62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

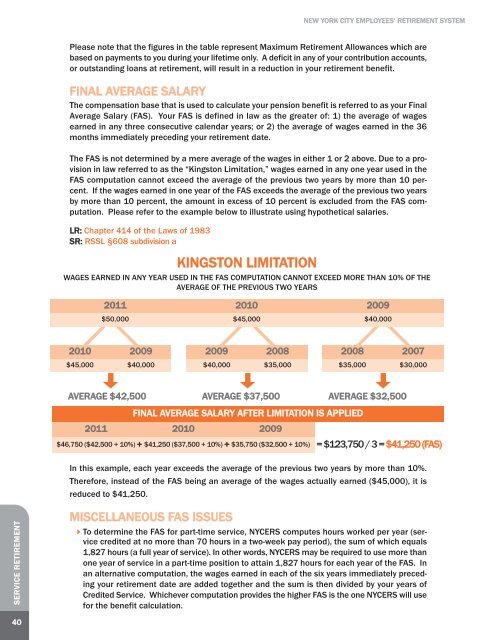

NEW YORK CITY EMPLOYEES’ RETIREMENT SYSTEMPlease note that the figures in the table represent Maximum Retirement Allowances which arebased on payments to you during your lifetime only. A deficit in any of your contribution accounts,or outstanding loans at retirement, will result in a reduction in your retirement benefit.FINAL AVERAGE SALARYThe compensation base that is used to calculate your pension benefit is referred to as your FinalAverage Salary (FAS). Your FAS is defined in law as the greater of: 1) the average of wagesearned in any three consecutive calendar years; or 2) the average of wages earned in the 36months immediately preceding your retirement date.The FAS is not determined by a mere average of the wages in either 1 or 2 above. Due to a provisionin law referred to as the “Kingston Limitation,” wages earned in any one year used in theFAS computation cannot exceed the average of the previous two years by more than 10 percent.If the wages earned in one year of the FAS exceeds the average of the previous two yearsby more than 10 percent, the amount in excess of 10 percent is excluded from the FAS computation.Please refer to the example below to illustrate using hypothetical salaries.LR: Chapter 414 of the Laws of 1983SR: RSSL §608 subdivision aKINGSTON LIMITATIONWAGES EARNED IN ANY YEAR USED IN THE FAS COMPUTATION CANNOT EXCEED MORE THAN 10% OF THEAVERAGE OF THE PREVIOUS TWO YEARS2011 2010 2009$50,000 $45,000 $40,0002010 2009$45,000 $40,0002009 2008$40,000 $35,0002008 2007$35,000 $30,000AVERAGE $42,500 AVERAGE $37,500 AVERAGE $32,500FINAL AVERAGE SALARY AFTER LIMITATION IS APPLIED2011 2010 2009$46,750 ($42,500 + 10%) + $41,250 ($37,500 + 10%) + $35,750 ($32,500 + 10%) = $123,750 / 3 = $41,250 (FAS)In this example, each year exceeds the average of the previous two years by more than 10%.Therefore, instead of the FAS being an average of the wages actually earned ($45,000), it isreduced to $41,250.SERVICE RETIREMENTMISCELLANEOUS FAS ISSUESTo determine the FAS for part-time service, <strong>NYCERS</strong> computes hours worked per year (servicecredited at no more than 70 hours in a two-week pay period), the sum of which equals1,827 hours (a full year of service). In other words, <strong>NYCERS</strong> may be required to use more thanone year of service in a part-time position to attain 1,827 hours for each year of the FAS. Inan alternative computation, the wages earned in each of the six years immediately precedingyour retirement date are added together and the sum is then divided by your years ofCredited Service. Whichever computation provides the higher FAS is the one <strong>NYCERS</strong> will usefor the benefit calculation.40