Financial Statements - The United Basalt Products Ltd

Financial Statements - The United Basalt Products Ltd

Financial Statements - The United Basalt Products Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Financial</strong> <strong>Statements</strong><br />

Year ended June 30, 2009 (cont’d...)<br />

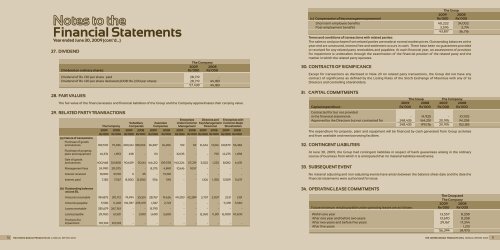

27. DIVIDEND<br />

<strong>The</strong> Company<br />

2009 2008<br />

Dividend on ordinary shares: Rs’000 Rs’000<br />

Dividend of Rs 1.30 per share paid 28,719 -<br />

Dividend of Rs 1.30 per share declared (2008: Rs 2.00 per share) 28,719 44,183<br />

57,438 44,183<br />

28. FAIR VALUES<br />

<strong>The</strong> fair value of the financial assets and financial liabilities of the Group and the Company approximates their carrying value.<br />

29. RELATED PARTY TRANSACTIONS<br />

Enterprises Directors and Enterprises with<br />

Subsidiary Associate Under Common Key Management Common Major<br />

<strong>The</strong> Company Companies Companies Management Personnel Shareholders<br />

2009 2008 2009 2008 2009 2008 2009 2008 2009 2008 2009 2008<br />

Rs’000 Rs’000 Rs’000 Rs’000 Rs’000 Rs’000 Rs’000 Rs’000 Rs’000 Rs’000 Rs’000 Rs’000<br />

(a) Nature of transactions<br />

Purchase of goods<br />

and services 103,570 79,696 200,461 180,656 36,837 34,206 513 69 16,664 13,616 60,879 56,382<br />

Purchase of property,<br />

plant and equipment 44,374 1,853 438 - 151 - 32,135 - - 795 12,275 1,058<br />

Sale of goods<br />

and services 400,468 321,808 90,609 50,161 166,212 109,578 140,226 117,219 3,022 1,232 8,082 6,435<br />

Management fees 24,990 20,075 - - 8,375 4,840 10,616 9,157 - - - -<br />

Interest received 8,000 31,150 11 35 - 19,150 - - - - - -<br />

Interest paid 7,182 7,567 8,000 12,000 556 545 - - 1,106 1,350 5,509 5,637<br />

(b) Outstanding balances<br />

at June 30,<br />

Amounts receivable 184,875 310,712 19,494 25,551 28,767 19,626 49,203 42,289 2,757 2,037 2,131 1,331<br />

Amounts payable 5,582 11,268 134,787 278,479 1,047 2,723 - - - - 5,478 3,940<br />

Loans receivable 335,679 267,763 - - 13,795 - - - - - - -<br />

Loans payable 29,960 61,501 - 1,500 1,600 2,600 - - 12,360 11,301 16,000 47,600<br />

Provision for<br />

impairment 107,013 107,013 - - - - - - - - - -<br />

<strong>The</strong> Group<br />

2009 2008<br />

(c) Compensation of key management personnel Rs’000 Rs’000<br />

Short term employee benefits 40,222 34,002<br />

Post-employment benefits 3,595 2,714<br />

43,817 36,716<br />

Terms and conditions of transactions with related parties:<br />

<strong>The</strong> sales to and purchases from related parties are made at normal market prices. Outstanding balances at the<br />

year-end are unsecured, interest free and settlement occurs in cash. <strong>The</strong>re have been no guarantees provided<br />

or received for any related party receivables and payables. At each financial year, an assessment of provision<br />

for impairment is undertaken through the examination of the financial position of the related party and the<br />

market in which the related party operates.<br />

30. CONTRACTS OF SIGNIFICANCE<br />

Except for transactions as disclosed in Note 29 on related party transactions, the Group did not have any<br />

contract of significance as defined by the Listing Rules of the Stock Exchange of Mauritius with any of its<br />

Directors and controlling shareholders.<br />

31. CAPITAL COMMITMENTS<br />

<strong>The</strong> Group <strong>The</strong> Company<br />

2009 2008 2009 2008<br />

Capital expenditure :<br />

Contracted for but not provided<br />

Rs’000 Rs’000 Rs’000 Rs’000<br />

in the financial statements - 14,925 - 10,925<br />

Approved by the Directors but not contracted for 248,435 164,251 211,976 141,258<br />

248,435 179,176 211,976 152,183<br />

<strong>The</strong> expenditure for property, plant and equipment will be financed by cash generated from Group activities<br />

and from available and new borrowing facilities.<br />

32. CONTINGENT LIABILITIES<br />

At June 30, 2009, the Group had contingent liabilities in respect of bank guarantees arising in the ordinary<br />

course of business from which it is anticipated that no material liabilities would arise.<br />

33. SUBSEQUENT EVENT<br />

No material adjusting and non-adjusting events have arisen between the balance sheet date and the date the<br />

financial statements were authorised for issue.<br />

34. OPERATING LEASE COMMITMENTS<br />

<strong>The</strong> Group and<br />

<strong>The</strong> Company<br />

2009 2008<br />

Future minimum rentals payable under operating leases are as follows: Rs’000 Rs’000<br />

Within one year 13,557 8,258<br />

After one year and before two years 13,670 8,258<br />

After two years and before five years 29,167 17,244<br />

After five years - 1,213<br />

56,394 34,973<br />

70 THE UNITED BASALT PRODUCTS LTD | ANNUAL REPORT 2009 THE UNITED BASALT PRODUCTS LTD | ANNUAL REPORT 2009 71