />

After one year and before two years 27,705 25,940 24,659 23,213<br />

After two years and before five years 39,459 42,141 34,199 38,633<br />

After five years - 1,586 - 1,586<br />

99,847 104,987 87,445 95,732<br />

Future finance charges on finance leases (17,084) (19,287) (14,975) (17,602)<br />

Present value of finance lease liabilities 82,763 85,700 72,470 78,130<br />

<strong>The</strong> present value of finance lease liabilities<br />

may be analysed as follows:<br />

Within one year 24,950 27,302 21,773 24,990<br />

After one year and before two years 22,484 20,427 20,056 18,195<br />

After two years and before five years 35,329 36,443 30,641 33,417<br />

After five years - 1,528 - 1,528<br />

82,763 85,700 72,470 78,130<br />

64 THE UNITED BASALT PRODUCTS LTD | ANNUAL REPORT 2009 THE UNITED BASALT PRODUCTS LTD | ANNUAL REPORT 2009 65