62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

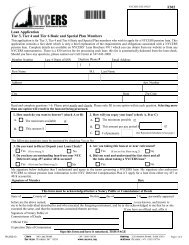

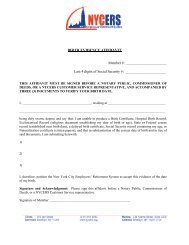

NEW YORK CITY EMPLOYEES’ RETIREMENT SYSTEMLOANSELIGIBILITYAs a Tier 4 member, you are qualified to take a loan if you:Have completed one year of <strong>NYCERS</strong> membership, andHave a minimum of $1,334 in your Member Contribution Accumulation Fund (MCAF), andAre in active payroll status, andAre not in default on a current loan from <strong>NYCERS</strong>, andAre not retired.NOTE: <strong>NYCERS</strong> must have your birth date on file before processing a loan.BORROWINGA loan cannot exceed 75% of the contributions, with interest, last posted to your MCAF account.You may not borrow less than $1,000, and you can obtain only one loan in any 12-month period.The restriction to one loan in any 12-month period is by law and <strong>NYCERS</strong> is not permitted tomake exceptions, even in the event of an emergency you may experience.LR: Chapter 920 of the Laws of 1990SR: RSSL §613-b subdivision bAPPLYING AND GETTING THE MONEYApplying OnlineMY <strong>NYCERS</strong> accountholders with registered Personal Identification Numbers can apply for aloan online. This online tool provides an efficient and resourceful way to apply for a loan. Itallows members to explore different loan options before settling on a loan amount and choosingwhich repayment option best fits their needs. This tool is particularly helpful for memberswith outstanding loans, since tax laws create a greater likelihood that all or part of your new loanwill be taxable. By applying online, members will be presented with taxable and/or tax-freeoptions to choose from and can weigh each option carefully. In addition, current proceduresrequire members to sign a tax authorization letter before a taxable loan can be processed. Byapplying online, members selecting a taxable loan option can fulfill this requirement by electronicsignature at the end of the online application.Applying by Mail or In PersonAn original (neither a copy nor a fax) Loan Application (Form #302) can be mailed or droppedoff in person at our Customer Service Center. If your loan is taxable, a trip to our Customer ServiceCenter will save you time, as you can sign the tax authorization letter immediately after filingyour application. If you apply by mail and your loan is taxable, a tax authorization letter willbe mailed to you.LOANSGetting the MoneyMembers will usually receive a new loan within 15 business days after receipt of their loanapplication. Members have the option of receiving their loan by mail (paper check) or depositeddirectly into their bank checking or savings account through Electronic Funds Transfer (EFT).20