62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

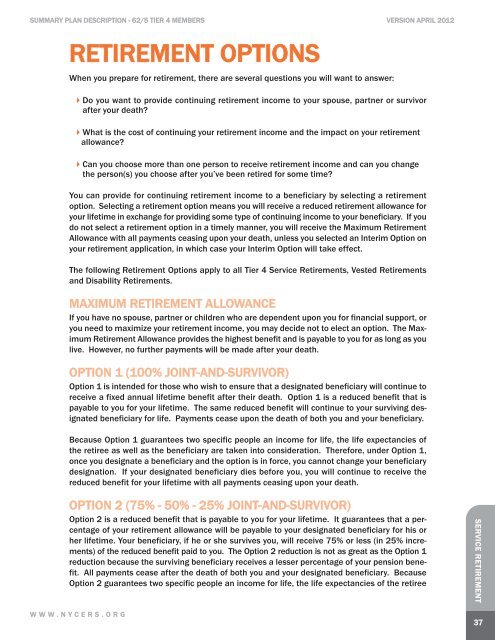

SUMMARY PLAN DESCRIPTION - <strong>62</strong>/5 TIER 4 MEMBERS VERSION APRIL 2012RETIREMENT OPTIONSWhen you prepare for retirement, there are several questions you will want to answer:Do you want to provide continuing retirement income to your spouse, partner or survivorafter your death?What is the cost of continuing your retirement income and the impact on your retirementallowance?Can you choose more than one person to receive retirement income and can you changethe person(s) you choose after you’ve been retired for some time?You can provide for continuing retirement income to a beneficiary by selecting a retirementoption. Selecting a retirement option means you will receive a reduced retirement allowance foryour lifetime in exchange for providing some type of continuing income to your beneficiary. If youdo not select a retirement option in a timely manner, you will receive the Maximum RetirementAllowance with all payments ceasing upon your death, unless you selected an Interim Option onyour retirement application, in which case your Interim Option will take effect.The following Retirement Options apply to all Tier 4 Service Retirements, Vested Retirementsand Disability Retirements.MAXIMUM RETIREMENT ALLOWANCEIf you have no spouse, partner or children who are dependent upon you for financial support, oryou need to maximize your retirement income, you may decide not to elect an option. The MaximumRetirement Allowance provides the highest benefit and is payable to you for as long as youlive. However, no further payments will be made after your death.OPTION 1 (100% JOINT-AND-SURVIVOR)Option 1 is intended for those who wish to ensure that a designated beneficiary will continue toreceive a fixed annual lifetime benefit after their death. Option 1 is a reduced benefit that ispayable to you for your lifetime. The same reduced benefit will continue to your surviving designatedbeneficiary for life. Payments cease upon the death of both you and your beneficiary.Because Option 1 guarantees two specific people an income for life, the life expectancies ofthe retiree as well as the beneficiary are taken into consideration. Therefore, under Option 1,once you designate a beneficiary and the option is in force, you cannot change your beneficiarydesignation. If your designated beneficiary dies before you, you will continue to receive thereduced benefit for your lifetime with all payments ceasing upon your death.OPTION 2 (75% - 50% - 25% JOINT-AND-SURVIVOR)Option 2 is a reduced benefit that is payable to you for your lifetime. It guarantees that a percentageof your retirement allowance will be payable to your designated beneficiary for his orher lifetime. Your beneficiary, if he or she survives you, will receive 75% or less (in 25% increments)of the reduced benefit paid to you. The Option 2 reduction is not as great as the Option 1reduction because the surviving beneficiary receives a lesser percentage of your pension benefit.All payments cease after the death of both you and your designated beneficiary. BecauseOption 2 guarantees two specific people an income for life, the life expectancies of the retireeWWW.<strong>NYCERS</strong>.ORGSERVICE RETIREMENT37